China-based e-commerce giant JD.com (NASDAQ:JD) has been an obvious beneficiary of the regulatory easing and end of prolonged lockdowns in China. Its technology peers have rallied significantly since the positive news came in. JD stock, currently trading at ~$52, is still far from its 2021 high of over $105. Nonetheless, based on robust consumer spending trends and a resilient business model, I am bullish on JD and believe the stock will be one of the biggest beneficiaries of the catalysts mentioned above.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

China’s Revival and Regulatory Easing Will Help JD

2023 started on a positive note for the Chinese tech sector following positive news from the Chinese government’s new financial policies that seek improved relations with their U.S. counterparts. Newly-appointed Chinese foreign minister Qin Gang stated that he hopes to see better relations with the U.S. in the future. With that, the ever-growing concern of the delisting of Chinese stocks from the U.S. stock markets is also put to rest.

The long-drawn Chinese government’s regulatory clampdown on Chinese tech stocks is also over. Guo Shuqing, Chairman of China’s Banking and Insurance Regulatory Commission, recently stated that the regulatory overhaul is nearing its end.

The much-awaited reopening of the Chinese economy and the final exit from its zero-COVID policy bodes well for all the Chinese stocks listed overseas. Specifically for JD, the company will now be able to freely concentrate on its several growth engines, spurring its revenues and profitability growth in the coming years.

While Chinese tech leaders like Alibaba (NYSE:BABA) and Tencent Holdings (OTC:TCEHY) are well off their 2022 lows, JD stock has not gained as much as them, and there likely is still room to capture its growth potential by buying the stock at current levels.

Positive Spring Festival Data Bodes Well for JD

JD is one of the leading B2C (business-to-consumer) online retailers in China, and that space is expected to grow significantly in the coming years. On January 28, JD revealed that JD Shop Now sales increased 90% year-over-year during the Chinese Spring Festival (from January 21 to 27). Additionally, search volume for Spring Festival decorations saw a massive jump of over 3.5x compared to the prior-year period.

In addition, consumers’ order value increased by 171% year-over-year on New Year’s Eve. It is important to note that significant sales growth was witnessed across most product categories, including home appliances (226%), cosmetics and perfumes (120%), warm clothing items (over 150%), and mobile phones (70%), to name a few.

Undoubtedly, the underlying trends of Chinese consumer spending look robust. JD is expected to gain market share amid growth in consumer spending and the easing of regulatory policies, and revenues are forecast to grow in double digits in the medium term. Coupled with incremental margin expansion from JD’s cost control initiatives, there should be meaningful earnings growth in FY2023 and beyond.

JD is scheduled to release its Q4 results during the first week of March, and it’s worth noting that the company has consistently outperformed Wall Street’s earnings expectations in all of the past eight quarters. It is especially commendable that despite pandemic lockdowns and tough regulations during 2022, JD reported impressive results. For example, Q3 revenues grew by 11.4% year-over-year, driven by 6.5% growth in annual active customer accounts to 588.3 million. This highlights the resilience of the company’s revenues and earnings despite challenging times.

Is JD Stock a Buy, According to Analysts?

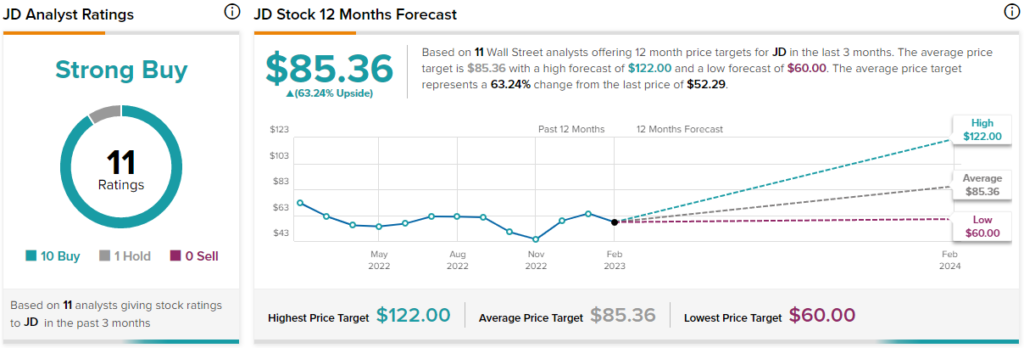

The Wall Street community is clearly optimistic about JD stock. Overall, the stock commands a Strong Buy consensus rating based on 10 Buys and one Hold. JD’s average price target of $85.36 implies 63.2% upside potential from current levels.

In terms of its valuation, too, JD stock looks extremely cheap. Currently, it’s trading at an attractive P/S ratio of 0.6x compared to much higher multiples of its peer group.

Meanwhile, China-based retail giant company Alibaba is trading at a P/S ratio of 2.3x, while e-commerce platform Pinduoduo (NYSE:PDD) is trading at over 7x. These are attractive discount levels and likely present a great buying opportunity, given the strong growth potential for JD.

Conclusion: Consider Buying JD Stock

Chinese stocks are clearly recovering and have witnessed a strong rally in 2023. Also, consumer demand tailwinds have shown strong signs of re-emergence recently. JD is well-positioned to tap the resurgent demand and gain increased market share in the coming quarters.

What’s even more appealing is that JD continues to trade at attractive valuation levels, making me keen to buy the stock at current levels.