Invitation Homes’ (NYSE:INVH) growth story endures despite the majority of residential REITs having been significantly impacted by the hurried interest rate increases over the past year. This is surprising since, unlike other real estate classes, such as commercial, retail, or industrial ones, residential real estate can be impacted more adversely by rising rates as it primarily involves individuals and families who are discouraged from taking on mortgages.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Simultaneously, with higher interest expenses directly pressuring their profitability, most residential REITs are going to see their bottom lines decline this year. Yet, Invitation Homes employs a unique strategy that differentiates it from its peers. By focusing on premium residential offerings whose demand tends to remain very strong even during challenging times, the company maintains enough pricing leverage to absorb such hurdles.

In fact, Invitation Homes projects to generate record profits this year, going full steam ahead against the industry’s headwinds. This likely explains the stock’s 17.2% gain year-to-date, considerably outperforming iShares’ Residential and Multisector Real Estate ETF (ETF:REZ), which is the largest residential REIT ETF out there, having gained 7.3% over the same period.

Besides setting targets for record profitability, Invitation Homes’ dividend yield remains above its historical average as well, while the company has enough room to support further dividend growth. Hence, I am bullish on the stock.

What Makes Invitation Homes Stand Out in a Rising-Rates Environment?

Invitation Homes stands out in a rising-rates environment due to its unique and effective strategy. The company focuses on leasing single-family homes, offering residents top-notch properties in highly-desirable neighborhoods throughout America. In fact, it is the largest owner of single-family homes in the country! Unlike most diversified residential REITs, Invitation Homes exclusively caters to affluent Americans. This targeted approach ensures that its tenant base consists of individuals and families with higher income levels rather than a diverse range that may include average or below-average earners.

Overall, Invitation Homes’ tenants are individuals and families who seek homes that align with their evolving lifestyle needs. The company provides them with renovated properties of exceptional quality, boasting features like proximity to employment opportunities and access to reputable schools. The positive impact of targeting affluent tenants is reflected in Invitation Homes’ impressive key metrics and sustained growth rates, even in the face of industry challenges.

For instance, in its most recent Q1 results, same-property average occupancy rose by 50 basis points to 97.8% quarter-over-quarter, while total collections as a percentage of revenue due came in at 98%. Further, the company was able to leverage its tenants’ resilient demand for premium residential offerings to continue raising rent, recording notable growth across the board. Specifically, the company posted same-home new lease rent growth of 5.7% and same-home renewal rent growth of 8.0% in Q1, driving a blended rent growth of 7.3%.

In the meantime, even though interest expenses and the company’s share count rose modestly, mainly due to the various acquisitions the company executed over the past year, the REIT was still able to post growth on a per-share basis (i.e., acquisitions and dispositions were accretive for investors). In particular, the company posted adjusted FFO per share of $0.38, up three cents year-over-year, as a result of prudent cost management.

Most importantly, Invitations Homes’ management expects the company to retain its robust momentum, driven by a lack of adequate housing supply and favorable demographic trends in the company’s markets (relevant to my previous point about targeting tenants looking to stay near markets with strong jobs growth) that continue to generate satisfactory leasing results across its portfolio.

To quantify this, management expects AFFO/share to land between $1.43 and $1.51 in Fiscal 2023, the midpoint of which ($1.47) implies year-over-year growth of 4.2% versus Fiscal 2022. This is not a massive increase, but it’s certainly a pleasant one for a residential REIT in a rising-rates landscape.

Dividend Growth Prospects Remain Robust

With Invitation Homes poised to further expand its profitability this year, the company’s prospects for dividend growth remain exceptionally strong. Notably, Invitation Homes has consistently increased its dividends for six consecutive years since its IPO in early 2017, underscoring its commitment to rewarding shareholders.

By considering the midpoint of management’s AFFO/share outlook at $1.47 alongside Invitation Homes’ current dividend payout run rate of $1.04, we see that the forward payout ratio stands at a favorable 71%. This suggests that the company still has ample room to pursue competitive dividend hikes, enhancing the potential for future returns.

What further bolsters this stance is the fact that even in the face of a challenging market environment with higher interest rates, Invitation Homes boldly increased its dividend by 18.2% back in February. This decision, given that management was aware they were entering a rising-rates environment at the time, demonstrates their confidence in the company’s overall strategy and the strength of its tenant base.

In the meantime, following such a strong dividend hike combined with shares lagging over the past year, the stock’s yield has now been pushed to roughly 3.0%, notably higher than its historical average. Hence, dividend growth investors might find the current share price a decent entry point.

Is INVH Stock a Buy, According to Analysts?

Regarding Wall Street’s sentiment, Invitation Homes features a Moderate Buy consensus rating based on right Buys and four Holds assigned in the past three months. At $37.21, the average Invitation Homes stock price target implies 4.8% upside potential.

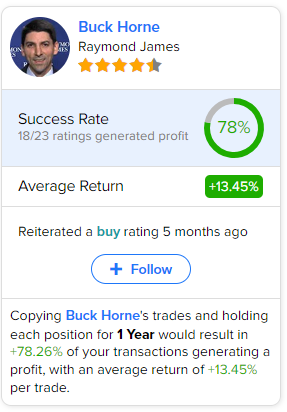

If you’re wondering which analyst you should follow if you want to buy and sell INVH stock, the most accurate analyst covering the stock (on a one-year timeframe) is Buck Horne from Raymond James, with an average return of 13.45% per rating and a 78% success rate.

The Takeaway

In my view, uncertainty in the residential real estate market should persist for as long as interest rates remain elevated. That said, there are always a few players within troubled industries that manage to stand out, and Invitation Homes appears to be one of them within the residential REITs space.

The company’s approach of catering to affluent tenants should continue to keep critical metrics such as occupancy and rent collection at industry-leading levels, while management’s guidance for further AFFO/share growth this year is a testament to the quality of its overall operations. Coupled with a decent dividend yield and Invitation Homes’ most recent, bold dividend increase hinting to confidence for future dividend hikes, I believe that the stock’s bullish case is rather compelling.