There’s been a lot of talk about the downward economic pressures that have pummeled the markets in 2022 – maybe too much such talk. Yes, the S&P 500 is down almost 21%, and the NASDAQ is down 35%, but investors can still find sound opportunities. J.P. Morgan analyst Ryan Brinkman has been sorting through the automotive industry stocks, and he’s found several that are worth a closer look.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

So let’s do just that. We know that the auto industry has its own particular headwinds, including the ongoing microchip shortage and raw material price inflation, and that these are pumping up prices. But the supply chain issues are easing, and are expected to ease further into 2023.

Brinkman, in some general notes on marketplace, writes, “There are some glimmers of normalization, with prices finally easing somewhat, though conditions remain far from normal…. 2023 has greater potential for a more rapid improvement in the volume environment and a more rapid normalization in pricing, with the wildcard being an economic downturn.” Putting some numbers on this prediction, Brinkman’s colleagues at JPM are modeling 2.5% to 5% price moderation in new vehicles, and 10% to 20% in used vehicles, through the calendar year 2023.

As for investor positioning, Brinkman is tapping two car-related stocks for one-year gains of ~70%. Let’s take a look at these two picks, using the latest data from TipRanks as well as the analyst’s comments, to get a feel for their potential.

Kar Auction Services, Inc. (KAR)

First up, KAR Auction, a leader in the world’s second-hand car auction market. The company operates in both the online and physical worlds, connecting sellers and buyers, and counts both businesses and individual consumers in its customer base. KAR offers vehicles for a wide range of uses, from commercial fleets to private travel to the second-hand auto parts market. Pre-pandemic, in 2019, KAR sold 3.7 million vehicles and made $2.8 billion in auction revenue.

The combination of, first, COVID, and second, high inflation, has pushed down on KAR’s top line; the company saw $2.25 billion in total revenues for 2021, and so far this year the revenue totals are not matching that. In the last quarter, 3Q22, the company reported $393 million at the top line. This was down 26% year-over-year but a sequential improvement which the company attributed to an increase in gross profit per vehicle sold, and to increased prices, which have offset lower volumes. KAR saw a gross profit per vehicle sold of $320, up 14% from the $280 reported in the prior year’s Q3.

Also indicating a positive outlook, KAR reported a net profit, with adjusted net income for 3Q22 coming it at 9 cents per diluted share. This compared favorably to the 11-cent loss reported one year earlier.

In his coverage of this stock for JPM, Ryan Brinkman points out several reasons why the company has been able to survive the current market troubles – and why it is likely to stand tall going forward. He writes, “KAR has a strong position in this market: it is the second-largest provider of whole car auction services. The resulting limited competition and high barriers to entry result in strong pricing and margins and strong free cash flow given low working capital requirements. We expect solid profit growth over the next several years, driven by cyclical recovery in currently depressed commercial consignor volumes and the firm’s push into the digital Dealer-to-Dealer space along with expected continued cost containment and exploration of numerous adjacencies, including retail reconditioning.”

These comments back up Brinkman’s Overweight (Buy) rating, and his $22 price target implies a gain of 75% for the shares over the next 12 months. (To watch Brinkman’s track record, click here.)

Brinkman is not the only analyst who is bullish on the future of KAR; the stock has 4 recent reviews, all positive, for a unanimous Strong Buy analyst consensus. The average price target is $22, matching Brinkman’s objective. (See KAR’s stock forecast at TipRanks.)

Special end-of-year offer: Access TipRanks Premium tools for an all-time low price! Click to learn more.

Camping World Holdings (CWH)

Next up is a specialized vehicle stock, Camping World Holdings. This company deals in recreational vehicles, offering a range of towed and powered RVs for sale new and used, as well as supporting gear, accessories, and other related products like boating and water sports vessels and their gear. In short, Camping World Holdings puts a world of outdoor leisure under one sales room.

Camping World’s sales and revenues are predictable, and follow a regular seasonal pattern with a peak in Q2 and a trough in Q4. With that in mind, the company posted revenues of $1.9 billion for 3Q22, a 3% y/y drop but beating the Street’s forecast by $100 million. Used unit sales totaled 14,460, for a company record, and used vehicle revenue was up more than 1%, to $526 million.

The company reported higher inventories for both new and used vehicles, to $1.6 billion, in Q3, an increase attributed to restocking new vehicles to normal levels, as well as strategic growth in the used vehicle business. The company opened 8 additional dealership locations during the quarter.

On the bottom line, the company saw a steep drop-off. Adjusted diluted EPS fell from $1.98 in 3Q21 to $1.07 in the recent quarterly report, a 45% y/y decline.

Even though earnings are down, CWH has maintained its common stock dividend. The company last declared a payment of 62.5 cents per share, for payment on December 29. At that rate, the dividend annualizes to $2.50 per common share and yields a powerful 11%, more than enough to beat the current rate of inflation and ensure a real rate of return.

JPM’s Ryan Brinkman highlights the reasons why he believes the stock is one to own. He writes, “Camping World’s much greater scale provides it with numerous benefits relative to its smaller competitors, including (1) gross margin-enhancing volume discounts; (2) more favorable terms with financiers; (3) the ability to offer consumers a wider assortment by tapping into the inventory available across its greater number of stores; and (4) an informational advantage in terms of consumer demand and pricing in the marketplace. The combination of the fragmented nature of the market and the significant benefits provided by scale in our view provides ample opportunity to create value by further consolidating the industry, and Camping World has historically been highly acquisitive.”

Putting some numbers to his stance, Brinkman rates the stock as Overweight (Buy) with a $37 price target indicating potential for 72% share appreciation in the coming year.

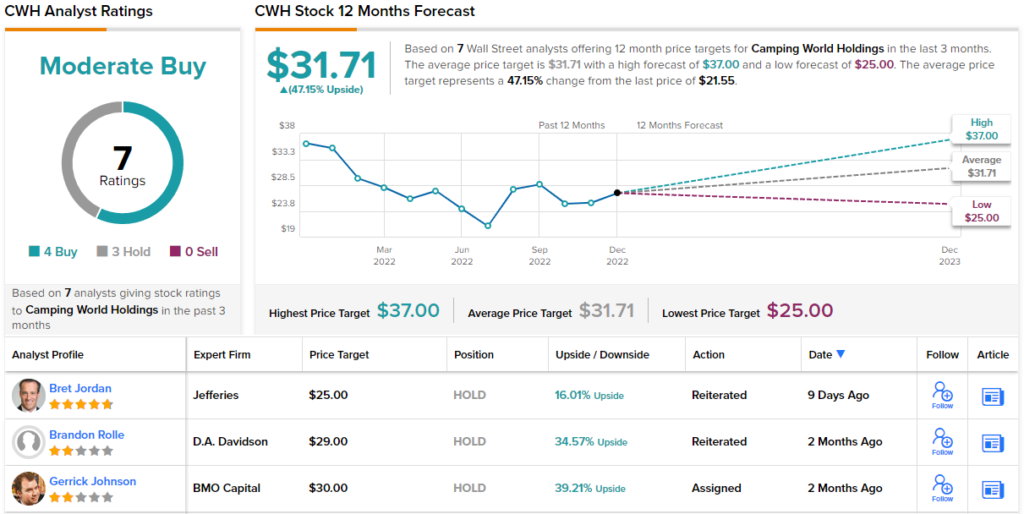

This stock holds a Moderate Buy consensus rating from the analysts on Wall Street, with 7 recent reviews breaking down to 4 Buys and 3 Holds. The stock is trading for $21.55 and has an average price target of $31.71, implying a one-year upside of 47%. (See Camping World Holdings’ stock forecast at TipRanks.)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.