Tired of hearing about inflation? Well, tough luck. That is once again this week’s hot topic. On the agenda, the wholesale and consumer inflation reports – out Wednesday and Thursday, respectively. Considering the market’s latest pullback, Wall Street is evidently on edge following a good-is-bad jobs report, with little expectation the Fed will be relaxing its monetary policy anytime soon.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Q3 earnings are also about to kick off and financial statements will offer a clue on inflation and rising costs’ ongoing impact.

Things feel particularly shaky, then, and uncertainty rules the roost. So, how to play the investing game against such a precarious economic backdrop? One way is to follow the recommendations of the experts.

Banking giant J.P. Morgan has a few of them on its roster and the firm’s analysts have been pinpointing the stocks they think are worthy of investor attention in the current climate. So, let’s dig into the details on 3 of their recent picks and check in with the TipRanks database for overall sentiment amongst Wall Street’s analyst corps.

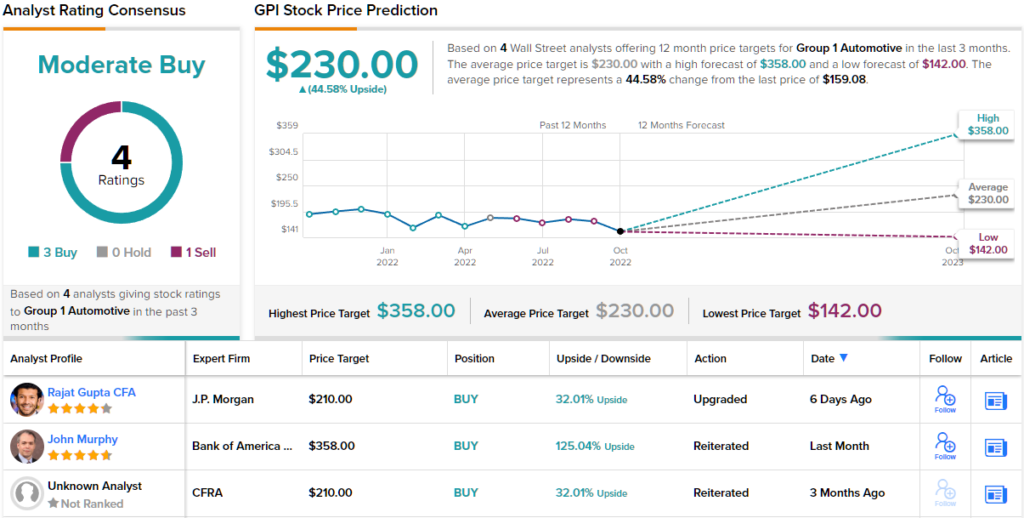

Group 1 Automotive, Inc. (GPI)

The first JPM pick we’ll look at is a car retailer. Group 1 Automotive is a US auto dealership with a footprint in 17 states (although most are based in Texas) while it also has a meaningful presence in the UK, which accounts for ~20% of overall revenues. Via its cross-channel business model, Group 1 sells new and used cars and light trucks. Other services included vehicle financing and insurance contracts while the company also offers car maintenance and repair services and sells vehicle parts.

As of July, the Texas-based firm boasted 204 owned and operated automotive dealerships, 273 franchises, and 47 collision centers with 35 brands of automobiles on tap.

There might be concerns around the prospects of the automotive retail space amidst fears of a widespread economic downturn, but that didn’t stop GPI delivering a strong Q2 report in late July. Revenue reached $4.1 billion, amounting to a 10.8% year-over-year increase and coming in $80 million ahead of the Street’s forecast. Adjusted net income hit a record $197.5 million, a 5% growth vs. the $188 million delivered in the same quarter last year. This resulted in adj. EPS of $12.00, some way above the $10.76 anticipated by the analysts.

While J.P. Morgan’s Rajat Gupta notes the dealership’s heavy skew to one state “creates room for higher volatility as regional economics could have an outsized impact on growth,” the analyst sees enough reasons to back the company.

“We see GPI’s initiative to drive higher used vehicle growth in a flattening SAAR (seasonally adjusted annual rate) environment as positive,” Gupta said. “GPI’s parts & services initiatives to increase technician headcount and better use existing manpower are compelling, in our view, with drop-through to the bottom line starting to show. EBITDA growth, balance sheet optionality, and standing ROIC are in line with group averages, though we see upside to standing consensus, which in our view is not discounted in current valuation.”

Accordingly, Gupta rates GPI an Overweight (i.e. Buy) along with a $210 price target. The implication for investors? Upside of 32% from current levels. (To watch Gupta’s track record, click here)

Overall, GPI has picked up 4 analyst reviews, and these include 3 Buys and 1 Sell, for a Moderate Buy consensus rating. Going by the $230 average target, shares have room for ~45% growth in the year ahead. (See GPI stock forecast on TipRanks)

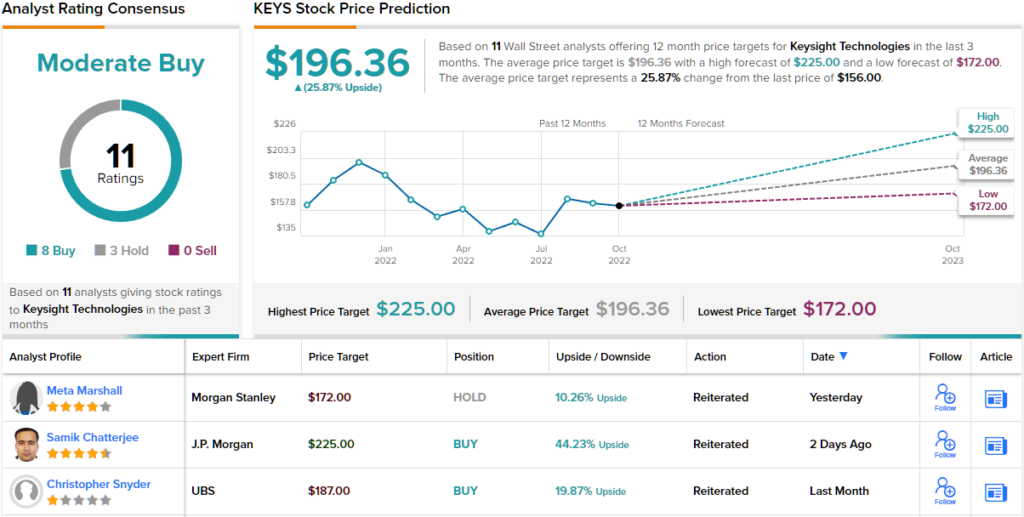

Keysight Technologies, Inc. (KEYS)

From cars let’s take a turn into a maker of electronics testing equipment. Keysight is a leader in the field, boasting both hardware and software products which are vendor-agnostic and allow it to participate across multiple markets. Its offerings range from oscilloscopes, signal generators, and spectrum analyzers to automated X-ray inspection (5DX) and in-circuit testers to tunable lasers and optical power meters, amongst others. The company also makes electronic design automation (EDA) software and caters mostly to the telecommunications, industrial, computer, A&D and semiconductor industries.

Boosted by a strong showing from its Communications Solutions Group (CSG) segment, the company delivered a better-than-expected FQ3 report, released midway through August. CSG generated revenue of $970 million, an 11% increase over the same period last year, which helped the overall top-line reach $1.38 billion – a $30 million beat over the consensus estimate.

On the bottom-line, the company delivered adj. EPS of $2.01, above the $1.79 anticipated on Wall Street. The outlook also met expectations with Q4 revenue anticipated in the range between $1.38 billion to $1.40 billion, at the mid-point the same as consensus at $1.39 billion.

Assessing this company’s prospects, JPMorgan’s Samik Chatterjee lays out the bull case.

“We rate Keysight shares Overweight [i.e. Buy] on our favorable demand outlook, including strong leverage to multiple cyclical industry drivers, primarily the 5G cycle, which should drive both strong top-line growth as well as margin expansion, delivering in line to better growth for 2023, relative to our forecasts for best-in-class execution and more diversified drivers in Amphenol. Keysight’s strong earnings growth should be led by leverage to 5G through the broad ecosystem of both devices and communication equipment as well as strong flow-through to the bottom line from strong revenue growth,” Chatterjee opined.

That Overweight rating is backed by a $225 price target which suggests shares will rise by 44% over the coming months. (To watch Chatterjee’s track record, click here)

Looking at the consensus breakdown, 10 other analysts join Chatterjee in the bull camp, but with 3 others staying on the fence, the stock makes do with a Moderate Buy consensus view. According to the $196.36 average target, the shares will be changing hands for a ~26% premium a year from now. (See KEYS stock forecast on TipRanks)

Akero Therapeutics, Inc. (AKRO)

Most stocks are showing heavy year-to-date losses but the same cannot be said of Akero Therapeutics, which has seen its shares jump 80% this year. Akero is a biotech focused on the development of medicines aimed at patients suffering from serious metabolic diseases, specifically ones with high unmet medical needs.

Akero only has one drug in its pipeline currently going through the clinical stage testing phases but that is all it takes to get heads spinning if the drug is making all right the moves. And that appears to be the case for efruxifermin (EFX).

The drug has been earmarked as a treatment for nonalcoholic steatohepatitis (NASH), a condition for which that there are currently no treatments approved by the FDA, despite an estimated 12% of U.S. adults being affected by this serious liver disease.

This is a huge market Akero is hoping to tap into, and results from the phase 2b HARMONY of EFX in NASH certainly offer promise. The data readout showed that the drug hit both the study’s primary endpoint of at least a one-stage improvement in liver fibrosis with no worsening of NASH following 24 weeks of treatment and a key secondary endpoint of patients achieving NASH resolution without worsening of fibrosis.

While the drug still needs to go through more testing before the company can file for approval, JPMorgan’s Eric Joseph is bullish on its chances of success.

“Based on the compelling, placebo-controlled activity profile in HARMONY, we see efruxifermin being materially derisked into phase 3 development, with our view of its best-in-class potential reinforced,” the analyst explained. “Combined with the multi-billion-dollar commercial opportunity in scope and a scarcity of demonstratively effective agents for NASH, we further see AKRO becoming increasingly elevated among potentially actionable strategic candidates over the mid-term.”

To this end, Joseph thinks the stock is worthy of an Overweight (i.e., Buy) rating and a $48 price target. Even after the huge gains, there’s still room for 26% upside from current levels. (To watch Joseph’s track record, click here)

In general, other analysts echo Joseph’s sentiment. 4 Buys and 1 Hold add up to a Strong Buy consensus rating. The average price target of $48 matches Joseph’s. (See AKRO stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.