San Diego-based Arcturus Therapeutics (NASDAQ:ARCT) specializes in discovering, developing, and commercializing treatments for infectious diseases and rare genetic disorders. ARCT stock is currently rated a Strong Buy based on analysts’ consensus opinion. Promising research, strong distribution partnerships, and solid financials all point to a small-cap biotech stock with robust growth potential. Even after a 112.5% rally in the past year, analysts’ average 12-month price forecast suggests further attractive upside potential.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Cracking the Code on ARCT Stock

Among Arcturus’ extensive patent portfolio of over 400 patents and patent applications is a recent groundbreaking development – the world’s first self-amplifying messenger RNA (sa-mRNA) COVID-19 vaccine, ARCT-154. In early February, the results of a Phase 3 study evaluating a booster dose of ARCT-154 found it induces a longer immune response than Pfizer’s (NYSE:PFE) Comirnaty. This head-to-head peer-reviewed literature suggests that ARCT-154 may provide more extended protection against COVID-19 at lower doses.

Along with COVID and influenza vaccines, Arcturus is in advanced clinical trials with potentially game-changing therapies for Ornithine Transcarbamylase (OTC) Deficiency and Cystic Fibrosis (CF).

Given the manufacturing and distribution partnerships with firms like CSL (AU:CSL), Meiji Seika Pharma, and Arcalis, Arcturus is poised to take full advantage of its drug and therapeutics pipeline and potential future licensing and research deals.

A robust balance sheet with significant cash reserves and positive net cash flow position Arcturus well to see its promising IP (intellectual property) through the regulatory approval process.

In a recent research note, William Blair analyst Myles Minter commented that the stock’s current valuation “suggests the stock is valued only on the company’s COVID program partnered with CSL and cash on hand ($36 per share).” This suggests that a fair-value estimate of the share price should also include credit for the CF and OTC programs and their broader technology pipeline.

Is Arcturus Therapeutics a Good Stock to Buy?

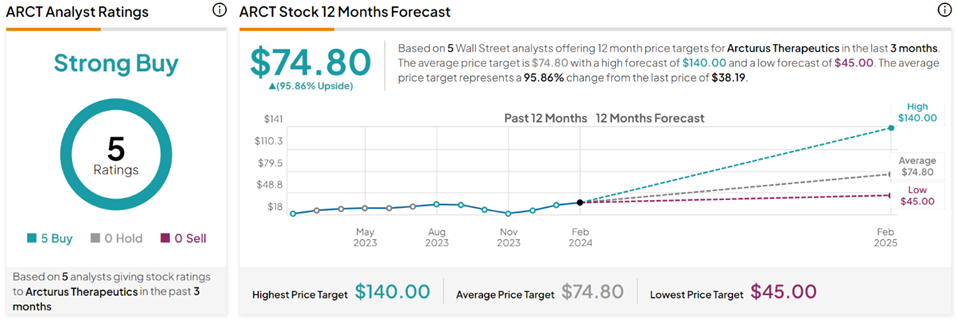

Arcturus Therapeutics has a consensus of Strong Buy from the five Wall Street analysts who have given a rating in the past three months. Their average price target is $74.80, with a high forecast of $140 and a low forecast of $45. The average price target represents a 95.86% change from current levels.

Final Shot

Arcturus Therapeutics, a frontrunner in developing transformative treatments for infectious diseases and rare genetic disorders, is poised to garner investors’ attention. The strength of its robust portfolio, including the revolutionary ARCT-154 COVID-19 vaccine, combined with strong distribution partnerships and solid financial standing, underscore the company’s potential. Add to this the positive outlook from analysts, pointing to a Strong Buy, and Arcturus appears strategically positioned for significant growth.