Sera Prognostics, which develops sophisticated pregnancy diagnostics, is expected to launch its IPO this week. The price range on the offering is $15 to $17 and the estimated valuation is over $550 million. The lead underwriters include Citigroup (C), Cowen, and William Blair.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

In 2008, Sean Esplin founded Sera Prognostics. He was a medical doctor and professor of Obstetrics and Gynecology at the University of Utah Maternal-Fetal Medicine Division. As for Sera Prognostics, he had the following vision: “With one simple blood test, proteomic science gives us early, accurate prediction of premature birth. With that comes hope—the hope of finally making a big difference for women and their babies.”

Esplin has continued with his research efforts but his company has gone on to assemble a strong management team. For example, the CEO is Gregory Critchfield, who is a medical doctor and the former president of Myriad Genetic Laboratories. Then there is Thomas Garite, who is the vice president of clinical studies. He also served as the president of the Society for Maternal Fetal Medicine.

Backgrounder on Sera Prognostics

Sera Prognostics has built a platform that provides analysis of the changes in both the mother and the fetus. A key part of this is a clinically and demographically annotated set of more than 10,500 blood samples from U.S. women. There is also the use of innovative spectrometry and sophisticated machine learning and AI (Artificial Intelligence) methods. In other words, the system gets better over time.

The company’s first commercial product is the PreTRM test. This is a blood-based biomarker to gauge the risk of premature delivery. It is a non-invasive test that is given to women carrying fetuses during weeks 19 to 20 of gestation.

As a major validator of the technology, Anthem (ANTM) has made the PreTRM test available to its pregnant members (this is a multi-year contract). The company has over 43 million members in the U.S. Keep in mind that the gross cost savings are $1,395 per pregnancy screened.

The market opportunity is substantial. Each year, there are about 140 million births globally and about 25% have complications. As for preterm births, these come to roughly 15 million per year.

Bottom Line on the Sera Prognostics IPO

The Sera Prognostics platform is quite versatile. This is why the company has a strong pipeline of other applications. Some of the areas include fetal growth restriction, stillbirth, postpartum depression, and gestational diabetes mellitus.

It’s true that Sera Prognostics is still in the early stages and there are still risks. But then again, the relationship with Anthem is likely to be a strong propellent for growth in the next few years.

It’s also important to note that existing methods for premature birth risk have been limited in terms of accuracy and efficacy. There truly is a need for innovation in the market. In other words, the Sera Prognostics IPO could be an interesting long-term play.

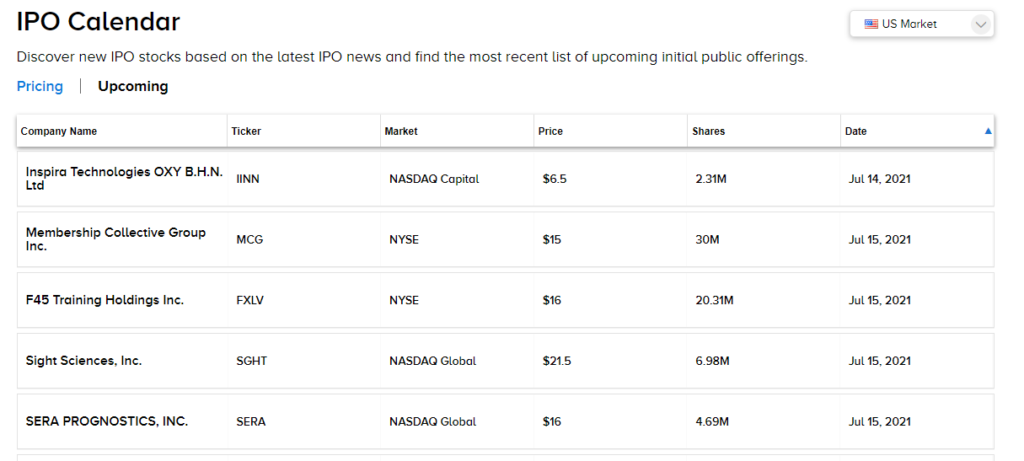

The offering is slated to start trading on Thursday on the NASDAQ and the proposed ticker is SERA. You can also check out other IPOs on the Tipranks site.

Disclosure: Tom Taulli does not have a position in Sera Prognostics stock.

Disclaimer: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities.