Republic Services stock (NYSE:RSG) appears to lack notable upside from here, which could limit investors’ total-return prospects. The waste management giant has managed to sustain a very high valuation in recent years, as investors have been willing to pay a premium for the company’s numerous qualities and highly-resilient business model. However, precisely because of this notion, shares of Republic Services are likely to struggle to advance higher. With investors having already priced in most of the stock’s future upside, I can hardly see the stock attaining an even higher premium.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

This could be already hinted at by the fact that even though the shares of the S&P 500-tracking SPDR S&P 500 ETF Trust (NYSEARCA:SPY) have rallied by about 16% since early February, shares of Republic Services have struggled to catch up to the overall index.

On the whole, although I anticipate Republic Services to maintain its resilient nature as a low-volatility investment option, its steep valuation raises concerns about the potential constraints on future returns. Hence, I remain neutral on the stock.

Necessity-Based Business Model Drives Robust Growth, Elevated Valuation

One of the reasons Wall Street holds Republic Services in high regard, which has, in turn, been a significant contributor to the stock’s elevated valuation, is the company’s continued ability to drive robust growth consistently. This results from its necessity-based business model, as waste management is a vital and indispensable service that remains in high demand regardless of the economic climate. The enduring need for the company’s services persists despite any sudden shifts or turbulence in the macro environment. In simpler terms, regardless of the state of the economy, people will always generate waste, ensuring Republic Services enjoys highly-predictable cash flows.

The company’s most recent result once again demonstrated this attribute. In its Q1 results, Republic Services achieved organic growth of 9.6% and 11% growth driven by acquisitions, resulting in total revenue growth of 20.6% to $3.58 billion. The almost double-digit organic growth the company posted essentially reflects what I described earlier. Basically, higher demand for the company’s services increases inherently over time as a result of higher consumer and industrial waste.

Higher pricing also boosts organic growth, as Republic Services has leveraged the critical nature of its services to negotiate long-term agreements with its governmental (municipalities) and corporate customers, which incorporate higher pricing over time. Indeed, a substantial 80% of Republic Services’ revenues feature a recurring, annuity-like profile, with an additional 50% being tied to the Consumer Price Index (CPI) or comparable indices.

Republic Services’ underlying revenue growth was able to flow down to its bottom line as well, despite inflationary pressures impacting its expenses. On an adjusted basis, net income came in at $393.7 million, or $1.24 per share, compared to $360.7 million, or $1.14 per share, in the prior-year period. This implies year-over-year growth of about 9.1%.

Can Republic Services Stock Sustain Its Hefty Valuation?

Republic Services has managed to sustain a hefty valuation in recent months. As I just argued, this can be attributed to the remarkable growth trajectory and unwavering certainty that Republic Services maintains, owing to the distinctive qualities inherent in its business model. Specifically, since 2019, Republic Services has consistently traded at a forward P/E that’s above 25x. This multiple is notably higher than the stock’s forward P/E of 18x to 20x that it would average prior to 2019.

Given that the markets have witnessed massive uncertainty between then and now (COVID-19-pandemic, high inflation, rising interest rates, housing & banking crises), you can see why investors have flocked to the company’s shares, diving a valuation expansion that has been sustained. Investor sentiment has shown signs of improvement recently, although the overall macroeconomic environment remains uncertain. Hence, I do believe there is a strong chance that Republic Services retains its current premium. However, I think the stock may have reached a plateau, as I do not anticipate further overvaluation. This situation presents a challenge for potential upside, which may be considerably limited.

Is RSG Stock a Buy, According to Analysts?

Despite its valuation premium, Republic Services has retained a Moderate Buy consensus rating based on four Buys and four Holds assigned in the past three months. At $155.13, the average Republic Services stock price target implies 8.15% upside potential.

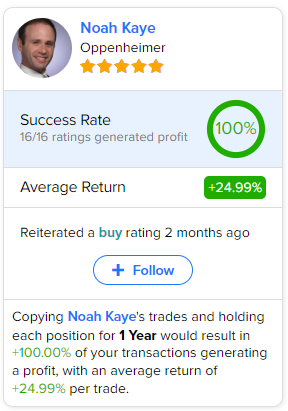

If you’re wondering which analyst you should follow if you want to buy and sell RSG stock, the most accurate analyst covering the stock (on a one-year timeframe) is Noah Kaye from Oppenheimer, with an average return of 24.99% per rating and a 100% success rate.

The Takeaway

In conclusion, Republic Services has enjoyed a rich valuation and sustained growth due to its necessity-based business model and ability to consistently deliver robust results. The company’s reliable cash flows, driven by steady demand for waste management services, have attracted investors seeking low-volatility investments. However, the stock’s valuation may have reached a plateau, and further overvaluation is unlikely. While Republic Services is expected to maintain its resilient nature as an investment option, concerns arise regarding its potential for future returns.