Beam Therapeutics (NASDAQ:BEAM) is a gene editing company — one that gets less attention than its peers. Nonetheless, it currently has a $2.7 billion market cap and a diverse portfolio with two disclosed candidates in clinical trials — one targeting sickle cell disease (SCD) and the other T-cell leukemia. However, with initial clinical trial data on the SCD trial not expected until the second half of the year and two peers already gaining regulatory approval in the space, BEAM may find itself too late to the market.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

It could be a more speculative investment than its peers, and that’s why I’m neutral on the stock.

How Gene Editing Works

Beam, founded by leading scientists from the CRISPR field, is pursuing therapies for serious diseases using its proprietary base-editing technology. CRISPR stands for Clustered Regularly Interspaced Short Palindromic Repeats, which reflects the hallmark of a bacterial defense system, after which the technology is designed.

However, Beam markets itself as having more advanced technology than this. Beam’s core and proprietary technology is called base editing. As opposed to other gene editing techniques, base editing allows for precise changes to a single DNA base and doesn’t cause double-stranded breaks. While effective, these breaks introduce the risk of unwanted modifications.

Base editing holds huge promise and could revolutionize medicine along with other CRISPR technologies. Scientists believe it could hold the key to treating a vast array of genetic diseases, including cystic fibrosis and SCD, by directly correcting single typos in our DNA. As it doesn’t cut the DNA, it does this with fewer risks and potentially leading safer and more effective treatments.

Too Late to the Market?

CRISPR technology and base editing are in their infancy, but investors might be intrigued to see that the big players in the sector seem to be targeting the same illnesses — SCD and beta thalassemia. That’s because SCD is caused by a single well-defined and traceable mutation in the beta-globin gene. As such, this makes it the perfect first target for precise gene editing techniques.

However, in the U.S., the world’s biggest market for novel treatments, there are already two approved treatments for SCD and beta thalassemia. The U.S. approved treatments from CRISPR Therapeutics (NASDAQ:CRSP) and Bluebird Bio (NASDAQ:BLUE) in December for SCD and at different times for beta thalassemia.

This is potentially a multi-billion dollar opportunity, but Beam might be too late to the market. The company expects to report its initial trial results in the second half of 2024. The first patient was dosed in the fourth quarter of 2023 and successfully achieved engraftment in the phase 1/2 clinical trial.

As such, Beam 101 — as the treatment is called — might not receive regulatory approval for a couple of years at least. By that time, one would expect that CRISPR Therapeutics and Bluebird Bio will have taken steps to cement their position in the market.

However, there is, of course, the argument that Beam’s treatment may be safer and more effective. This remains something of a speculative assessment, and we’re yet to see the data to back up the notion that base editing is more effective. While Beam hopes to have the best-in-class treatment, they haven’t provided an idea of how much the treatment will cost.

Using CRISPR Therapeutics as an example, there could be an initial patient pool of 32,000, and the treatment is priced at $2.2 million. In turn, this infers an initial market opportunity of $70.4 billion.

Beam’s Pipeline

Of course, Beam Therapeutics has more than just one treatment in development. Its second treatment in clinical trials targets T-cell cancers. The treatment uses multiplex base editing and gene silencing, which should enable universal compatibility while reducing host rejection, fratricide, and immunosuppression. However, if trials are successful, we’re unlikely to see this treatment move towards approval for some time.

The company recently announced that it was still onboarding for the trial. Beam expects to report an initial clinical dataset for BEAM-201 in the second half of the year. In addition, Beam has a handful of other treatments in development, including BEAM-301 for glycogen storage disease type 1a and BEAM-302 for alpha-1 antitrypsin deficiency.

Is Beam Therapeutics a Buy, According to Analysts?

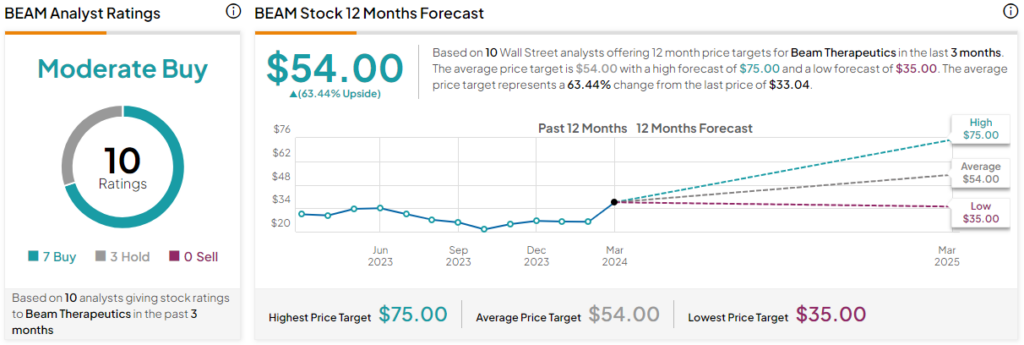

Beam Therapeutics is a Moderate Buy, according to analysts that have covered the stock in the past three months. BEAM stock has received seven Buys and three Hold ratings. The average Beam Therapeutics stock price target is $54, inferring a 63.4% upside from the current share price. The highest share price target for Beam Therapeutics is $75 and the lowest share price target is $35.

The Bottom Line

Beam Therapeutics has highly exciting technology and could be the best-in-class when it comes to gene editing treatments across multiple areas of medicine. However, it remains a highly speculative investment, given the lack of clinical data and the head start given to its peers. While I want to have faith in the company and its treatments, sometimes it’s hard to put your money where your mouth is.