For the past week, it’s been impossible to go about the day without hearing of the devastating war between Russia and Ukraine. The global disasters just keep coming, with the conflict erupting at the tail-end of the Omicron wave and once again affecting international travel. With the global stock market nearing a crisis, investors in travel companies such as Booking Holdings (BKNG) are wary of the situation.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

BKNG shares dropped 22% over the past 10 trading sessions, despite last week’s stellar earnings report displaying the company’s resilience after the two-year pandemic. Fourth-quarter revenue surged 141% year-over-year to $3 billion, not much lower than pre-COVID levels.

However, it turns out that this impressive bounce-back didn’t provide immunity for the travel tech company’s stock. Investors fled to the exit gates after Canada and the EU shut their airspace to Russian aircraft. In a swift response, Russia barred many European planes from entering its own airspace.

Although not a major tourist hub, Russia has the highest population of any country in Europe, so the prevention of Russian travelers from entering the EU and Canada can at least be a mild threat to Booking’s business. On BKNG’s earnings, CEO Glenn Fogel tried to quell investors’ concerns about how this would affect the company, ensuring that the warring countries generally constitute a low single-digit percentage of reservations.

It seems the real risks involve the impact of the conflict on the European economy, the potential for the war spreading, or an impending refugee crisis across Europe. Following a series of stifling economic measures against Russia by the West, Booking should be feeling the impact, since most of its revenue comes from the European market.

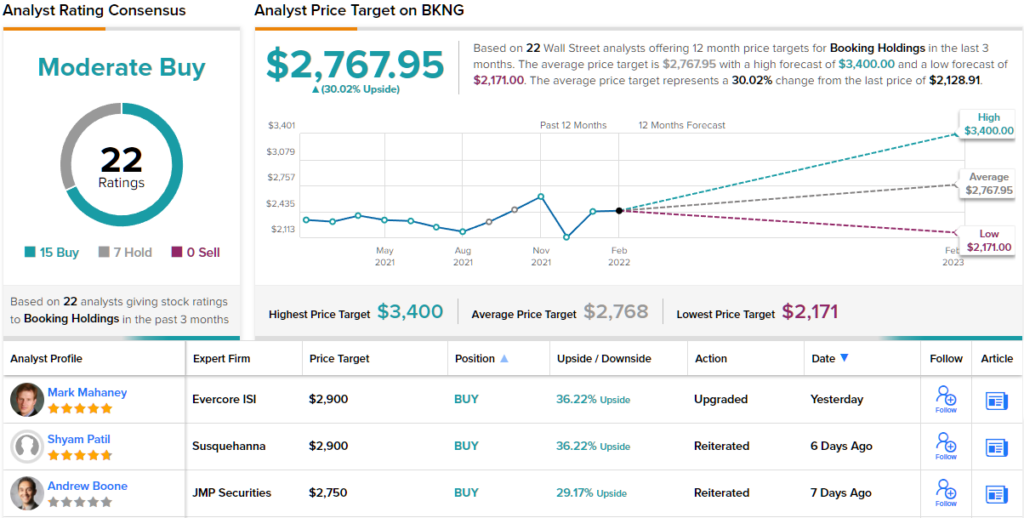

On the bright side, Evercore analyst Mark Mahaney gives BKNG a big vote of confidence “Against a very challenging environment for growth equities.” He posits, “BKNG sits squarely in the middle of an attractive Venn Diagram that captures both High-Quality assets (based on fundamentals & valuation) and clear recovery plays (leisure travel). We believe this Venn positioning will allow BKNG to outperform even in a highly uncertain rate environment.”

On to the bottom line for investors, the 5-star analyst upgrades his rating on BKNG to an Outperform (i.e. Buy), while also raising his price target from $2,500 to $2,900. This implies shares could increase ~36% over the coming year. (To watch Mahaney’s track record, click here)

Looking at the consensus breakdown, the majority of analysts are bullish on BKNG’s prospects, too; 15 Buys and 7 Holds add up to a Moderate Buy consensus rating. The average price target of $2,767 and change suggests upside of 30% in the year ahead. (See Booking stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.