New York-based Lemonade, Inc. (NYSE: LMND) provides insurance services through an artificial intelligence-based platform. Its services include term life insurance, pet insurance, car insurance, homeowners’ insurance, and renters’ insurance.

Apart from the U.S., the company also has a presence in France, the Netherlands, and Germany. Lemonade got listed on the New York Stock Exchange on July 1, 2022, and the stock price more than doubled on the first day of trading.

After the listing, LMND stock kept gaining to reach an all-time high in February 2021. Thereafter, the stock started falling and reached its lowest point this month.

The company reported its first-quarter results last month. Let’s take a look at how it fared.

Q1 Results

For the first quarter ended March 31, Lemonade recorded a loss of $1.21 per share, narrower than the Street’s loss estimate of $1.39 per share but wider than the year-ago loss of $0.81 per share.

Revenues rose 89% year-over-year to $44.3 million and gross earned premium jumped 71% year-over-year to $96 million. In Force Premium (IFP) climbed 66% to $419 million, driven primarily by a 37% rise in the number of customers to over 1.5 million and a 22% increase in premium per customer to $279.

Adjusted gross profit soared 226% to $16.3 million, and EBITDA loss stood at $57 million.

The company said, “Notwithstanding the turbulent market forces and macroeconomic environment, both our top line and our bottom line came in ahead of expectations.”

Guidance

For the second quarter, Lemonade expects revenue to range from $46 million to $48 million, and adjusted EBITDA loss to lie between $65 million and $70 million. Gross earned premium is expected to be in the range of $103 million to $105 million, and IFP to be around $445 million to $450 million.

Analysts expect the insurance provider to post a loss of $1.33 per share in the second quarter.

The company also provided full-year 2022 guidance. It anticipates revenue to range from $205 million to $208 million and adjusted EBITDA loss between $265 million and $280 million. Gross earned premium is expected to be in the range of $426 million to $430 million and IFP to lie between $535 million and $545 million.

Price Target

Based on four Buys, one Hold, and two Sells, the stock has a Moderate Buy consensus rating. LMND’s average price target of $27.71 implies 47.6% upside potential from current levels. Shares have lost 82.6% over the past year.

Bloggers’ Sentiment

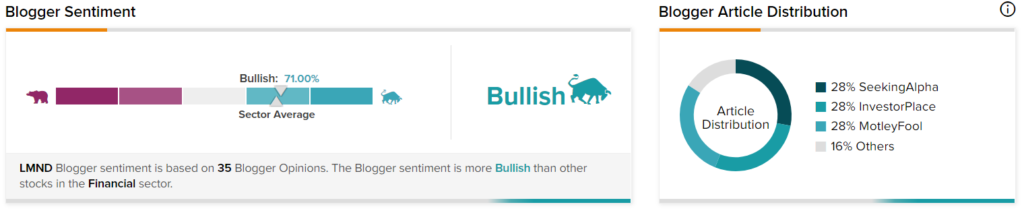

TipRanks data shows that financial bloggers are 71% Bullish on LMND, compared to the sector average of 70%.

Conclusion

Last quarter was the first complete quarter in which all of the company’s products were available in the market. Currently, all the products are available only in Tennessee and Illinois as a bundle, and in the first full quarter itself, Illinois witnessed 40% higher bundle rates compared to the rest of the U.S.

Once Lemonade launches all its products across the country, the bundle rates could significantly boost its revenue.