Li Auto (NASDAQ:LI) stock has tanked since the beginning of March. But that doesn’t mean this stock is necessarily down and out. In fact, Li Auto proved itself to be one of the big winners in the new energy vehicle (NEV) market in 2023, and unless we see a significant deviation from this trajectory, the stock continues to look undervalued with a forward price-to-earnings ratio around 16x and a price-to-earnings-to-growth (PEG) ratio of 0.8.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Q1 Disappointment

Li Auto issued a concerning note on 21 March, which resulted in the share price sliding more than 7% during that day alone. The Chinese NEV company said that deliveries for the first quarter would be significantly below the original estimate of 100,000 to 103,000 vehicles. The company now anticipates delivering between 76,000 and 78,000 vehicles.

Taking the midpoints of the previous guidance and the new guidance, we can observe a 24.1% decrease. That’s pretty significant. Li didn’t provide an update on revenue generation during the period.

The update comes a couple of weeks after Li launched the MEGA — its first battery electric vehicle (BEV). While the vehicle was initially greeted with much fanfare, achieving more than 10,000 pre-orders in less than two hours in November, some onlookers have been rather scathing.

Some have suggested on social media that the vehicle, which was designed to achieve minimum wind resistance, looks like a coffin. The negative feedback has even drawn a cryptic response from the company’s CEO, who vowed to fight back. According to local media reports, fewer than 4,000 orders were placed for the Li Mega in the three days after its March launch.

Trajectory Unchanged

The first quarter is often challenging for Chinese businesses as this is when the Chinese New Year, and the associated holiday, falls. While the holiday always falls during this time of the year, it can be notoriously hard to forecast consumer behavior during the period. And this gives me some confidence going forward that the lower February data represents a blip rather than a step change in the company’s performance.

Of course, it’s concerning to hear reports that Li’s first venture into the BEV market hasn’t been hugely successful. The company intends to sell 8,000 of the Mega vehicles monthly as part of a wider strategy to see deliveries reach 800,000 annually.

From my personal understanding, Li’s Mega has only fallen short on account of its appearance. The seven-seater vehicle can be fully charged within 12 minutes, offers a state of the art entertainment system, and impressive passenger comfort. However, the bullet train design clearly hasn’t impressed.

Likewise, it’s alarming to see sales of its EREVs (extended-range electric vehicles) fall in Q1. Li plans to introduce a further three BEVs in the second half of the year, and hopefully, for investors, they will be better received than the Mega — if the Mega really has fallen flat at all.

Personally, I don’t think there’s any evidence that the low reported order volume for the Mega is indicative of demand for future Li Auto models. In short, I believe Li’s positive long-run trajectory can be sustained. Its range offering, charging speeds, and passenger comfort is exceptional. The fundamentals are there for continued success.

Li Auto’s Valuation

Li Auto’s valuation metrics continue to be very enticing. The stock is trading around 16x forward earnings, and given the expected earnings CAGR of 19.3% over the next three to five years, it has a PEG ratio of 0.8. In the current market, it’s challenging to find companies with PEG ratios under one.

As such, these valuation metrics are particularly attractive from a relative perspective. For example, Tesla (NASDAQ:TSLA) trades with a PEG ratio of 3.62. Several other EV makers are yet to turn a profit, further highlighting Li’s advantage over the sector and its relative attractiveness as an investment.

Is Li Auto Stock a Buy, According to Analysts?

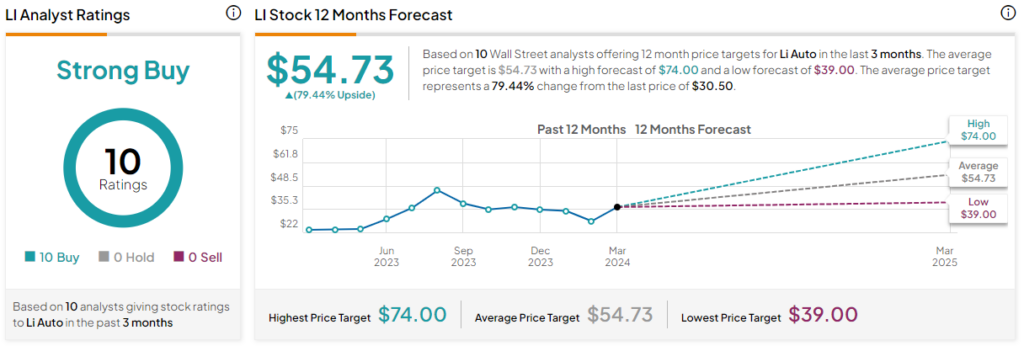

Li Auto stock is rated Strong Buy, according to analysts. The stock currently has 10 Buys, zero Holds, and zero Sell ratings. The average Li Auto stock target price is $54.73, inferring upside potential of 79.44% from the current share price. The highest share price target is $74.00, and the lowest share price target is $39.00.

The Bottom Line

Despite the lower guidance for deliveries (and likely earnings) in Q1, Li Auto still looks like an attractive investment opportunity, highlighted by its Strong Buy rating and attractive valuation metrics. And while reports that the Mega has fallen short of expectations in terms of orders, it would be wise to see how things out and not to assume that future releases will fall short of customer expectations.

Moving forward, all eyes will be on production and delivery figures as Li moves towards the second half of the year, when it will unveil three more BEVs.