Is the R1S electric SUV from Rivian Automotive (NASDAQ:RIVN) “the best SUV that you can buy right now?”

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

In a popular car review episode that’s garnered nearly 70,000 likes since airing in mid-April, YouTube star Marques Brownlee ultimately admits that this is a question that remains “up for debate.” Personally, he thinks “it makes a really compelling case.” And it seems more and more car buyers agree.

Rivian’s Q1 2023 financial report, released Tuesday evening, showed the company passing the 35,000-EVs-produced mark, including 9,345 electric vans, trucks, and SUVs produced in Q1 alone, and 7,946 delivered to customers, “despite our commercial van production line being down for a significant portion of the quarter.” As if that weren’t already impressive, Rivian is sticking with its plan to produce more than 50,000 EVs this year, or more than 5 times as many EVs as it produced in the first quarter alone.

From a financial perspective, however, Rivian’s Q1 was more of a mixed bag.

On the plus side, Rivian beat analyst expectations on both top and bottom lines. Sales for the quarter topped $661 million, versus Street predictions of $652 million. Rivian’s losses, meanwhile, were slimmer than expected — $1.43 per share (adjusted for one-time items) instead of the expected $1.59 per share loss.

Sales septupled year over year, rising from $95 million to $661 million for the quarter, while cost of goods sold merely doubled. Operating costs actually declined despite the sales growth, with selling, general, and administrative spending down 24% year over year, and research and development costs slimming by 9%. Ultimately, on the bottom line, Rivian still lost money. But it lost 18% less money in Q1 2023 than it did in Q1 2022.

Not all the news was great, however. Part of the reason that Rivian’s per share losses declined in this year’s Q1 was due to stock dilution — Rivian’s share count inched up 3% year over year, spreading the company’s $1.35 billion net loss among more shares outstanding. Rivian also filed a “shelf registration” with the SEC on Tuesday that may foreshadow more share issuances, “from time to time in one or more offerings.”

So more dilution may be coming down the pike.

Why might Rivian need to sell more shares? Again, there’s good news and bad news.

The good news is that Rivian says it still has “~$12B” (specifically, $11.78 billion) “of cash, cash equivalents, and restricted cash as of March 31, 2023” with which to fund its production expansion.

The bad news, though, is that Rivian continues to burn through its cash at an accelerating rate. Total negative free cash flow for the first quarter of 2023 came to $1.8 billion — 24% more cash than it was burning a year ago, despite the greater number of EVs being sold and turned into cash. And with operating cash flow averaging negative $1.5 billion per quarter, and an expected $2 billion in total capital spending this year, this implies that Rivian is currently burning cash at the rate of $8 billion per year.

Unless that changes, Rivian only has about 20 months to turn free cash flow positive before it runs out of cash and needs to sell more shares. Fingers crossed that Mr. Brownlee’s review converts enough car buyers into Rivian buyers to prevent that from happening — and fast.

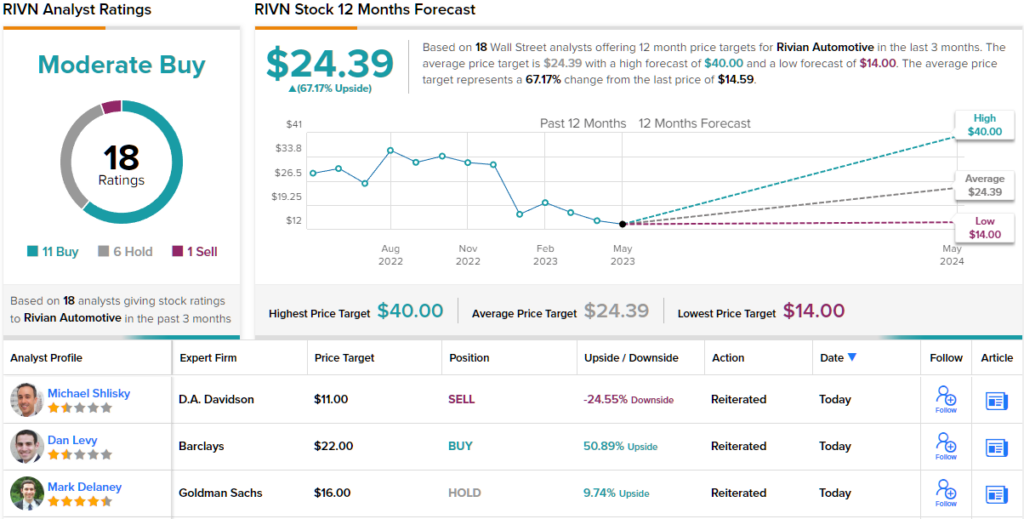

Let’s turn our attention now to Wall Street analysts. According to TipRanks, the world’s biggest database of analysts and research, RIVN has garnered 18 analyst reviews, which break down to 11 Buys, 6 Holds and a single Sell, for a Moderate Buy consensus rating. The stock is currently trading for $14.70 and its average price target of $24.39 implies a one-year upside of 67%. (See RIVN stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.