40 states and Washington, D.C. now permit either medical or recreational marijuana use. Simultaneously, the cannabis market has grown exponentially and is expected to continue doing so for years. However, because of still-high interest rates, market saturation, and ongoing earnings disappointments, I remain bearish on one of the industry’s darlings: Village Farms (NASDAQ:VFF), which looks burnt up.

The global cannabis market is expected to increase from $27.7 billion in 2022 to $82.3 billion through 2027. In the U.S. alone, retail cannabis sales are projected to reach $56.9 billion by 2028, a 32.51% increase over 2024’s projected retail cannabis sales of $38.4 billion. Given those factors, on the surface, it may seem like Village Farms’ unfortunate performance over the past few years is a buy-low opportunity.

That’s especially true when considering how long the company’s been in business. For over 30 years, Village Farms has made a name for itself as one of the leading suppliers of fresh produce for retailers in the U.S. and Canada.

In 2017, Village Farms branched into cannabis, looking to take advantage of high-growth opportunities. Its wholly-owned subsidiary, Pure Sunfarms, is one of the world’s largest marijuana growers. The company has a global footprint, too, announcing in late January 2024 the build-out of its first indoor production facility in Drachten, Netherlands, with production tentatively slated for Q4 2024.

However, like the industry itself, Village Farms faces numerous headwinds that, in the near and medium term, are likely to continue blunting its share price.

3 Pot Stock Headwinds

The Canada-based company, founded in 1989, exploded onto the pot stock scene. Shares gained ~1,200% from 2016 to March 21, 2019, when it reached its then-all-time-high closing price of $17.45. After plummeting in April 2020 to around 85% from their highs, shares recovered, ultimately reaching VFF’s all-time-high closing price of $19.37 on February 10, 2021. Unfortunately, it’s all been downhill since. Currently, the stock is trading at around $0.84.

Village Farms’ struggles aren’t unique, as demonstrated by last year’s performance of the MJ PurePlay 100 Index, which tracks the shares of 100 pot stocks. In 2023, that index fell by ~15%, hitting its all-time low in October. It’s also 91% off its all-time high.

A multitude of factors is likely to keep Village Farms underperforming for the foreseeable future and could threaten its three-decade run in the controlled environment agriculture space.

#1: Market Saturation

The medical and recreational cannabis industries’ rate of growth has resulted in market saturation. Although sales have increased annually, competition’s resulted in price reductions, with U.S. retail prices falling by up to 20% from 2021 to 2022. It’s expected that fewer than one-quarter of companies in the sector will be profitable when year-end 2023 earnings are reported.

Oversupply is exacerbated by other factors that threaten profitability, including costly licensing and taxes, product losses due to fires stemming from lighting system failures, theft, and a rapidly-spreading plant pathogen that could cost producers billions in the years ahead.

Concurrently, the industry’s rapid expansion and poor performance are deterring investments, resulting in cannabis companies having to lower prices further or cut costs.

#2: Interest Rates

While the Federal Reserve’s expected to cut interest rates in 2024, the cost of borrowing remains high. Cannabis companies burn through cash. Village Farms doesn’t report Q4-2023 or full-year 2023 earnings until March 14, but as of September 30, 2023, VFF saw its cash on hand fall by 63.05% year-over-year.

Meanwhile, sales were 2.2% lower than the same period a year prior, with $28.81 million in sales in Canadian markets but only $4.99 million in America. The company’s long-term debt stood at $39.81 million. The result — more borrowing and a continuation of negative EPS, which for Q4 2023 is estimated to be -$0.02.

#3: Insurance Rates

According to HUB International, an insurance and wealth management firm, “Whether they are growers, retailers or distributors, cannabis companies operate in a complex marketplace with a highly sensitive product. Hazards in cannabis growing and processing facilities remain a concern for underwriters.”

“High-pressure sodium grow lights present significant fire risks; fertilizers and extraction equipment can compromise worker safety …. Rates are rising for many lines of coverage, and carriers are making modifications, such as reducing indemnity time in business interruption insurance.”

To recap:

- Market saturation has driven down prices, hurting bottom lines.

- Interest rates remain elevated, making the cost of borrowing money higher for companies notorious for high cash burn rates.

- Insurance rates are increasing, presenting higher expenses for cannabis producers already operating in the red.

In total, these headwinds are likely to have long-lasting impacts. Given current valuations, cash burn rates, and macroeconomic factors, stocks like VFF may not be the buy-low opportunity investors are hoping they are. This is further illustrated through technical sentiment.

Tepid Technical Sentiment

Despite headlines purporting 2024 as the year for pot stocks, similar headlines made financial news every year since decriminalization and recreational legalization accelerated. However, regardless of renewed enthusiasm, technical sentiment doesn’t align.

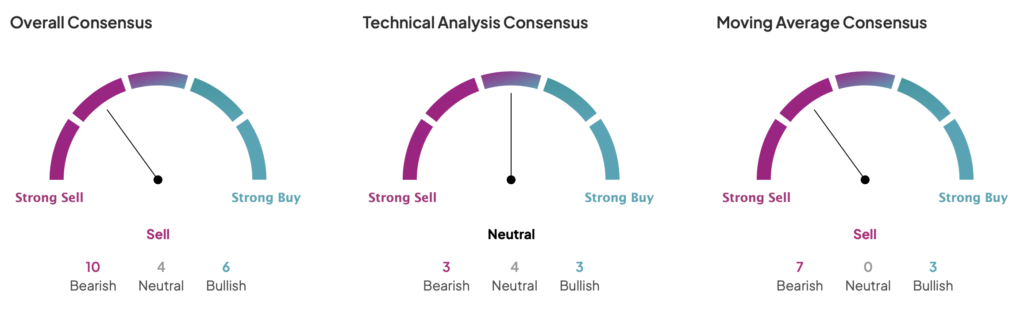

One-month technical sentiment is notably negative for VFF, ranging from neutral to bearish in overall consensus, technical analysis consensus, and moving average consensus.

On its three-year chart, VFF has been trading below its 200-week moving average (MA) — the dividing line for long-term bearishness — since November 2021. Further, the 200-week MA (sitting at $4.93) is extremely distant from VFF’s current share price. Given the company’s troublesome fundamentals and headwinds, there’s no reason to expect this to change in the short term.

Is VFF Stock a Buy, According to Analysts?

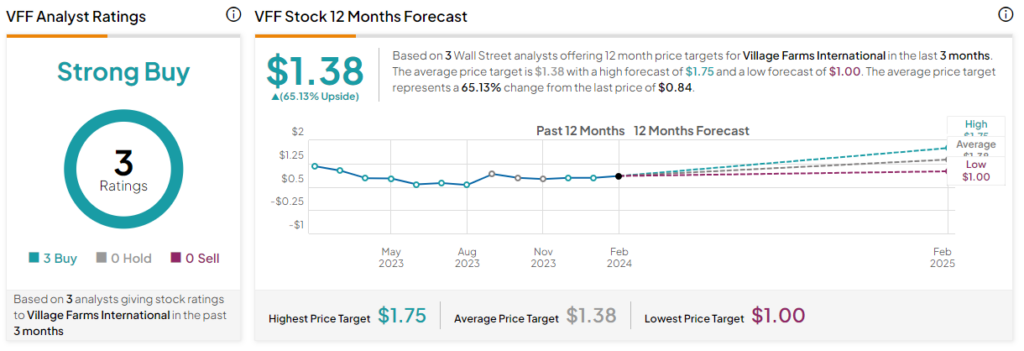

On TipRanks, VFF stock earns a Strong Buy consensus based on three Buys, zero holds, and zero sells. The one-year average VFF stock price target is $1.38, with the low price target at $1.00 per share and the high at $1.75. This represents 58.6% upside potential. However, my contrarian take is that, when factoring in the challenges VFF faces, underperforming those marks in 2024 would not be surprising.

The Takeaway

The cannabis industry is expected to continue its rapid growth through the latter part of the decade. Because of progressively lower barriers to entry, the market has become saturated, retail prices have plummeted, and investments have eroded. Those factors, along with high interest rates, increasing insurance rates, and significant long-term debt, make VFF an unlikely candidate to reverse its decline.