Semiconductor giant Nvidia (NASDAQ:NVDA) released its fiscal Q2 2024 earnings results on Wednesday evening, and the numbers were pretty terrific.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Quarterly revenues set a new record of $13.5 billion, up 101% year over year, led by data center revenue (76% of total revenue) that grew 171%. GAAP earnings per share surged 854% year over year, to $2.48, helped by gross profit margins improving 450 basis points to 70.1%.

Nvidia crushed analyst predictions of $11.2 billion in revenue, and $2.09 per share in earnings. It crushed forecasts for future results as well. Instead of the $12.6 billion that Wall Street analysts foresaw for fiscal Q3 2023, Nvidia says it will generate sales of $16 billion (plus or minus 2%), and improve gross profit margins even further to 71.5%.

And how did investors react to all of this good news? They bid up Nvidia shares by precisely 0.1% during ordinary trading hours Thursday — and then sold them off by 2.43% in Friday’s trading session.

One analyst who I imagine was more than a little confused by this result is Goldman Sachs’ Toshiya Hari, who was considerably more impressed by Nvidia’s results than other investors appear to be. Recapping the Q2 results, Hari exulted at Nvidia’s beating consensus sales projections by 21%, and earnings projections by 30%.

Of particular importance, says Hari, is the fact that Nvidia’s data center business is doing so well. 29% revenue growth in data centers was an even bigger surprise than Nvidia’s overall revenue outperformance. As Hari explained, Nvidia has a deep “competitive moat” around its semiconductors for artificial intelligence purposes, and “customers are developing/deploying increasingly complex AI models” requiring these chips.

In a situation like this, Hari expects “Nvidia to maintain its status as the accelerated computing industry standard for the foreseeable future.” And just as important as the demand side of the equation, Hari emphasized how Nvidia is working with its supply chain partners to ensure it can manufacture an adequate supply of chips to meet — and capitalize upon — this demand.

Why is this important? Well, basically, because of the advantages of scale that Nvidia enjoys. Look back up above real quick. Nvidia’s sales grew 101% year over year… but its profits on those sales grew more than eight times as fast. This is because, as Nvidia produces and sells more and more chips, its revenues grow a whole lot faster than its costs do. In fact, between fiscal Q1 2024 and fiscal Q2 2024, Hari points out that sales grew 88% sequentially, but operating costs only inched up a bare 5%.

The difference between those two numbers basically dropped straight to the bottom line, swelling Nvidia’s profits. And now Nvidia is saying revenues are going to keep growing faster than expected, and profit margins are going to be even bigger than expected, in Q3.

Little wonder, then, that Hari reiterated a “buy” rating on Nvidia stock, while other investors are selling these shares. Hari is taking the opposite side of this bet by predicting that Nvidia stock will reach $605 per share over the next 12 months, adding 28% gains to a stock that has already risen by 190% in the last 12 months. (To watch Hari’s track record, click here)

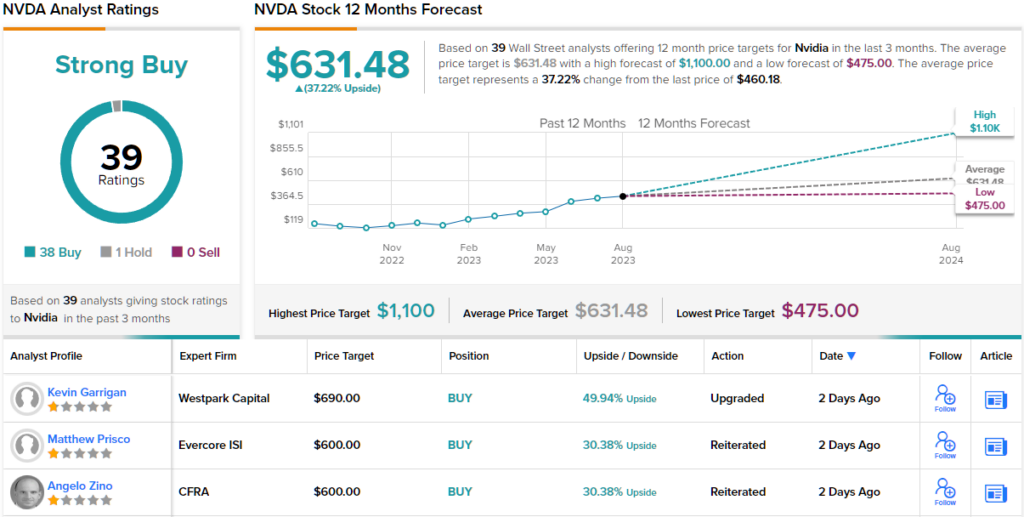

Overall, it’s clear that Wall Street likes what it sees here. The stock has 39 recent analyst reviews, breaking down into 38 Buys and a single Hold, for a Strong Buy consensus rating. The stock is selling for $460.18, and its $631.48 average price target suggests that it has room to grow ~37% in the year ahead. (See NVDA stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.