Looking for a long-term winner in the tech sector? Look no further than The iShares U.S. Technology ETF (NYSEARCA:IYW). Not only has this $10.7 billion tech ETF from BlackRock’s (NYSE:BLK) iShares posted double-digit annualized returns for years, but as of the end of the most recent month, it sported an annualized return of over 20% over the past decade. Therefore, let’s take a closer look at this powerhouse tech ETF.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

What is the IYW ETF’s Strategy?

IYW seeks to give investors “targeted access to domestic technology stocks” by investing in U.S.-based information technology, electronics, and computer software and hardware companies.

IYW’s Long-Term Track Record

As discussed above, IYW has put up phenomenal results over the years. As of the end of August, IYW returned 12.2% on an annualized basis over the past three years. Looking further out, the fund’s five-year return is an even more impressive 18.6% on an annualized basis. Going all the way out to 10 years, IYW has generated a stellar 20.2% return on an annualized basis.

Looking at things cumulatively, IYW’s 10-year return was an incredible 544.2%, meaning that an investor who put $10,000 into the fund 10 years ago would have a stake worth $64,420 as of the end of August.

These results soundly beat those of the broader market over the same time frame. For example, the Vanguard S&P 500 ETF (NYSEARCA:VOO) has returned 10.5% annualized over the last three years, 11.1% annualized over the past five years, and 12.8% over the past decade.

At the same time, IYW’s results are roughly on par with those of some of the market’s biggest and most well-known tech ETFs, the Technology Select Sector SPDR ETF (NYSEARCA:XLK) and the Invesco QQQ Trust (NASDAQ:QQQ). XLK’s annualized returns over the past three, five, and 10 years stand at 13.4%, 19.7%, and 20.5%, respectively, just a hair above IYW’s over each time frame.

Meanwhile, IYW has slightly outperformed QQQ over each of the same time frames. QQQ’s annualized returns over the past three, five, and 10 years come in at 9.3%, 16.0%, and 18.6%, respectively.

At the end of the day, these are all great ETFs, and IYW is right there in the mix with them. Below, you’ll find a comparison of IYW, QQQ, and XLK using TipRanks’ ETF comparison tool, which gives investors the ability to compare ETFs on a variety of customizable factors.

IYW’s Holdings

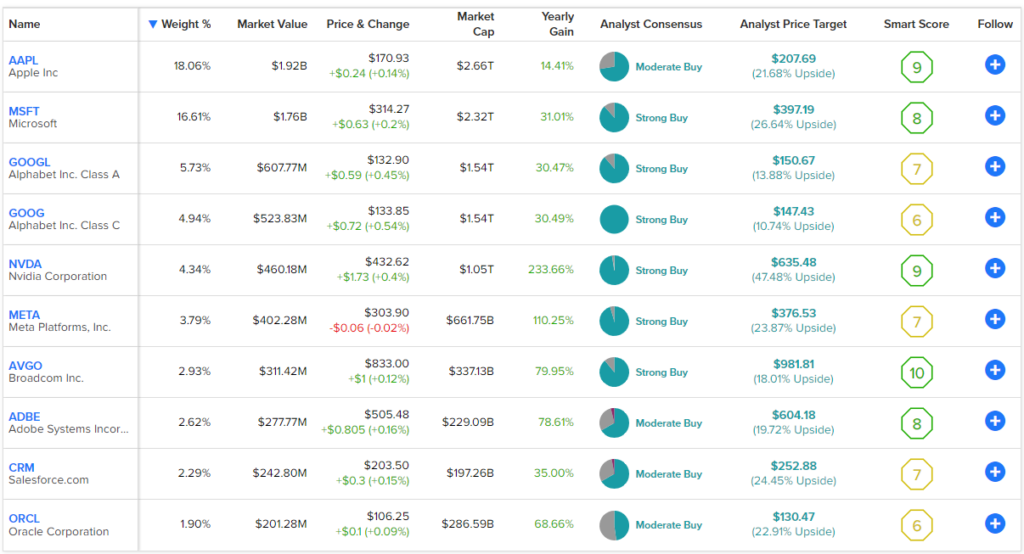

With 137 holdings, IYW offers decent diversification. However, the fund is also fairly concentrated in that its top 10 holdings account for 63.2% of assets. Below, you’ll find an overview of IYW’s top 10 holdings using TipRanks’ holdings tool.

As you can see, the fund’s largest two holdings, Apple (NASDAQ:AAPL) and Microsoft (NASDAQ:MSFT), combine to make up over one-third of the fund’s assets. The two classes of Alphabet (NASDAQ:GOOG) (NASDAQ:GOOGL) shares also combine to make up over 10% of the fund.

What I like about IYW’s overall group of holdings is that it gives investors a nice mix of exposure to all aspects of the technology sector. About 40.9% of IYW’s holdings fall under the software and services subsector, and 21.8% are classified as semiconductors and semiconductor equipment. Another 20.9% are classified as tech hardware and equipment, while media and entertainment accounts for a 14.9% weighting.

This allows investors to tap into the full range of what the tech sector has to offer, whether it’s semiconductor giants like Nvidia (NASDAQ:NVDA) and Broadcom (NASDAQ:AVGO), enterprise software providers like Oracle (NYSE:ORCL) and Salesforce (NYSE:CRM), or multifaceted tech behemoths like Alphabet and Meta Platforms (NASDAQ:META).

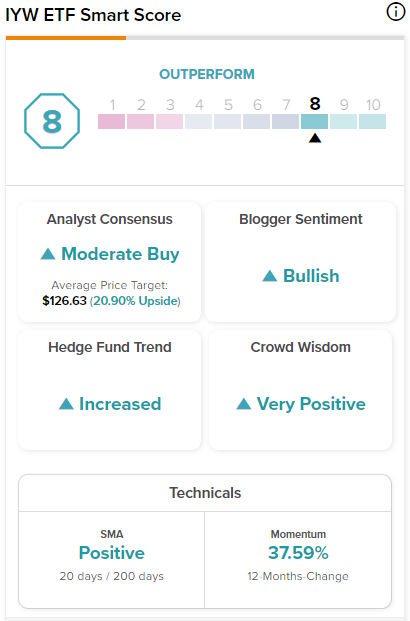

Collectively, IYW’s top holdings are the owners of some strong Smart Scores. The Smart Score is a proprietary quantitative stock scoring system created by TipRanks. It gives stocks a score from 1 to 10 based on eight market key factors. A score of 8 or above is equivalent to an Outperform rating. Seven of IYW’s top 10 holdings feature Smart Scores of 8 or above, led by Nvidia and Broadcom, which have ‘Perfect 10’ Smart Scores. IYW itself has an Outperform-equivalent ETF Smart Score of 8.

Is IYW Stock a Buy, According to Analysts?

Turning to Wall Street, IYW earns a Moderate Buy consensus rating based on 109 Buys, 27 Holds, and one Sell rating assigned in the past three months. The average IYW stock price target of $126.63 implies 20.9% upside potential.

Expense Ratio

Outside of the high concentration in its top holdings, the only real negative of IYW is its expense ratio. While its expense ratio of 0.40% is reasonable, it’s also higher than those of comparable ETFs like the aforementioned QQQ and XLK, which charge 0.20% and 0.10%, respectively.

An investor allocating $10,000 into IYW would pay $40 in fees and expenses during their first year of investing versus $20 for an investor putting the same amount into QQQ or $10 for a $10,000 investment in XLK.

While these are all reasonable amounts, IYW is the most expensive of the group. The difference in fees would also compound over time. Assuming that each fund returns 5% per year going forward and that each maintains its current expense ratio, the IYW investor would pay $505 in fees over the course of 10 years, versus $128 for the XLK investor and $255 for the QQQ investor.

When a fund is returning 20% or more on an annualized basis, this might not be a major consideration, but it’s still something that investors should be aware of.

Investor Takeaway

Ultimately, IYW is another top tech ETF that has proven itself as a long-term winner. The fund has achieved excellent annualized returns of over 20% over the past 10 years, creating significant long-term wealth for its investors in that time.

Also, the ETF gives investors broad exposure to all facets of the U.S. technology sector while having an Outperform-equivalent ETF Smart Score of 8 and a Moderate Buy rating from analysts. The only real downside is its expense ratio, which while reasonable, is higher than those of its larger competitors. Nonetheless, IYW’s long-term performance and proven track record make it a solid choice for investors to consider adding to their portfolios.