The headlines in recent days have pointed to Apple’s (AAPL) massive valuation reset, as the stock has shed $1 trillion off its market cap over the past year.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Apple’s predicament amongst the tech giants is certainly not unique with all the heavy hitters having undergone some serious toning down over the past year. In fact, compared to some of the others, it has performed relatively well. More specifically, the bear case around Apple, apart from the broader macro concerns around consumers cutting back on spending, has been exacerbated in recent times by big supply chain issues correlated to the Covid-driven shutdowns in China.

Wedbush analyst Daniel Ives notes that his Asia supply chain checks are “clearly mixed,” and taking into account a softer consumer backdrop, it looks like Apple is “cutting back” on some orders around Macs, iPads, and AirPods for the coming quarters.

“That said,” the 5-star analyst added, “the core iPhone 14 Pro demand appears to be more stable than feared and is still coming out of the supply chain abyss seen in November/December due to the zero Covid lockdowns in China/Foxconn. While March and June could see some cutting of iPhone orders (iPhone 14 Plus remains a major strikeout), we believe the overall demand environment is more resilient than the Street is anticipating and thus we believe baked into the stock is a massive amount of bad news ahead.”

The supply chain issues have resulted in roughly 8 million to 10 million iPhone units being “pushed out” of the December quarter. But that should prove beneficial for the March quarter, with Ives believing there is no indication demand is “evaporating but rather moving into 2023.”

The fact of the matter is there are more than 200 million iPhone units that have not been upgraded over the past 4 years with the “flagship” iPhone 15 is also set to be released in the Fall. Add to that the possibility the “much-anticipated” Apple Glasses could be unveiled this summer and Apple remains Ives’ “favorite tech name.”

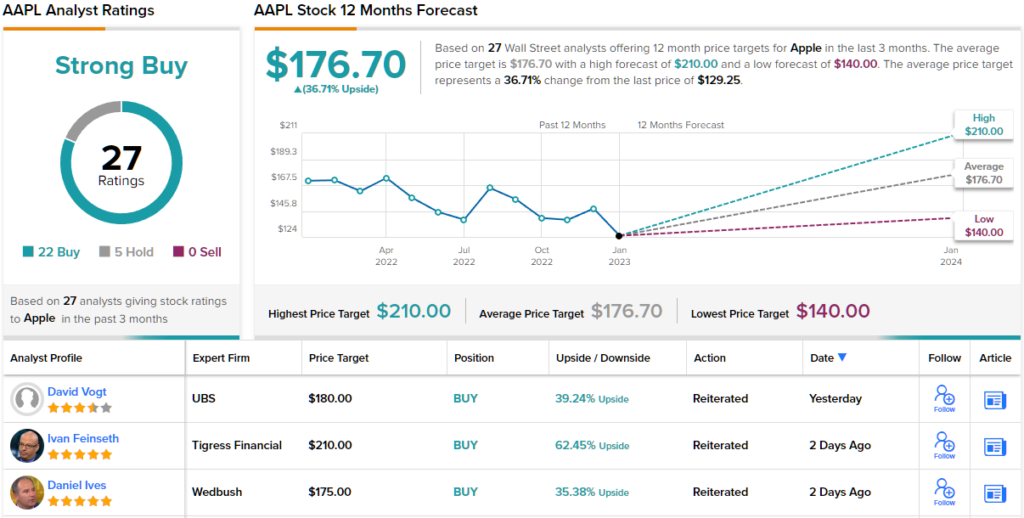

That said, given the “uncertain environment,” Ives cut his price target from $200 to $175, which now implying the shares will climb 35% higher over the coming months. Ives’ rating stays an Outperform (i.e., Buy). (To watch Ives’ track record, click here)

The Street’s average target is only a tad higher; at $176.70, the figure suggests shares have room for ~37% growth in the year ahead. All in all, the stock’s Strong Buy consensus rating is based on 22 Buys vs. 5 Holds. (See Apple stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.