American Water Works (NYSE:AWK) enjoys some of the most insulated growth prospects I have encountered while researching equities. While it’s true that water utilities often offer predictable growth prospects due to the necessity of their services, American Water Works stands out from the crowd.

As the largest and most diversified utility in the U.S., the company benefits from an additional layer of safety, enabling its management to provide exceptionally narrow, forward-looking projections. This instantly makes American Water Works a particularly compelling investment opportunity during the current uncertain market environment.

However, as investors are well-aware of this benefit, American Water Works has attracted a premium valuation. While AWK stock has somewhat corrected from its past highs, it remains extremely pricy relative to the rest of the market. This could limit future shareholder gains significantly, which is why I am neutral on the stock. Nonetheless, let’s discuss its features.

Unparalleled Growth Visibility

American Water Works features unparalleled growth visibility prospects, which have resulted in consistent earnings and dividend growth. Over the last 10 years, the company has demonstrated impressive compound annual growth rates of 7.9% and 10.3% in earnings per share and dividend per share, respectively, with minimal fluctuations.

This is largely attributed to the company’s robust business model, as water is an indispensable resource for both residential and commercial usage and is also considered a mission-critical asset by the military. By leveraging this essential demand for water, American Water Works has been able to expand its distribution network and operations with minimal risk.

Moreover, the company has made significant progress in securing general rate cases in three jurisdictions and infrastructure surcharges in two jurisdictions, which together represent a potential annualized revenue increase of approximately $181 million through upcoming rate hikes. This growth strategy is a typical component of water utilities, and American Water Works fully utilizes it to drive its financials.

In addition to the aforementioned factors, American Water Works benefits from gradual organic growth resulting from population expansion in the regions it serves. Last year, the company achieved a record-breaking 70,000 customer connections added by combining organic population growth with the acquisition of 26 various regulated water and wastewater systems.

Thanks to the predictability of water consumption, population growth, rate increases, and acquisitions, American Water Works’ management has been able to provide investors with one of the most precise forward-looking outlooks investors can find among all equities.

In particular, the company expects to achieve a compound annual growth rate of 7% to 9% in earnings per share through 2027, driven by 5% to 7% growth from regulated investment capital expenditures, 1.5% to 2.5% growth from regulated acquisitions, and less than 1% growth from military services. In line with this outlook, management also anticipates growing the dividend at a rate of 7% to 10% per annum over the same period.

This level of specificity in growth estimates over an extended period is rare among companies and sets American Water Works apart. I find it especially noteworthy considering the current turbulent economic environment.

Why is American Water Works Trading at a Hefty Premium?

Precisely because of the factors mentioned above that constitute a highly-predictable growth avenue for the company, investors have been willing to pay a hefty premium for the stock. No matter the underlying factors that may negatively affect the economy, there is virtually nothing that stands between management’s outlook and actually delivering on their forecasts.

Whether or not we enter a recession in 2023 or later, water consumption or rate increases won’t be influenced. Therefore, you can see why investors are eager to allocate their money to such a secure stock during an uncertain market landscape. Specifically, at the midpoint of management’s Fiscal 2023 earnings-per-share guidance of $4.72 to $4.82, the stock is now trading at a forward P/E of 31.2 (a meager 3.2% earnings yield), which is expensive even if the company were to achieve the high end of its provided outlook’s range.

Is AWK Stock a Buy, According to Analysts?

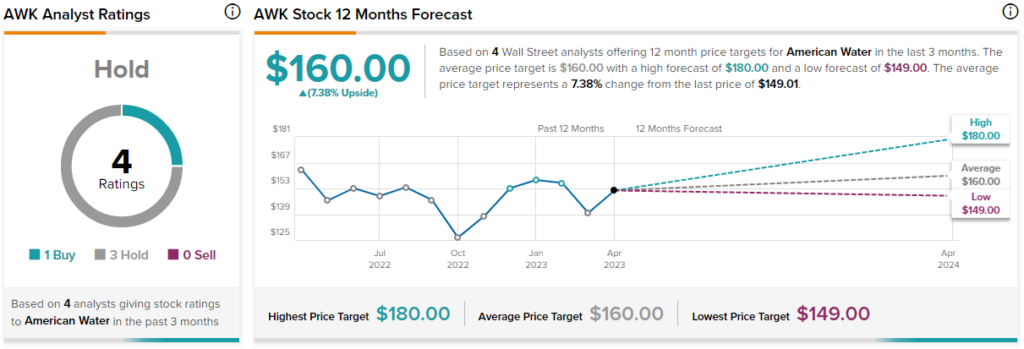

Regarding Wall Street’s view on the stock, American Water Works has a Hold consensus rating based on one Buy and three Holds assigned in the past three months. At $160, the average American Water Works stock forecast implies 7.4% upside potential.

Takeaway: Is American Water Works Worth Considering?

Despite its prominent qualities, I don’t think American Water Works has much to offer at its current price levels. Investors are paying for the company’s predictable growth, but paying 31.2 times this year’s earnings for mid-to-high single-digit growth can seriously limit future shareholder returns. A further multiple expansion is highly unlikely, while a much more reasonable multiple compression could signal downside potential.

American Water Works’ rich valuation is also reflected in the stock’s thin yield. At just 1.8%, American Water Works’ yield is barely enough to compensate investors with a tangible return in today’s high-interest-rate environment.

Again, investors value that the company has already grown its dividend every year since its IPO (in 2008), has provided a multi-year dividend growth outlook, and is likely to maintain this track record for decades to come, similar to industry peers. Nevertheless, the current yield can essentially not protect investors against the potential losses from a valuation multiple compression. Hence, I am neutral on the stock.