Cisco Systems (NASDAQ:CSCO) delivered better-than-expected Q4 earnings, which is why the stock is up about 2.1% in after-hours of trade. However, the expected slowdown in revenue growth led Goldman Sachs analyst Mike Ng to maintain a Hold rating on CSCO stock post-Q4 earnings.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Cisco which provides networking, cloud, and security solutions expects Q1 revenues for Fiscal 2024 to be in the range of 14.5 billion to 14.7 billion. This compares to the revenue of $13.6 billion in the Q1 of Fiscal 2023. Highlighting the guidance, the analyst said that Q1 outlook represents a year-over-year growth of 6-8%. On the other hand, for the full year, the CSCO projects revenue between $57 billion and 58.2 billion, indicating that its full-year top line could stay flat or improve by only 2%. This implies a slowdown in sales beyond Q1, noted the analyst.

Mike Ng said that Cisco’s Q1 and Fiscal 2024 revenue guidance suggests that barring the first quarter growth, its remaining three quarters of Fiscal 2024 “should be down 1% yoy in aggregate.” This raises concerns about future demand, which is why he reiterated a Hold recommendation on the stock.

Nonetheless, not all is gloom and doom for Cisco. The company has multiple growth catalysts to support its share price.

These Developments Paint a Brighter Picture

Cisco’s strong backlog and annual recurring revenues add visibility over its future performance. Additionally, the company gained market share in Campus switching, wireless LAN (Local Area Network), and SP (Service Provider) routing. Moreover, it remains confident of increasing its share in the coming quarters.

Other positive developments include the launch of the company’s new AI-scale infrastructure innovation to capitalize on AI (artificial intelligence) demand. Also, CSCO is witnessing early success in Hyperscale Ethernet AI fabric deployments.

Cisco also returned $10.6 billion to its shareholders through share repurchases and dividends. Apart from this, it remains on track to lift its shareholders’ value further via dividend growth and share buybacks.

Is Cisco a Buy or Hold?

The AI-led opportunity, solid backlog, and focus on margin improvement are positive. Nevertheless, the expected slowdown in future revenue growth remains a concern. Thus, Wall Street analysts are cautiously optimistic about CSCO stock.

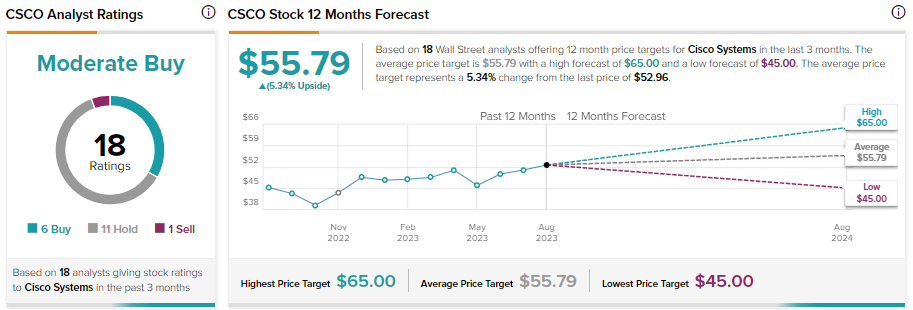

With six Buy, 11 Hold, and one Sell recommendations, Cisco stock has a Moderate Buy consensus rating on TipRanks. Meanwhile, analysts’ average price target of $55.79 implies 5.34% upside potential from current levels.