While it’s hard to say Nvidia’s (NVDA) latest quarterly statement was a resounding success, allaying fears of a more severe downturn, investors seemed to take the fiscal third quarter’s results in their stride.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Even as revenue dropped by 16.5% year-over-year to $5.93 billion, it compared well with the $5.77 billion expected on Wall Street.

On the other hand, there was a miss on the profitability profile with adj. EPS of $0.58 coming in short of the analysts’ forecast of $0.69. The quarter included a $702 million inventory charge, mostly correlating to restrictions on sales to China of the A100/H100 GPUs and which the company put down to “lower data center demand in China.”

Segment-wise, there was another big drop from the out-of-demand gaming business, with sales falling by 51% from the same period a year ago to $1.57 billion. However, holding the fort, data center sales put in another strong performance and grew by 31% from a year ago to $3.83 billion.

For FQ4, the company is calling for revenue of $6 billion “plus or minus 2%,” indicating a range between $5.88 billion to $6.12 billion. The consensus estimate stood at $6.09 billion.

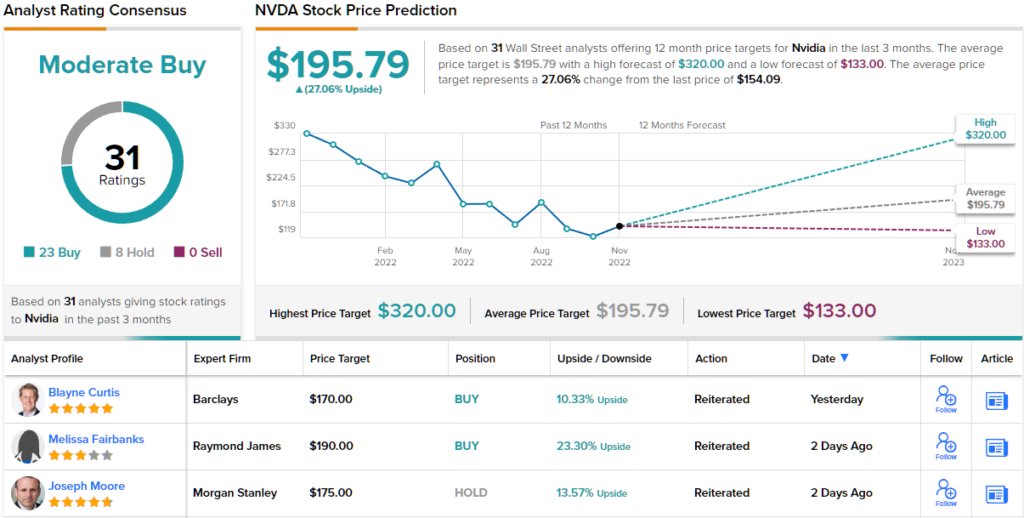

Assessing the print and outlook, Raymond James’ Melissa Fairbanks highlights the bright days ahead for Nvidia’s outperforming segment.

“Looking beyond the near-term noise in Datacenter, management expects the H100 ramp to be meaningfully stronger than prior generations, with rapid adoption of Hopper for a growing set of workloads (now including generative AI) – and endorsed by Microsoft’s decision to partner with NVDA for a multi-year AI supercomputing project,” the analyst explained. “Net, with the Datacenter business now almost 2.5x the size of Gaming, combined with an expanding pipeline of new applications, our thesis remains unchanged.”

That thesis recognizes the stock as a Strong Buy, although the price target is given a trim; the figure comes down from $210 to $190, now suggesting shares will see growth of 23% in the year ahead. (To watch Fairbanks’ track record, click here)

Across Wall Street, there are currently 31 Nvidia reviews on file and these break down to 23 Buys and 8 Holds, all coalescing to a Moderate Buy consensus rating. The average target is almost identical to Fairbanks’ objective; at $195.79, the figure makes room for 27% share appreciation over the coming months. (See Nvidia stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.