It’s no secret that Amazon (NASDAQ: AMZN) has rewarded its shareholders with spectacular returns over the past decade. Nevertheless, following last year’s peak market euphoria, shares of Amazon have been gradually correcting, in line with the underlying, deteriorating market conditions. In fact, at under $95, Amazon stock is now trading near its three-year lows, which begs the question of whether it’s time to reconsider its investment case.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

In my view, Amazon does have the potential to post massive net income margins powered by its already highly-profitable Amazon Web Services segment and economies of scale in its e-commerce segment. However, as long as inflationary pressures keep the company’s expenses elevated and the ongoing macroeconomic situation suppresses consumer demand, shares are likely to remain sluggish. Accordingly, I am neutral on the stock.

Profitability Needs to Improve

As I just mentioned, Amazon has the ability to generate massive amounts of net income. We saw this potential in last year’s results when Amazon recorded a tremendous $33.4 billion in net income. However, with the company already posting an unprofitable first half of the year and a barely-profitable Q3, even if the holiday season boosts its results substantially, Amazon will likely end up losing money for the year. After all, Amazon’s guidance for Q4 already targets an operating income between just $0 and $4.0 billion.

Additionally, with the macroeconomic environment barely improving lately, this trend may be brought forward to 2023. Sure, inflation slightly decelerated in October, but it still remains at quite high levels. The Fed remains hawkish too, so additional interest rate hikes could further increase Amazon’s interest expenses. Thus, we shouldn’t be surprised if management slows down its future investments, dragging the company’s economies of scale down in the short-to-medium term.

Regardless, I believe that for investors to start getting excited about the stock again, Amazon’s profitability needs to improve materially first.

Can AWS’s Growth be Sustained?

Amazon’s most profitable segment is its Web Services due to enjoying quite high margins. Thus, this is why I think its future prospects are key to predicting Amazon’s net income recovery.

In Amazon’s most recent Q3 results, AWS produced $20.5 billion in net sales, implying a year-over-year increase of 27% (or 28% in constant currency). Its operating income remained juicy as well, coming in at $5.4 billion, up 11% compared to last year. Nevertheless, it implies a slowdown from the prior’s quarter’s growth of 33% and last year’s Q3 growth of 39%.

Due to the ongoing market conditions, including global corporate spending likely to decline moving forward as firms aim to reduce costs, it’s quite likely that AWS’ growth will decelerate further. I mean, it’s still growing at impressive levels, especially considering that the company goes all the way back to 2002. But yes, given the macro landscape, a further slowdown is more or less certain – especially with competition from Microsoft (NASDAQ: MSFT) and Alphabet (NASDAQ: GOOGL) (NASDAQ: GOOG) ramping up.

Retail Segment: The Struggle Persists

Despite AWS’s success and robust contribution to profits, Amazon’s Retail business, which makes up the largest chunk of revenues, seems to be struggling quite hard.

In North America, segment growth has been sustained at satisfactory levels, with Q3 revenues rising 20% year-over-year, from $65.6 billion to $78.7 billion. Nevertheless, this growth hardly satisfied investors, as the segment posted an operating loss of $142 million versus an operating profit of $880 million last year. Not only is this a massive plunge, but it’s especially worrying considering that Amazon should have achieved further economies of scale given its top-line growth. This just goes to show how severe the increase in labor and fulfillment costs has been lately.

The situation in the International segment has been even worse, as current headwinds amid a strong dollar have been negatively impacting results further. While revenues would have grown 12% in constant currency, revenues actually declined 5% to $27.7 billion. Combine that with the ongoing rise in costs, and you get an operating loss of $2.5 billion, an even further loss from last year’s $911 million. With the dollar remaining exceptionally strong, Amazon will have an even harder time here in terms of achieving sustainable profits in the current market environment.

Is AZMN a Good Stock to Buy, According to Analysts?

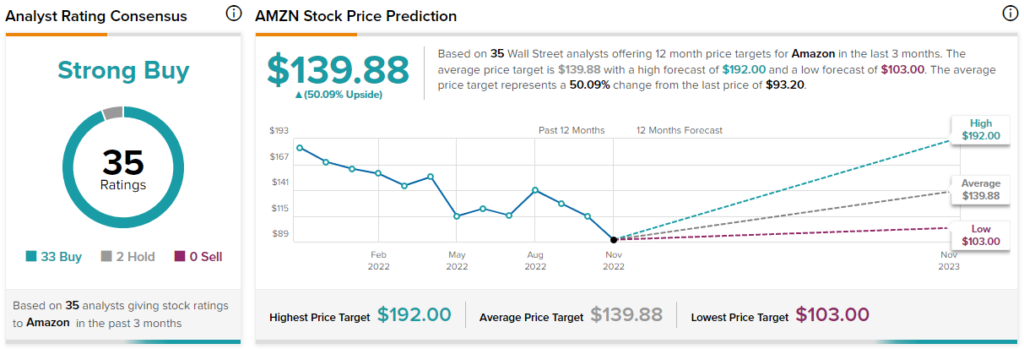

Turning to Wall Street, Amazon has a Strong Buy consensus rating based on 33 Buys and two Holds assigned in the past three months. At $139.88, the average Amazon stock price prediction implies 50.09% upside potential.

Takeaway: Wait for Amazon’s Retail Outlook to Improve

Amazon has a great business, but the company is currently sitting in the middle of a storm due to its retail segment being very sensitive to unfavorable macroeconomic events. While the stock may have already fallen enough to justify buying the stock, assuming profitability improves in the future, I will stay on the sidelines until I see the Retail business navigating the current environment better.