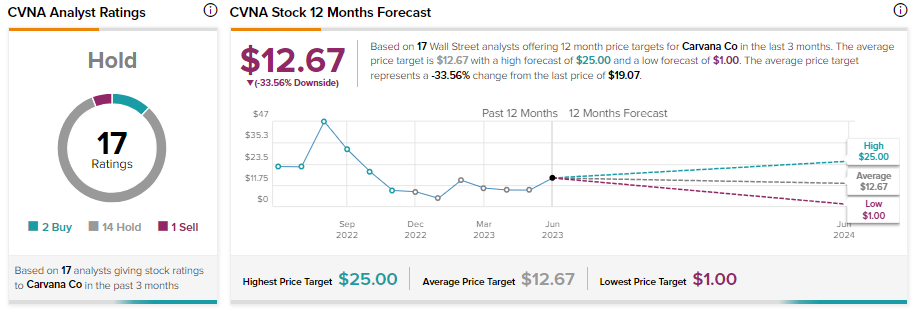

Carvana (NYSE:CVNA) stock has risen over 300% so far this year. The massive jump in the shares of this online used car retailer reflects the improvement in its GPU (Gross Profit per Unit) and overall financial outlook. However, analysts remain sidelined, with their average price target indicating a significant drop in CVNA stock from current levels.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Analysts Remain Sidelined

CVNA, on June 8, provided strong Q2 guidance. The company said that it expects to achieve adjusted EBITDA above $50 million in the second quarter, reflecting a sharp sequential improvement. Further, it expects its GPU to come in above $6,000, up 635% year-over-year. Additionally, GPU represents a new company record.

Carvana highlighted that its efforts to drive profitability have resulted in significant cost savings. Further, the company stated that it sold or securitized loans of approximately $2 billion on a quarter-to-date basis.

While CVNA’s efforts to improve unit economics and drive profitability are positive, its fundamentals warrant a Hold rating, said Needham analyst Chris Pierce. Following the Q2 guidance, Pierce said that his Hold recommendation is based on the company’s current capital structure, wherein the debt (CVNA had a total debt of $6.75 billion at the end of Q1) is driving its enterprise value. The analyst added that CVNA’s valuation looks generous, due to the uncertainty around its return to unit growth.

Echoing similar sentiments, Wells Fargo analyst Zachary Fadem also remained sidelined on CVNA stock. In a note dated June 8, Fadem acknowledged the positive development at CVNA. However, the analyst said that the challenging industry backdrop and concerns over the balance sheet keep him sidelined.

What is the Price Target for Carvana?

Including those from Pierce and Fadem, Carvana stock has received 14 Hold recommendations. Two analysts suggest a Buy, and one analyst has a Sell rating. Overall, CVNA has a Hold consensus rating on TipRanks. Meanwhile, these analysts’ average price target of $12.67 implies 33.56% downside potential from current levels.