Dallas, Texas-based Energy Transfer LP (NYSE: ET) could be an attractive investment option for investors seeking exposure to the U.S. oil & gas industry. The midstream company has expertise in providing transportation and storage facilities for natural gas and refined products. It also engages in the transportation of crude oil.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Units of this $34.6-billion energy services company have grown 35.5% since the beginning of 2022. This performance is way higher than the year-to-date decline of 10.2% for the S&P 500 and 17.2% for the NASDAQ.

It is worth mentioning that Energy Transfer has a Strong Buy consensus rating based on two Buys. ET’s average price forecast of $14.50 suggests 22.88% upside potential from the current level.

On August 16, 2022, Theresa Chen of Barclays maintained a Buy rating on ET while increasing the price target to $14 (18.64% upside potential) from $13. The analyst opines that “the U.S. refining fundamentals will continue to fare well” in the absence of “a severe economic shock.”

Factors Favoring Energy Transfer’s Growth Prospects

Energy Transfer’s huge network of assets is a boon. These include thousands of intrastate and interstate miles of pipelines for the transportation of natural gas, five natural gas storage facilities, and multiple properties for conducting midstream operations.

Also, the company has a presence in Texas, Louisiana, New Mexico, Ohio, Pennsylvania, West Virginia, Arkansas, and multiple other regions in the United States. Such diversification in geographical presence raises the competitiveness of the stock. Its efforts to build cryogenic processing plants in the Permian Basin and progress on the Gulf Run Pipeline project will be an added advantage.

Furthermore, portfolio-restructuring measures by Energy Transfer have been helpful in simplifying the organizational structure. In August 2022, the company concluded a 51% stake sale in Energy Transfer Canada ULC. Also, it agreed to purchase Woodford Express, LLC in the same month. The latter provides a gas gathering and processing system. Energy Transfer has also worked on five Sale and Purchase Agreements (SPAs) related to liquefied natural gas since the beginning of 2022.

The financial performance of Energy Transfer has been impressive in the last couple of quarters. In the second quarter of 2022, the company’s earnings of $0.39 per unit came in above the consensus estimate of $0.35 per unit. On a year-over-year basis, the bottom line expanded 95%, driven by a 71.8% rise in revenues. The adjusted earnings before interest, tax, depreciation, and amortization (EBITDA) were up 23% year-over-year.

For 2022, the company forecasts adjusted EBITDA of $12.6-$12.8 billion, up from $12.2-$12.6 billion stated earlier. Its debt-reduction actions, growth projects, and macro tailwinds will be beneficial in the quarters ahead.

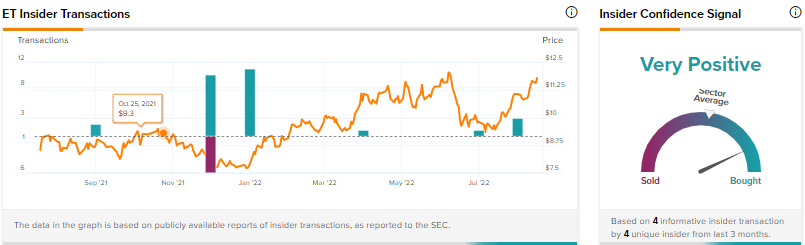

Insiders & Hedge Funds Are Bullish on ET Stock

According to TipRanks, insiders are Very Positive about Energy Transfer. In the last three months, corporate insiders have increased their exposure to ET shares by $31.5 million.

Similarly, hedge funds are Very Positive about ET stock, as they bought 2.2 million of Energy Transfer in the last quarter.

What Is the Future of ET stock?

Without a doubt, Energy Transfer seems to have all the ingredients that might tempt a prospective investor. While the stock is in the good books of analysts, insiders, and hedge funds, it has a ‘Perfect 10’ score on TipRanks’ Smart Score rating system, which implies that ET stock has the potential to outperform the broader market. Lastly, the company’s fundaments look solid, industry prospects are bright, and growth opportunities are immense.

Read full Disclosure