After an absolutely horrible 2020, OrganiGram (OGI) is one of the best performing cannabis stocks of 2021 so far, with shares skyrocketing 200%.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The latest leg up took place after American Tobacco announced it has partnered with OrganiGram to the tune of ~20% of the entire company. They are doing a joint venture where British American Tobacco will sell a cannabis product, and Organigram has the exclusive right to produce this product on behalf of British American.

This kind of deal solidifies a trajectory that is already positive for OrganiGram; the company reported multiple quarters of positive cash flow from operations. This is a key milestone to achieve. It shows that the company’s products and overall game plan will be profitable.

OrganiGram – a fuller picture of their revenue

Given the new partnership with British American Tobacco, the subsequent stock price surge, and the trajectory of OrganiGrams’ positive financials, I wanted to look to see if the penny stock is still a buy.

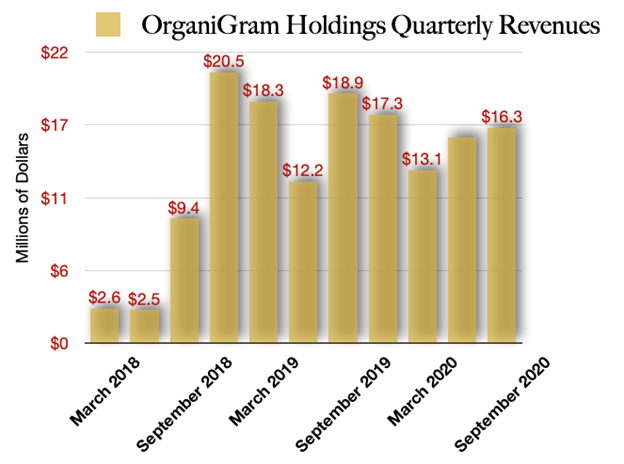

To start, here is a look at the revenue picture for OrganiGram Holdings:

(Chart Source: Company Data – Author’s Chart)

As you can see, OrganiGram’s revenues have started to increase since the COVID-induced decline. As mentioned, cashflow from operations are positive. This means that OrganiGram’s revenues generated from sales are higher than the overall cost of goods; a key milestone. If OrganiGram continues to increase revenues, this will add to economies-of-scale and start to contribute significantly to the bottom line.

What is impressive is OrganiGram has been able to achieve the positive cash flow from operations with gross margins and operating efficiencies that are below some of the best players within the industry.

OrganiGram stock has reported adjusted gross margins at 30% and operating efficiencies at 55%. After having reviewed countless cannabis companies, I have a pretty good sense as to where the best players land in certain metrics. The very best companies are hitting roughly 60%-65% in gross margins. And, operating efficiencies are typically about 35% for the best companies.

Room for improvement

OrganiGram has a lot of room for improvement with these two metrics given where they are currently. This becomes an opportunity for an investor looking for changes in financials that may increase shareholder value.

With the new addition of the British American partnership, this will improve operating efficiencies significantly simply from the mathematics of increased revenues versus operating costs. This will happen naturally. Instantly, OrganiGram’s metrics will improve with increased products being produced from British American’s own product line.

Then, with gross margins, should OrganiGram achieve a respectable level, the financial for OGI present an interesting opportunity.

As more and more sales create more and more profits via economies-of-scale, this increase in cash from operations will begin to contribute to other operating costs such as SG&A. On its own, OrganiGram is moving in a very positive direction.

And then you get to factor in a mega-partner.

British American Tobacco is a multi-billion dollar company generating revenues in the billions. They will now be able to market a cannabis product that OrganiGram will produce. Although it is still a little early to tell, future projections have Organigram’s revenues doubling.

When you start to factor in the economies-of-scale for OrganiGram, and you double the revenue while increasing gross margins by just 5%, all of a sudden OrganiGram’s financials begin to paint a very promising picture.

If OrganiGram can print $35M with 60% in gross margins, that is $21M in gross profits. Simultaneously, if OrganiGram can achieve a base-line operating efficiency of 35% on the $35M in revenues, that is $12M in costs. This amounts to $9M in operating profits; a significant increase from current levels.

OrganiGram is already moving towards profitability. Now, with a mega-partner and joint venture such as one of the biggest tobacco companies in the world, OrganiGram will add significant increases in revenues and profits. For OrganiGram, a company already on a solid path, this is a significant boost in the right direction for this penny stock.

Current price – under $5

However, after the recent share price rally of this penny stock, some analysts appear to feel the stock has surged enough for now; at $3.49, the average price target suggests shares will decline by 12% from the current share price of $3.99. (See OrganiGram stock analysis)

Disclosure: No position.

Disclaimer: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities.