Energy stocks, including Exxon Mobil (NYSE:XOM) and Marathon Oil (NYSE:MRO) had a great run in 2022. For instance, XOM stock has gained about 87% year-to-date. Meanwhile, MRO is up approximately 84%. However, as crude oil prices reversed most of their gains in 2022, now could be a time to book profits in these energy stocks.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Russia’s invasion of Ukraine, supply challenges, and increased economic activity drove oil prices higher. The increase in average realized prices led these companies to deliver solid financials, lower debt, and boost shareholders’ returns through accelerated share buybacks and higher dividend payments.

However, the resurgent virus in China, its tight COVID control measures, and the weak global macro environment have led to a decline in crude prices, resulting in lower profits for oil companies and hurting their share prices.

Is XOM a Buy, Sell, or Hold?

Our data shows that Wall Street has turned cautiously optimistic about XOM’s prospects. It has received seven Buy and four Hold recommendations for a Moderate Buy consensus rating on TipRanks. Meanwhile, analysts’ average price target of $118 represents a 7.5% upside potential.

Analysts expect XOM to report EPS of $3.45 in Q4, which reflects a sequential slowdown. Importantly, hedge funds sold 2.4M XOM stock in the last quarter. Also, XOM stock has a negative signal from insiders who sold their stock.

Nevertheless, Exxon Mobil stock has an Outperform Smart Score of nine out of 10 on TipRanks. Moreover, its forward EV/EBITDA multiple of 4.46x looks attractive and is lower than the sector mean.

Is Marathon Oil a Buy, Sell, or Hold?

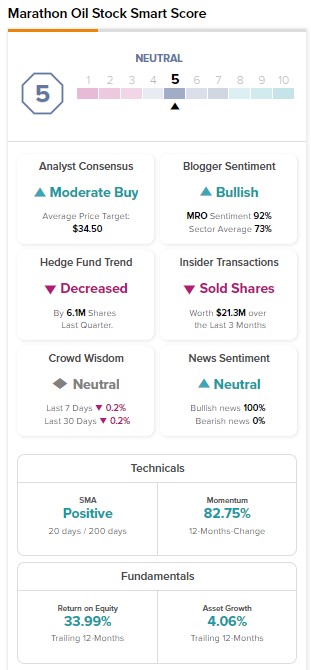

Like XOM, analysts are cautiously optimistic about MRO’s prospects. It has received seven Buy, five Hold, and two Sell recommendations for a Moderate Buy consensus rating. Analysts’ average price target of $34.50 implies 15.7% upside potential.

Analysts expect Marathon Oil to post earnings of $1.06 per share in Q4, reflecting a quarter-over-quarter decline. Meanwhile, our data shows that hedge funds and insiders sold a significant amount of MRO stock last quarter. Hedge funds sold 6.1M MRO stock. Meanwhile, insiders sold MRO stock worth $21.3M.

Marathon Oil stock has a Neutral Smart Score of five out of 10 on TipRanks. However, the stock looks attractive on the valuation front with its forward EV/EBITDA multiple of 3.77x, comparing favorably to the sector median of 5.55x.

Bottom Line

Exxon and Marathon oil stocks look attractive on the valuation front. However, the drop in oil prices could impact their profitability and lead to a correction in their stock prices.