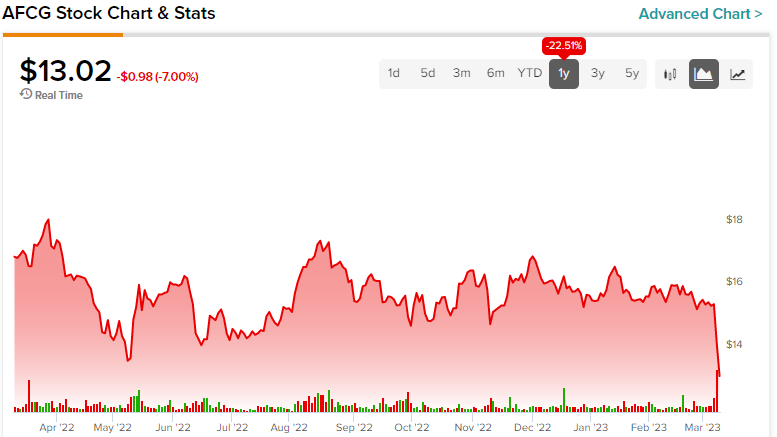

AFC Gamma (NASDAQ:AFCG) has drawn investors’ attention recently, as its dividend yield has risen to a hefty 17.4% following the stock’s prolonged decline. Although AFC Gamma shows promise, the associated risks with such a high dividend yield are numerous and should not be ignored. Therefore, it is wise to exercise caution and not place too much trust in the company solely based on its dividend yield. I am bearish on the stock.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

In this article, we will look into the following:

- AFC Gamma’s unique prospects

- Discuss AFC Gamma’s financials and risks attached

- Examine the sustainability of AFC Gamma’s massive dividend

- Conclude what investors should be wary of before considering investing in AFC Gamma

AFC Gamma’s Unique Prospects

AFC Gamma’s prospects are quite unique, as the company specializes in lending funds for commercial real estate in the cannabis industry, an area very few players have dared to enter. The intricate and unpredictable regulations surrounding the cannabis industry have deterred the majority of lenders from engaging with cannabis producers.

Thus, conventional financial institutions like banks are currently unable to facilitate transactions related to cannabis due to its illegal status at the federal level.

Therefore, companies in the space are largely underbanked, let alone have access to financing. Thus, AFC Gamma can take advantage of this supply-demand imbalance created by such a constrained financing environment to demand excessive returns on its capital.

With the cannabis industry thirsty for financing and the lack thereof, AFC Gamma has been targeting annual gross yields on its portfolio within the range of 12% – 20%. Therefore, the company can, in theory at least, generate considerably higher returns compared to its traditional mortgage REIT peers. The current rising-rates environment has further strengthened AFC Gamma’s opportunity in cannabis and commercial real estate lending, as capital has become increasingly scarce.

High Lending Yields Drive Results, but Risks Loom

With AFC Gamma able to demand such tremendous yields for commercial real estate in the cannabis industry, the company has so far been able to post strong results. In Fiscal 2022, the company reported total interest income of $81.5 million, up from $38.1 million in Fiscal 2021, following further underwritings during this period.

Additionally, net interest income came in at $74.7 million, also a significant increase from last year’s $37.0 million. Finally, despite the company’s share count jumping by about 44%, distributable earnings per share rose 35.7% to $2.51.

That said, it’s crucial to recognize the presence of various potential risks that could swiftly hinder AFCG’s results. Here are the two most significant, in my view.

Squeezed Interest Spreads

One notable risk that could compress AFCG’s future profitability is squeezed interest spreads. In the results we just discussed, the company’s total interest income jumped by 114%, but its net interest income grew by “only” 101%. This is because the company’s interest expenses grew by a much larger 503% to $6.8 million.

Over time, it’s quite possible that the company’s net interest spreads will be compressed. Creditors are likely to have higher demands from AFCG due to its risky business model, especially in the current market environment.

In the meantime, AFC can only charge so much, as its own lending yields are already massive. The company could issue equity instead of debt, but at the current dividend yield, that would be suicide and an even more expensive financing route.

Unreliable Counterparties

Another critical factor that could severely impact AFCG’s results is counterparties that are largely unreliable and could easily default on their obligations. Cannabis producers are subject to incredibly thin margins, as the industry is highly competitive and is also competing with the black market.

Combined with loan-shark financing from companies such as AFC Gamma, there is pretty much no room for sustainable profit generation. This is why even the large publicly-traded cannabis producers have failed to report sustainable profits despite their advantageous scale.

Now, add that AFC does not disclose its counterparties and that some of them are private companies, and you can see why there are tons of red flags here.

A Dividend Cut May be Coming

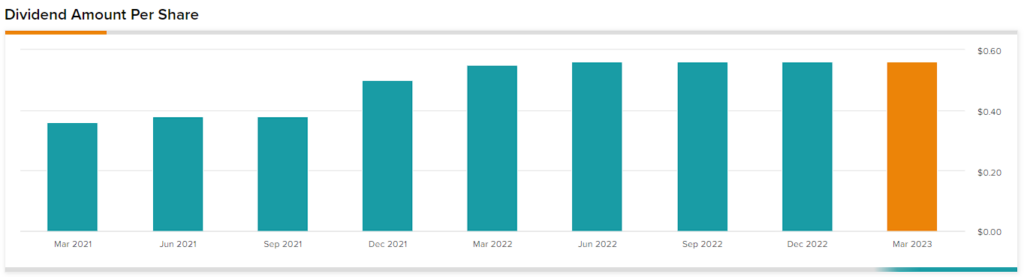

In my view, AFC is quite likely to cut its dividend in the coming quarters. The market is already pricing the stock for such a scenario, hence the massive 17.4% dividend yield. So far, the company has put out a great dividend growth track record, increasing its quarterly dividend from $0.38 following its IPO to $0.56 currently.

Yet, the current quarterly dividend is barely covered, with distributable earnings-per-share in Q4 coming in at $0.62. The slightest compression in the company’s interest spreads or the smallest misjudgment in share issuances is almost certainly going to lead to a dividend cut. Needless to say, the moment one of the company’s counterparties defaults, a dividend cut is to follow.

What is the Price Target for AFCG Stock?

Wall Street seems to have yet to catch up with the underlying risks attached to AFC Gamma’s investment case. The stock currently has a Strong Buy consensus rating based on three Buys and one Hold assigned in the past three months. At $20.50, the average AFCG stock forecast implies 55.9% upside potential.

Conclusion

AFC Gamma’s investment case appears compelling at first glance, given its massive dividend yield of 17.4%. Indeed, the company does have prospects and could be a useful mediator between cannabis producers and the financing industry.

That said, it’s fairly unlikely that the company will be able to sustain its current payout run rate, given the severe risks attached to its business model. In any case, investors should not trust or rely upon the stock’s massive yield.