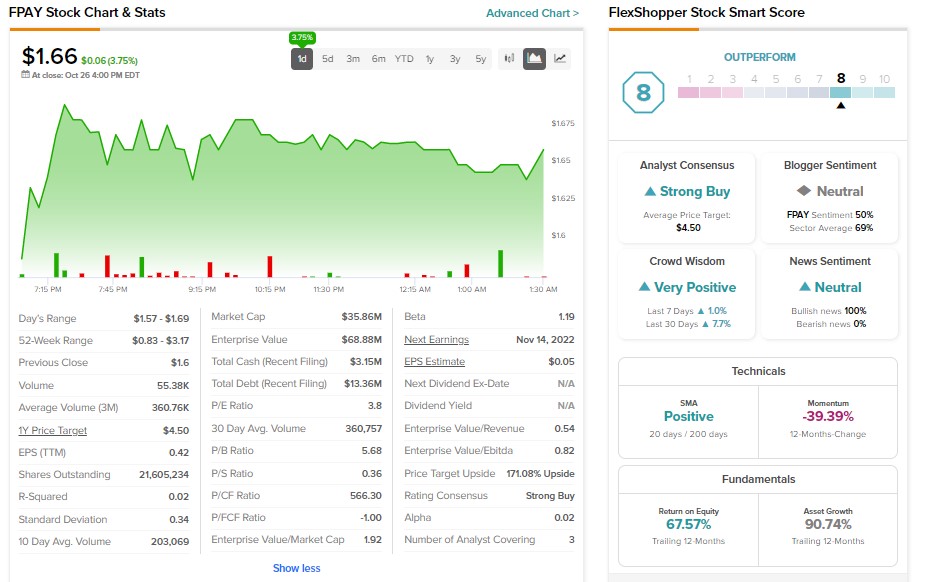

Penny stocks are risky and equally rewarding (learn more about Penny stocks here: Are Penny Stocks a Good Investment?). Thus, TipRanks’ Penny Stocks Screener comes in handy to select those more likely to deliver strong returns. Using the Screener, we narrowed on FlexShopper (NASDAQ:FPAY) stock that sports an Outperform Smart Score on TipRanks. Moreover, FPAY stock has significant upside potential and is trading cheaply, which supports the bull case.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Here’s Why to Bet on FlexShopper Stock

FlexShopper is a financial technology company offering lease-to-own as an alternative payment solution to retailers and consumers. FPAY’s focus on expanding its product and marketing channels and growing retail partnerships bode well for growth in a largely underserved market.

An increase in lease originations continues to drive its gross profit and adjusted EBITDA. Meanwhile, FlexShopper is profitable on the net income front, which is positive.

It recently announced an exclusive long-term marketing relationship with Liberty Tax, which will likely boost its loan originations. Its CEO, Richard House, stated that this partnership would enable the company to sell complementary loan products to its customers and help it to grow rapidly.

In response to this partnership, H.C. Wainwright analyst Scott Buck said that the “partnership has the potential to meaningfully increase loan origination volume as well as introduce a demographically similar customer base to FlexShopper’s legacy lease-to-own services.”

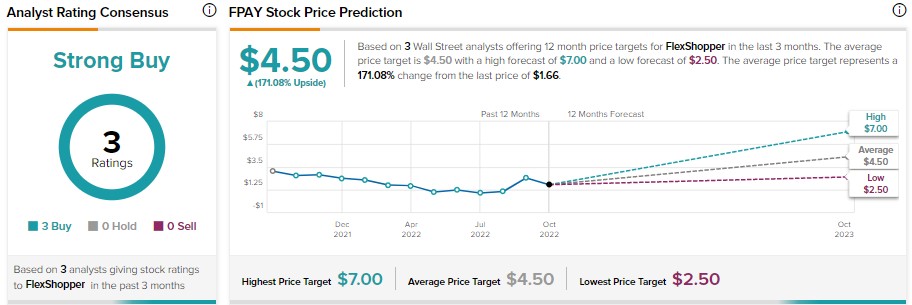

Buck is bullish about FPAY stock and has a price target of $4.

Is FlexShopper Stock a Buy?

On TipRanks, FlexShopper stock has received three unanimous Buy recommendations for a Strong Buy consensus rating. Furthermore, its average price target of $4.50 implies a stellar 171.1% upside potential.

FPAY stock is down over 29% year-to-date. Meanwhile, TipRanks’ data shows that retail investors have used the weakness in FPAY to go long. According to TipRanks’ Stock Investors tool, 7.7% of investors increased their exposure to FlexShopper stock in the last 30 days.

Bottom Line

FlexShopper’s large target market, product and channel expansion, and recent partnership with Liberty Tax position it well to deliver solid financials and will likely support the uptrend in its stock price. Further, its Price/Earnings ratio of 3.8 and Enterprise Value/EBITDA multiple of 0.82 remain low, making it attractive on the valuation front.