With two and a half months of 2024 behind us, it’s fair to say that last year’s rally is still with us, with the S&P 500 up 8.5% so far this year. In an interesting development, the ‘Magnificent 7’ mega-cap tech firms, or at least some of them, have slowed down, giving investors a chance to diversify their portfolios without sacrificing gains.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Madison Faller, global investment strategist for the investment firm JPMorgan, sheds light on the situation: “We agree that the path forward for markets is higher. We think big tech can continue to climb and other segments of the market can also join in… Other sectors and pockets of the market, such and consumer-linked names, health care and small and mid-cap companies, stand to join in the rally.”

“Last year, the Magnificent 7 contributed 60% of the S&P 500’s 26% total return, while remaining 493 companies accounted for just 40%. So far this year, that’s flipped, with ‘everything else’ now driving almost 60% of the S&P’s return,” Faller added.

Following her lead, the JPMorgan stock analysts have identified two small-cap stocks that show potential to gain as much as 140% in the coming months. In fact, JPMorgan analysts are not the only ones singing the praises of these stocks. According to TipRanks database, they are both rated as ‘Strong Buys’ by the analyst consensus. Let’s take a closer look.

Annexon Biosciences (ANNX)

First on our list of JPMorgan picks is Annexon Biosciences, a clinical-stage biopharmaceutical company working on new treatments for patients who suffer from complement pathway-mediated disorders of the brain, body, and eye. The company works with a distinct approach designed to stop C1q and all inflammatory aspects of the complement pathway before activation begins. Annexon is the only biopharma active now to focus solely on C1q, and its ‘flagship’ programs target several conditions, including Guillain-Barré syndrome (GBS), geographic atrophy, and other autoimmune indications.

The leading program in the company’s pipeline is ANX005, a proposed treatment for GBS. This condition is an autoimmune disease of the peripheral nervous system, characterized by sudden-onset muscle weakness. The condition can be life-threatening when it affects the muscles that control breathing or when it causes abnormal heart rate or blood pressure.

ANX005 has received both Fast Track and Orphan Drug designations from the FDA, and Annexon expects to report data from the drug candidate’s Phase 3 pivotal clinical trial results during Q2 of this year. The company is on track to prepare and submit the BLA (Biologics License Application), a key regulatory milestone, during 2H24.

Also on track for this year is Annexon’s ANX007 program. This drug candidate is under study as a treatment for geographic atrophy, a form of dry age-related macular degeneration. Currently, the company plans to initiate the Phase 3 ARCHER II trial in mid-2024, as well as the Phase 3 ARROW trial during the second half of this year.

The company’s solid pipeline, and particularly the advanced state of its leading ANX005 program, has caught the eye of JPM’s 5-star biotech expert Anupam Rama, who is bullish on Annexon.

“We see a high probability of success for the near-term ANX005 pivotal phase 3 readout in Guillain-Barre Syndrome. Recall, data are expected in 1H24 and is a key near-term value driver of ANNX shares… We are conservatively on the lower end of Street peak sales for ANX005 in GBS (JPMe: WW $500M+; Street range $500M-$1B in US / EU). On positive pivotal data in GBS, we see ANNX shares trading to the high-single digits / share level versus downside to the low-single digits / share level; hence balanced reward / risk profile at current levels (though again, we see a high probability of success and see potential for sentiment based upside),” Rama opined.

Quantifying his bullish stance, Rama gives Annexon shares an Overweight (i.e. Buy) rating, and he supports that with an $11 price target that shows his confidence in a 140% potential gain for the stock over the course of this year. (To watch Rama’s track record, click here)

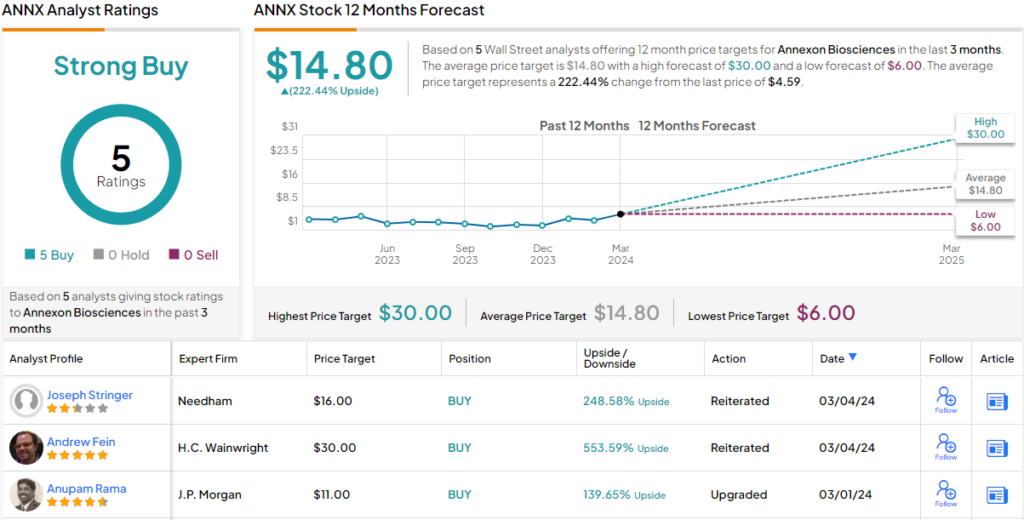

The JPMorgan view may turn out to be the conservative look at Annexon – the stock’s Strong Buy consensus rating is based on a unanimous 5 analyst reviews, and the average price target of $14.80 suggests 222% upside from the current share price of $4.59 (See Annexon stock forecast)

EverQuote (EVER)

Next up is the online insurance marketplace EverQuote. This company operates a platform that connects insurance buyers with insurance agents and covers multiple aspects of the industry, including life insurance, car and vehicle insurance, and home and renter insurance. Agents can post policies and pricing on the platform in a format that is searchable for potential buyers. Buyers can use the search capability to seek out specific insurance products and specific policy pricing ranges. EverQuote provides these services free of charge to the policy buyers and takes its own cut after policies are purchased through fees paid by the issuing insurance company.

EverQuote was founded in 2011 and is one of many companies that have taken advantage of the digital economy to streamline consumer or financial industries for both customers and vendors. The company describes its mission as ‘empowering insurance shoppers’ and uses the combination of digital tech and data to make the insurance market – traditionally viewed by its customers as too complex – simpler and more affordable, as well as more personalized to the buyer’s needs. The end result is cost savings for the customer through better risk management.

As more and more consumers, across the economy generally, turn to online and digital business, EverQuote has found itself realizing some overall gains, reflected in a 49% increase in the company’s stock year-to-date.

In the latest reported quarter, 4Q23, EverQuote recorded revenues of $55.7 million, exceeding expectations by nearly $6 million. The company’s bottom line figure, the GAAP EPS, was a loss of 19 cents per share – but this compared favorably to the 26-cent loss in the prior-year quarter and beat the forecast by 13 cents per share. Overall, it was a solid quarter for EverQuote.

Those sound results were expected by JPMorgan analyst Cory Carpenter, who sees this company in a sound position to continue delivering strong results.

“We expected strong results after peers MAX/QNST called out improved auto carrier spend into year end, but EVER’s 1Q outlook far exceeded expectations… Indeed, EVER is still operating far below its pre-hard cycle revenue runrate, though Adj. EBITDA has almost returned to prior highs of ~5.5-6% margin due to structural improvements made during the downturn. We are increasing our 2024 revenue by 26% and our 2024 Adj. EBITDA from $5M to $17M. EVER shares are up 200%+ over the last 6 months, but we continue to like EVER as a levered play on the auto carrier recovery, which we expect to drive accelerating revenue growth and healthy margin expansion through 2025,” Carpenter stated.

Looking ahead, Carpenter puts an Overweight (i.e. Buy) rating on EVER stock, with a $25 price target that implies a one-year upside potential of ~37%. (To watch Carpenter’s track record, click here)

The Strong Buy consensus rating on EVER shares is based on 7 recent analyst reviews, which break down to 6 Buys and 1 Hold. The stock is currently trading for $18.30 and its $24.33 average price target indicates room for ~33% gain on the one-year horizon. (See EverQuote stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.