JD.com (NASDAQ:JD) is scheduled to release its first-quarter Fiscal 2023 results on May 11, before the market opens. The company is expected to have benefited from a recovering Chinese economy. Also, cost-control initiatives might have aided its performance in the yet-to-be-reported quarter.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

The Street expects JD.com to post adjusted earnings of $0.51 per ADS in Q1, higher than the prior-year quarter figure of $0.37 per ADS. Meanwhile, analysts expect the company to report net revenue of $34.8 billion, down 7.9%.

Analyst James Lee is Bullish About JD.com

Analyst James Lee of Mizuho Securities is highly optimistic about JD.com. The company is one of the top Chinese picks for Lee due to its potential to gain market share and maintain competitive pricing.

Ahead of the earnings release, Lee maintained a Buy rating on the stock but reduced his price target to $82 from $90.

Regarding Q1 performance, the analyst expects total revenue growth to remain muted as inventory optimization efforts may present a short-term challenge. Nevertheless, Lee anticipates a 35% jump in revenue from JD Logistics based on the “rapid growth of 3P merchants, who utilize JD Logistics services to ship their inventory.” On the other hand, the analyst sees a 5% decline in JD Retail revenues.

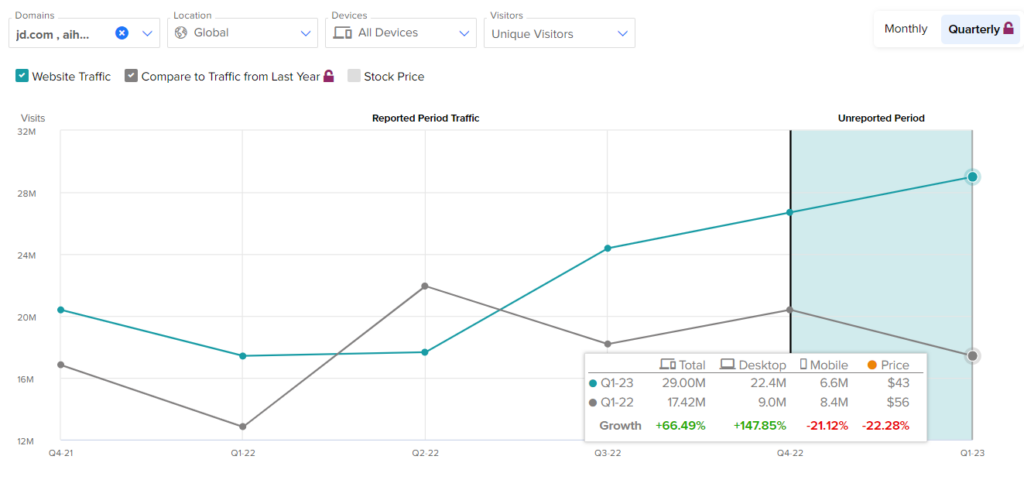

Website Traffic Depicts Strong Growth

Website visits can be a good indicator of user involvement on its platform for companies, including JD.com, that have a wide online presence. As per the TipRanks Website Traffic tool, total global visits to jd.com and aihuishou.com climbed 66.5% year-over-year in the to-be-reported quarter.

The increase in monthly visits could indicate that demand for the company’s products remained strong during the quarter.

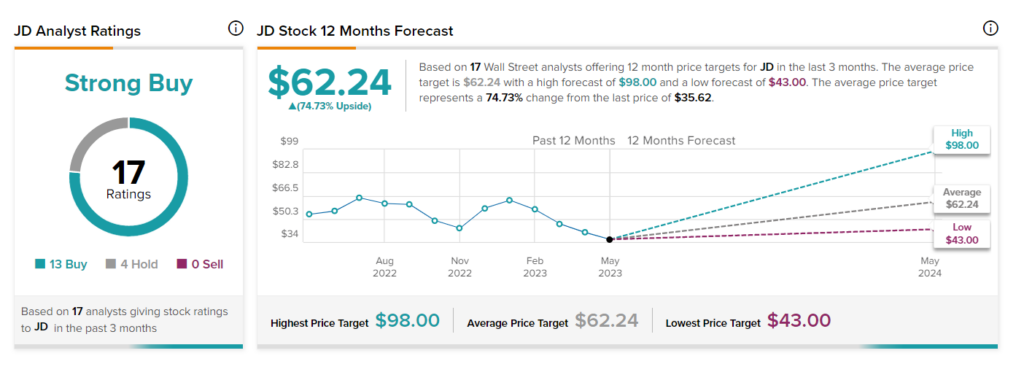

What is the Forecast for JD Stock?

On TipRanks, the average JD.com price forecast of $62.24 implies 74.7% upside potential from current levels. Also, analysts have a Strong Buy consensus rating on JD stock based on 13 Buy and four Hold recommendations.