The unprecedented demand for generative AI (Artificial Intelligence) following the success of OpenAI’s ChatGPT gave C3.ai (NYSE:AI) stock a solid boost. However, the euphoria around AI stock fizzled out soon as it lost substantial value over the past three months. Further, Bank of America Securities analyst Bradley Sills believes the company is not benefitting from the rising AI demand, raising concerns about its prospects.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Investors should note that the interest in deploying AI to business processes has significantly increased. Moreover, C3.ai, with its growing enterprise AI applications, is expected to benefit from the spike in demand. However, that is not reflected in C3.ai’s outlook.

During the Q1 FY24 conference call, the company’s management said that its enterprise AI applications are gaining substantial traction. However, the company expects to deliver revenue in the range of $295 to $320 million in Fiscal 2024, reflecting a year-over-year growth of about 11-20%, which appears low given the stellar demand for AI. Moreover, C3.ai’s margins are expected to remain under pressure in the short run as the company increases investments in generative AI.

Commenting on C3.ai’s outlook, Sills said the company reiterated its Fiscal 2024 revenue outlook despite solid AI demand. This suggests that there are no meaningful AI tailwinds. The analyst maintained a Sell rating on AI stock on September 6. Meanwhile, Wedbush analyst Daniel Ives reiterated a Buy recommendation on C3.ai stock on September 7. However, the analyst reduced the price target to $42 from $50, citing near-term margin headwinds.

With this backdrop, let’s look at what the analysts’ consensus rating suggests for C3.ai stock.

Is C3.ai Expected to Grow?

C3.ai stock is still up over 144% year-to-date despite the recent decline in the price. However, analysts remain sidelined on C3.ai stock, and their average 12-month price target suggests a slight downside potential from current levels.

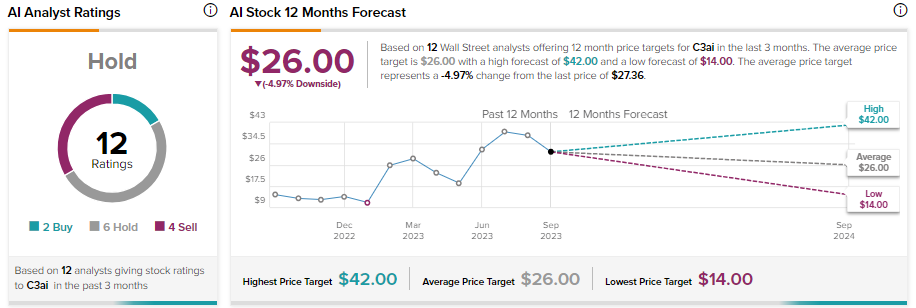

AI stock has received two Buy, six Hold, and four Sell recommendations for a Hold consensus rating on TipRanks. Further, the analysts’ average price target of $26 implies a possible downside of 4.97%.

Bottom Line

C3.ai’s suite of generative AI products, investment in AI solutions, and a growing pipeline of enterprise opportunities augur well for long-term growth. However, C3.ai stock has gained quite a lot, while its revenue growth outlook appears unattractive, which could limit the upside potential.