The week started off in excellent fashion for investors of SoFi Technologies (NASDAQ:SOFI). The neobank’s Q2 results impressed the Street, and the shares saw out Monday’s trading 20% into the green.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

SoFi delivered adj. revenue of $488.82 million, representing a 37.3% year-over-year increase whilst beating the analysts’ expectations by $15.45 million. Q2 adjusted EBITDA reached $76.8 million, climbing sequentially from $75.7 million and up from $20.3 million in the same period a year ago. The Street was looking for just $59 million.

Personal loan originations also surprised, coming in at $3.7 billion, above consensus at $3 billion. Additionally, the company made further strides in the personal lending space, claiming share gains of 90bps (9.1% during the quarter compared to 8.2% in Q1).

Over 584,000 new members were added, and the company exited Q2 with more than 6.2 million members, amounting to a 44% YoY increase.

The outlook was also promising. 2023 adjusted net revenue in now expected to be in the range between $1.974-$2.034 billion, up from the prior $1.955-$2.02 billion range and above the midpoint of the Street’s $1.99 billion estimate. The 2023 adjusted EBITDA outlook was also raised – from between $268-$288 million to the range between $333-$343 million. Consensus had $289 million.

With so many metrics delivering the goods, it’s no surprise BTIG analyst Lance Jessurun applauds a “strong quarter overall.” That said, Jessurun points out that “lingering questions remain.”

“We remain positive on SOFI, but are more cautious about near-term murkiness, especially given the recent share price growth,” Jessurun expounded. “We will never have trouble being strong proponents of SOFI’s business models and strong management teams, but we would be remiss to acknowledge valid concerns around capital levels, discount rates, and potential student loan refi volumes. That being said, SOFI has clearly built a fantastic product. Member growth, deposit growth and direct deposit uptake, and personal loan growth without compromising credit quality continues to leave us impressed.”

Based on this assessment, Jessurun sticks with a Buy rating yet has lowered the price target from $14 to $13, with the new figure now implying share growth of 22% over the coming year. (To watch Jessurun’s track record, click here)

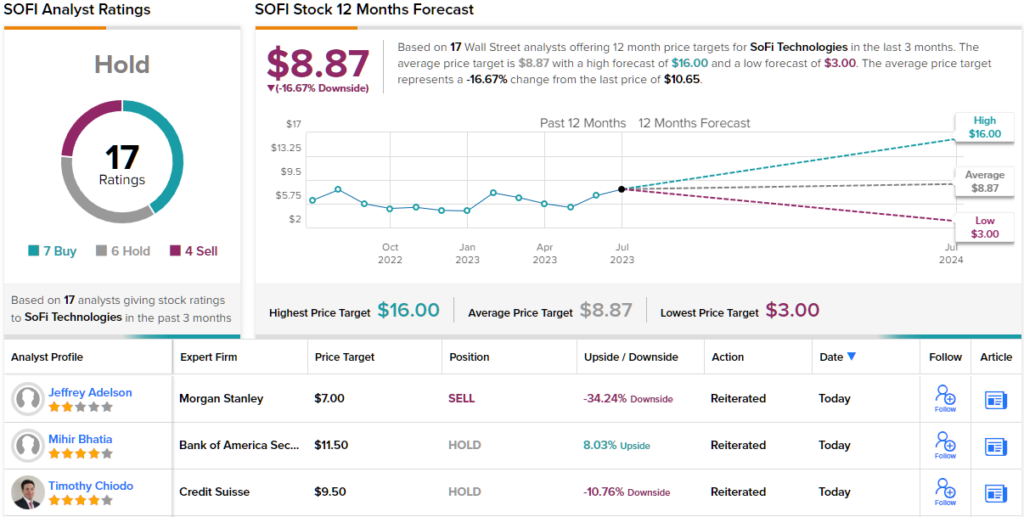

Most on the Street, however, feel the rally (shares are up by ~130% this year) has run its course. Going by the $8.87 average target, the shares will be changing hands for ~17% discount a year from now. Rating wise, the analyst consensus views the stock as a Hold, based on 7 Buys, 6 Holds and 4 Sells. (See SoFi stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.