In the investing world, the art of “stock picking” is crucial for success; investors must choose the right stocks to invest in to achieve strong returns. Therefore, when Wall Street experts label a stock as a ‘Top Pick,’ it’s a significant indication that the stock has great potential, and investors should take note.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Using the TipRanks platform, we’ve looked up the details on two stocks that have recently gotten ‘Top Pick’ designation from the analysts at banking giant J.P. Morgan.

So, let’s dive into the details and find out what makes them so. Using a combination of market data, company reports, and analyst commentary, we can get an idea of just what makes these stocks compelling picks for 2023.

Targa Resources Corporation (TRGP)

We’ll start in the energy industry, with Targa Resources. This is a midstream company, operating in the area between the wellheads and the end customers. Midstream firms control networks of pipelines and infrastructure facilities, moving hydrocarbon products to where they’re needed. Targa, one of North America’s largest independent midstream operators, focuses on the movement of natural gas and natural gas liquids; its asset network is centered around rich production areas of Texas, New Mexico, Oklahoma, and Louisiana’s Gulf Coast.

Targa is relatively insulated from natural gas and crude oil costs in the commodity markets, as it moves products through its network on a ‘toll road’ model; that is, producers pay by contract for moving specified amounts through the system. This model allowed Targa to realize increased earnings and cash flow in its recently reported 4Q22, despite a year-over-year drop in revenues.

Getting into detail, Targa reported a top line of $4.55 billion, down 16% from the $5.44 billion reported in 4Q21. In the good news, the company’s operating income improved y/y from a net loss of $335.4 million to a net gain of $317.9 million. The gain in income was driven by a strong y/y increase in volumes of natural gas liquids transported, from 432,800 barrels per day in the year-ago quarter to 502,300 barrels per day in the current reporting period – a gain of 16%.

Also of interest to investors, Targa reported returning $542 million in aggregate capital to shareholders in 2022, through a combination of regular dividends and share buybacks.

Taken together, all of this has caught the eye of JPMorgan analyst Jeremy Tonet who writes, “We continue to believe TRGP’s advantaged Permian footprint and franchise create a favorable risk/reward proposition. With a fully integrated well-to-dock Permian NGL value chain, we see TRGP as a differentiated growth story versus all C-Corp peers… We reaffirm TRGP as a top pick given the integrated Permian wellhead to export value chain, NGL operating leverage, direct commodity price uplift, visibility to deleveraging and increased shareholder returns.”

Tonet doesn’t just lay out an upbeat path for this stock, he also gives it an Overweight (i.e. Buy) rating, along with a $119 price target that implies a one-year upside potential of 76%. (To watch Tonet’s track record, click here)

JPMorgan is highly bullish on this stock, but it’s view is far from an outlier. Targa shares have 11 unanimously positive recent analyst reviews on file, giving them a Strong Buy consensus rating. The stock is priced at $67.52 and its average price target of $100 and change indicates it has room for ~48% appreciation in the year ahead. As a small bonus, the company pays regular dividends that currently yield 2% annually. (See TRGP stock forecast)

BeiGene, Ltd. (BGNE)

The next JPM top pick is BeiGene, a biopharma company at both the clinical and commercialization stages. BeiGene features a pipeline that is both wide and deep, giving the firm multiple ‘shots on goal’ as it develops new drug candidates in the field of oncology. BeiGene is working both in-house and with collaboration partners in these pipeline endeavors; the company currently has over 60 clinical programs in the works, targeting some 80% of cancers, and giving it a tremendous advantage of scale when compared to peers.

While the pipeline is impressive for its size and scope, the key factor in this stock, for investors, is that it has already succeeded in getting new drugs into circulation. BeiGene has three drugs – all cancer treatments – approved for use and has been working on expanding sales.

The approved drugs are tislelizumab, branded under its own name, zanubrutinib, branded as Brukinsa, and pamiparib, branded as Partruvix; BeiGene describes the first two of these as its ‘cornerstone products.’ All three are approved in multiple jurisdictions and are used in the treatment of various solid tumors and hematological cancers.

By the numbers, BeiGene realized $102.2 million in product revenue from tislelizumab in 4Q22, and $564.7 million from the drug for all of 2022. These results were up 72% and 97% respectively from their 2022 values. The second ‘cornerstone’ product, Brukinsa, saw revenues of $176.1 million for Q4 and $564.7 million for the full year; these figures represented y/y growth of 101% and 159%.

BeiGene’s total top line in 2022 came to $1.4 billion, compared to $1.2 billion in 2021. The 2022 total revenues included $1.3 billion in product revenues, which was up 97.9% from the prior year.

In covering this stock, JPMorgan analyst Xiling Chen focused on the company’s sales successes and prospects.

“We expect US sales momentum to further accelerate in 2023 driven by launch in CLL/SLL (largest indication in nHL), and we highlight that script trends so far already point to signs of an inflection point in uptake one month after approval in late January. Along these lines, we are modestly raising our near and longer term Brukinsa US sales estimates. We are currently expecting the product to achieve US$1bn sales this year and peak sales of ~US$4bn in 2032. This is slightly below consensus, and we see additional room for upside tied to commercial execution of the BeiGene team as well as additional indication expansions,” Xiling wrote.

“We continue to highlight BeiGene as our current top-pick with strong Brukinsa CLL/SLL momentum in the US setting up potential sales beats for the next few quarters,” the analyst summed up.

These comments back up Chen’s Overweight (i.e. Buy) rating on the shares, while the $297 price target suggests a one-year gain of ~35%. (To watch Chen’s track record, click here)

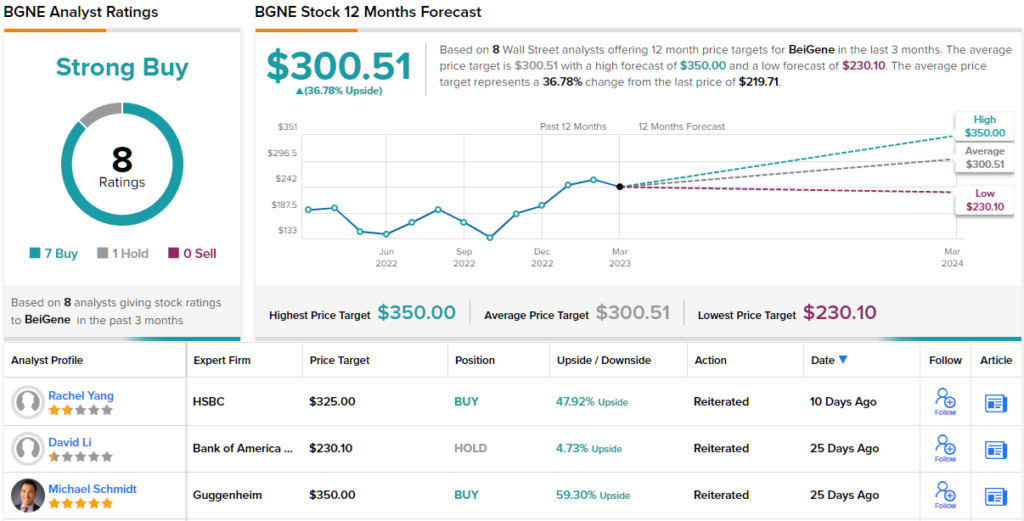

Overall, JPMorgan has tapped a stock with a Strong Buy consensus rating as a top pick; BeiGene has 7 recent analyst reviews, with a 7 to 1 breakdown favoring Buy over Hold. The shares are trading for $219.71 and have an average price target of $300.51. (See BGNE stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.