We’re about eight months into President Trump’s second term, and after a tumultuous period, a few things are coming into focus. The administration’s priorities are dramatically different from those of the preceding Biden Administration, and cutting back on benefit programs forms a central part of that agenda.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

In fact, the ‘Big Beautiful Bill’ that Trump recently signed into law contains several provisions that cut back on Medicaid spending, including stricter checks on eligibility, as well as work requirements for eligibility, along with reductions in federal Medicaid grant funding to the states. Medicaid isn’t likely to disappear, but the program is likely to see substantial changes.

Against this backdrop, J.P. Morgan analyst Benjamin Rossi sees the current outpatient landscape as especially favorable for healthcare facility stocks with less exposure to federal reimbursements, given both the OBBBA-driven changes to Medicaid and the continuing rate pressure in Medicare.

“The group shares favorable secular tailwinds derived from 1) an aging population in the U.S. that is increasing in aggregate acuity; 2) payer preference given cost savings potential on the lower cost of care within outpatient settings vs traditional inpatient; and 3) patient preference given ease of access. Collectively, these names also operate in fragmented industries possessing sizable market opportunities, with M&A serving as a meaningful growth lever and lower leverage allowing for greater optionality on upside opportunities,” Rossi noted.

Building on this thesis, Rossi has highlighted two healthcare facility stocks he sees as well-positioned to thrive under these conditions. These companies, the analyst argues, can protect their business models while capitalizing on strong secular demand.

We’ve turned to the TipRanks database to see how the broader Wall Street community views them as well. Let’s dive in.

Concentra Group Holdings (CON)

The first JPM pick we’re looking at here is Concentra Group Holdings, the largest outpatient provider of occupational health services in the US market. The company’s services include physical exams, physical therapy, tests and screenings, and onsite workplace clinics. Concentra traces its roots to 1979, and in its current incarnation boasts a market cap of $2.65 billion, employs a network of 11,000 health professionals, physicians, clinicians, and support personnel, and its network can see more than 50,000 patients every day.

Concentra’s business follows two main paths, occupational health and workplace injury management. On the first path, the company partners with more than 239,000 employers to offer services including employee health education, wellness, injury prevention, ergonomics, occupational therapy and medicine, and pre-placement testing. Concentra bills its facilities as a one-stop shop for employers to find all of their occupational health needs.

Turning to workplace injury management, the company works with employees to ensure prompt recovery and safe return to the job with a minimum of business interruption. Concentra gives its chief concern as ensuring workers’ health after injuries on the job, along with streamlining the process of workers’ compensation. The company employs experts in injury care to help employers ensure that injured workers can quickly receive the needed care.

Occupational health is big business, and Concentra has a network that includes more than 540 medical centers around the country. The company boasts that it treats 1 in 5 workplace injuries, a solid market share.

Concentra last reported quarterly results for 2Q25. In that quarter, the company’s top line was $550.8 million, up 15% year-over-year and beating the forecast by $13.44 million. At the bottom line, the company’s earnings came to 37 cents per share in non-GAAP measures; this figure missed the forecast by a penny.

The company’s strong position in its field has caught the attention of JPM’s Rossi, who writes of the healthcare firm, “CON is our top pick among outpatient names given the company’s lower exposure to federal spending programs that reduces execution risk as the company de-levers following sizable acquisitions in 1H25… We believe that the scale of CON’s platform within occupational health vs peers allows the company to be an attractive partner for large, multi-state employers and should ultimately allow CON to maintain favorable terms during future rate negotiations across its growing Employer Services segment. We also note potential upside to rate development in 2026 on the upcoming FY2026 Medicare Physician Fee Schedule (PFS) final rule set for release at the end of October… With integration of recent M&A and de-levering both top priorities heading into next year, we believe CON’s more favorable reimbursement backdrop de-risks the story and allows for upside on incremental M&A/favorable rate development.”

Rossi goes on to rate CON as Overweight (i.e., Buy), and his $31 price target implies a one-year upside potential of 50%. (To watch Rossi’s track record, click here)

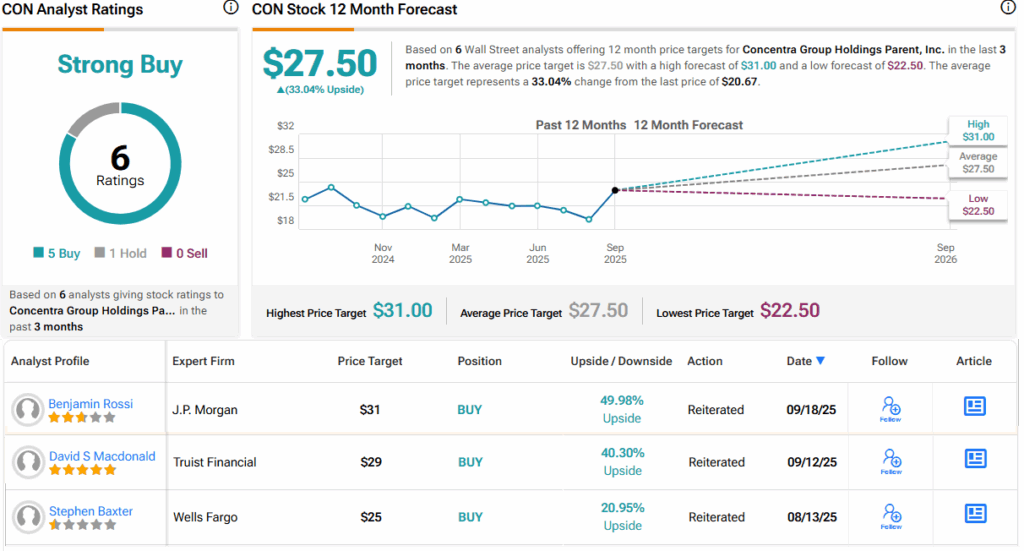

CON shares have a Strong Buy consensus rating, based on 6 analyst reviews that include 5 Buys to 1 Hold. The stock is priced at $20.67, and its $27.50 average price target suggests that it will gain 33% by this time next year. (See CON stock forecast)

US Physical Therapy (USPH)

The next of JPM’s picks that we’ll look at here is US Physical Therapy, a pure-play operator of outpatient clinics for physical therapy and occupational therapy. The company is one of the largest such firms to be publicly traded, and boasts a market cap of $1.2 billion. US Physical Therapy operates in 44 states, and its clinics provide a wide range of preventative and post-op care for orthopedic disorders and sports injuries, as well as treating neurologic injuries and providing rehab for workplace injuries.

US Physical Therapy provides these services through its network of clinics, but it also manages PT facilities for “unaffiliated third parties,” 38 of them in all. In addition, the firm provides onsite services for the workforces of its clients, as part of an industrial injury prevention business. These services include injury rehab as well as prevention, along with ergonomic assessments, functional capacity evaluations, post-offer employment testing, and performance optimization.

A look at some of the company’s numbers will give the scale of the business. US Physical Therapy has been in business since 1990, and currently has over 2,300 therapy clinicians operating out of 765 clinics. The company uses a partnership model, working with private practitioners to expand its network while keeping the partners’ brands in place. US Physical Therapy buys a percentage of each partner’s business, while the partners keep an ownership stake in that business. The model allows for community-focused clinics to provide personalized care in the PT and OT fields.

Turning to the company’s financial side, we find that US Physical Therapy generated revenue of $197.3 million in 2Q25, for an 18% year-over-year increase and beating the forecast by $7.45 million. On the bottom line, the company reported a non-GAAP EPS of 81 cents; this figure was up 8 cents per share year-over-year and beat the estimates by 12 cents per share.

Checking in one last time with Rossi and the JPM view, we find that the analyst sees US Physical Therapy riding a demographic wave and health-positive social trends to continued success. He writes of the company, “We believe USPH is well positioned to benefit from long-term demographic trends, including an aging population, higher incidence of obesity, and broader population trends that favor a more physically active lifestyle, all of which drive demand for physical therapy services. The physical therapy industry remains highly fragmented with >37K clinics in the U.S., and we believe USPH is well-positioned to continue gaining market share through favorable secular demand trends as well as favorable balance sheet capacity to continue adding facilities inorganically (net leverage of 1.4x a/o 2Q25). With dry powder available for accretive M&A, we see ample opportunity for the company to increase market share through further consolidation.”

Rossi’s Overweight (i.e., Buy) rating on USPH is accompanied by a $110 price target that implies a gain of 34% over the next 12 months.

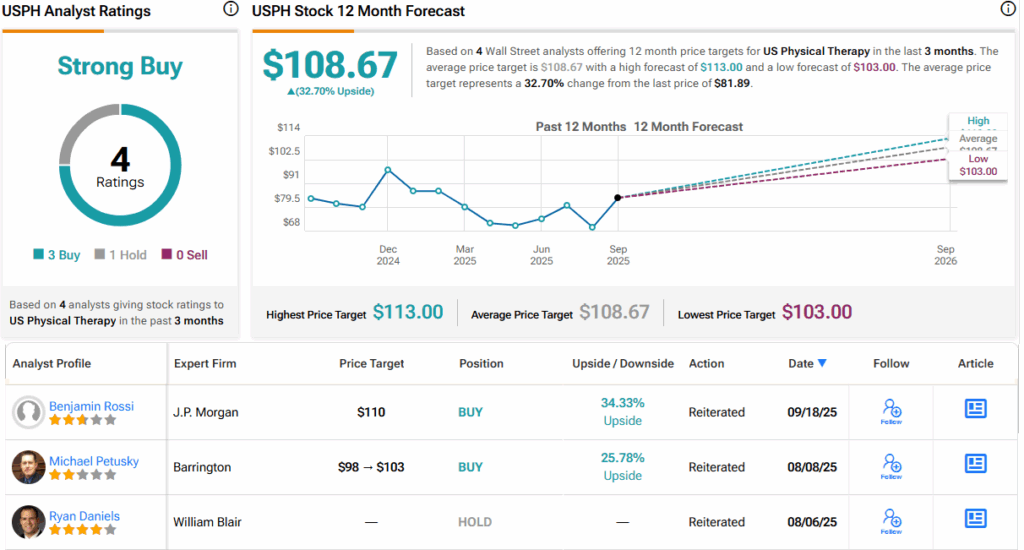

Overall, USPH stock has a Strong Buy consensus rating, based on 4 recent reviews that include 3 to Buy and 1 to Hold. The shares are currently priced at $81.89 and the $108.67 average price target points toward an upside of 33% on the one-year horizon. (See USPH stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.