International Business Machines (NYSE:IBM) currently has a 5% dividend yield, which is likely to attract investor interest for a couple of reasons. For starters, IBM is currently the highest-yielding large-cap tech stock and the second highest-yielding S&P 500 (SPX) tech constituent. Additionally, IBM has an outstanding reputation for delivering consistent dividend increases, with an impressive 27-year track record of consecutive annual raises that places the company among the elite group of Dividend Aristocrats. This exceptional history further reinforces the credibility and reliability of IBM’s dividend.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Against the backdrop of the highly unpredictable and volatile macroeconomic environment of today, it’s understandable why investors may seek refuge in the safety and stability of IBM’s substantial and well-established dividend.

That said, IBM continues to lack meaningful growth prospects, and its balance sheet remains highly indebted. Therefore, while the company is likely to sustain its current level of payouts, I find it unlikely that future dividend increases will be material, which could limit investors’ future returns. Accordingly, I am neutral on the stock.

Can IBM Return to Growth Mode?

Before determining the potential for IBM’s dividend growth, it is imperative to evaluate the likelihood of the company reverting to growth mode.

Revenue Trajectory

The truth is that IBM’s revenues have been on a declining trend for more than a decade. They peaked at $106.9 billion in 2011, and they have since gradually slipped lower, coming in at $60.5 billion in 2022.

On a positive note, the $60.5 billion achieved last year was actually 6% higher year-over-year, or 12% in constant currency (CC), which sparked some hopes for reinvigorated growth. The increase in revenues was primarily driven by IBM’s Hybrid Cloud, whose revenues landed at $22.4 billion, up 11% compared to Fiscal 2021, or 17% in CC.

This is the segment that includes the rapidly growing Red Hat, which IBM acquired back in 2019 for a hefty $34 billion. Red Hat’s revenues, while not disclosed, grew by 12.6% during the year, or 17.5% in CC. IBM claims that 100% of commercial banks, telecommunication, media, and technology companies in the Fortune Global 500 rely on Red Hat technologies.

Given Red Hat’s market-leading position, ongoing growth momentum, and global corporate spending on the cloud remaining rock-solid, IBM’s revenue growth prospects could indeed be promising. Still, it’s also quite likely that IBM’s two legacy divisions, Consulting and Infrastructure, could partially offset Software’s growth over the long term, in line with their long-term erosion trend.

Profitability Trajectory

IBM’s profitability has paced in line with its revenues, sliding down a decline for years with no signs of a turnaround in sight. For context, Adjusted EPS came in at $15.59 in 2014, had declined to $12.81 by 2019, and landed an even lower $9.13 in 2022.

Fiscal 2022’s $9.13 was actually higher than the previous year’s $7.93 as a result of higher revenues and some expense control. That said, it’s still hard to say whether IBM’s adjusted EPS can sustain meaningful growth moving forward, especially given that gross profit margins in its legacy segments have been shrinking lately.

Can IBM Afford to Meaningfully Grow Its Dividend?

IBM is unlikely to be able to afford meaningful dividend increases moving forward. While its revenues and adjusted EPS somewhat rebounded last year, its legacy segments have continued to struggle. Even last year’s improved adjusted EPS implies a payout ratio of about 72%. This means that IBM is likely to be highly careful with future dividend hikes to prevent the risk of putting itself in a precarious position of having to reduce its payouts.

Another reason that supports this argument is that IBM is highly indebted, featuring $54 billion worth of debt on its balance sheet, including $46 billion of long-term debt. With interest rates on the rise, IBM’s interest expenses will skyrocket over such a massive amount of debt when it eventually has to refinance its notes. Thus, the company will most likely prioritize paying down its debt over growing the dividend by a decent rate.

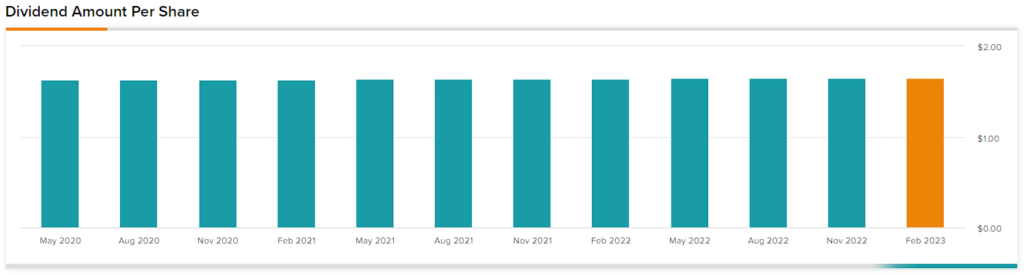

IBM’s lack of earnings capacity to grow the dividend meaningfully is also reflected in the fact that its past three consecutive dividend increases have all been by a meager 0.6%.

Is IBM Stock a Buy, According to Analysts?

As far as Wall Street’s estimates go, International Business Machines has a Hold consensus rating based on three Buys, six Holds, and one Sell assigned in the past three months. At $145.00, the average IBM stock price target suggests 10.7% upside potential.

The Takeaway

With its hefty 5% dividend yield, IBM is likely to lure prospective investors, especially since it boasts the highest yield among large-cap companies in the tech sector. Moreover, IBM’s prestigious status as a Dividend Aristocrat is likely to serve as an additional draw for income-oriented investors.

However, despite showing some positive developments in its results over the past year, IBM has still not managed to fully reverse the downward trend of declining revenues and profits. This challenge is exacerbated by decreasing profit margins in its traditional business segments and the upcoming emergence of rising interest expenses, which I expect to continue to impact the company’s bottom line in the years ahead.

Given these circumstances, while IBM may do anything to safeguard its dividend-growth track record, it’s likely that future increases will be relatively insignificant. This has been the case for a few years now, and I find it unlikely that we will see any significant deviation from this trend in the near future.