If you are interested in investing in wide-moat stocks, the VanEck Morningstar Wide Moat ETF (BATS:MOAT) is a great place to start.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

What is a “moat” anyway? The traditional definition of a moat is a body of water or an obstacle that surrounds a castle, protecting its inhabitants from whatever dangers lurk outside. From an investing perspective, the definition takes inspiration from this same concept — a moat is simply a sustainable competitive advantage that protects a business from encroachment by competitors. In fact, the legendary investor Warren Buffett helped popularize the concept of an economic moat.

VanEck defines a moat as a company’s “ability to maintain the competitive advantages that are expected to help it fend off competition and maintain profitability into the future.” These are the types of businesses you want to invest in, as their moats should help them to beat the competition and continue to generate durable profits well into the future.

MOAT is a large ETF and has garnered $7.3 billion in assets under management (AUM). The aptly-named ETF seeks to replicate the performance of the underlying Morningstar Wide Moat Focus Index.

MOAT’s Top Holdings

MOAT holds 50 stocks, and its top 10 holdings account for 27.9% of the fund. Looking at these holdings gives an idea of what Morningstar views as a wide moat.

A wide moat can come in many different forms. For example, Meta Platforms (NASDAQ:META) is the largest holding, sporting a 3.27% weighting. With nearly 3 billion users worldwide, Meta has a wide moat thanks to its massive user base, the network effects it creates, and the enormous amount of data it has thanks to this user base.

It would be difficult for a new company to start a network like Facebook today because it wouldn’t have the same network effects. People join platforms like Facebook or Instagram because a lot of other people they know are on them, which is why starting a social network from scratch with zero users is a Herculean task.

Similarly, the second-largest holding, MercadoLibre (NASDAQ:MELI), has a moat through its tremendous network effects, thanks to the vast network of users and merchants who use its Mercado Pago payments system. Customers want to use it because a lot of merchants accept it, and merchants want to use it so that they can take payments from as many customers as possible.

MercadoLibre has also built a moat around the e-commerce side of its business by investing heavily in a logistics network covering much of Latin America. If a competitor wanted to come in and do this, it would take considerable time, money, and expertise. This is easier said than done, and this is part of the reason why would-be competitor Sea Limited (NYSE:SE) ended up leaving several key markets in Latin America last year, giving credence to the idea of Mercadolibre’s moat.

The fund’s third-largest holding, Boeing (NYSE:BA), has a different type of wide moat. Commercial airliner manufacturing is essentially a duopoly between Boeing and Airbus (OTC:EADSF), which is evidence that it’s hard to just come in and set up shop in this industry. Aircraft manufacturing requires significant technical expertise, and there are also considerable regulatory barriers for companies to contend with.

Other top 10 holdings include enterprise software platforms like Salesforce (NYSE:CRM) and Workday (NASDAQ:WDAY), semiconductor manufacturing equipment provider Lam Research (NASDAQ:LRCX), and semiconductor testing equipment maker Teradyne (NASDAQ:TER).

Below, you’ll find an overview of MOAT ETF’s top holdings using TipRanks’ holdings tool. Stocks such as MercadoLibre, Salesforce, Fortinet (NASDAQ:FTNT), Teradyne, and Lam Research all have Smart Scores of 9 out of 10 or above.

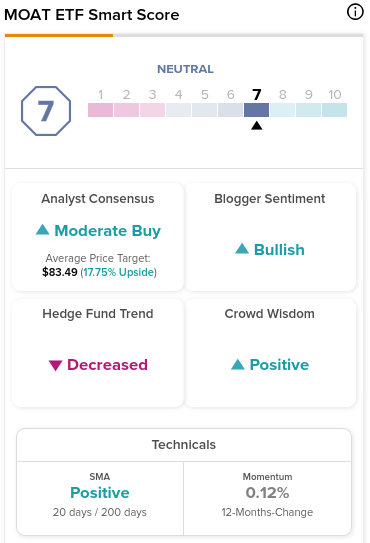

The Smart Score is TipRank’s proprietary quantitative stock scoring system that evaluates stocks on eight different market factors, such as Wall Street analyst ratings, corporate insider transactions, hedge fund activity, and more. Stocks with a Smart Score of 8 or above receive “Outperform” ratings.

MOAT Stock’s Performance

These businesses are classified as having wide moats, but let’s take a look at how this translates into market performance over time. MOAT stock is up 8.8% year-to-date and more or less flat over the past year. However, over the past five years, MOAT has returned 73%, and over the past decade, it has returned 202%.

Meanwhile, the S&P 500 has returned 45.2% over the past five years and 154.9% over the past 10 years. Also, the Nasdaq has returned 52.5% over the past five years and 254.8% over the past 10. Therefore, MOAT has essentially outperformed both indices over the past five years and outperformed the S&P 500 over the past decade while lagging the Nasdaq.

Nonetheless, despite lagging the Nasdaq over a 10-year time frame, a 202% return is still very respectable, and based on the more recent performances, MOAT could outperform the Nasdaq, going forward.

Is MOAT Stock a Buy?

The analyst community is fairly bullish on the VanEck Morningstar Wide Moat ETF. Analysts collectively view MOAT as a Moderate Buy, and the average MOAT ETF price target of $83.49 indicates upside potential of 17.3% from current prices.

Of the 826 analyst ratings on MOAT, 64.65% are Buys, 31.23% are Holds, and 4.12% are Sell ratings.

TipRanks uses proprietary technology to compile analyst forecasts and price targets for ETFs based on a combination of the individual performances of the underlying assets. By using the Analyst Forecast tool, investors can see the consensus price target and rating for an ETF, as well as the highest and lowest price targets.

TipRanks calculates a weighted average based on the combination of all the ETFs’ holdings. The average price forecast for an ETF is calculated by multiplying each individual holding’s price target by its weighting within the ETF and adding them all up.

The MOAT ETF has an ETF Smart Score of 7 out of 10. Additionally, blogger sentiment and crowd wisdom are both bullish, although hedge fund activity is decreasing.

MOAT has a reasonable, though not insignificant, expense ratio of 0.46%. The ETF is also a dividend payer, and it currently yields 1.1%.

The Takeaway

When looking for stocks that you want to own for the long-term, businesses with strong, sustainable moats are a great place to start. Whether it’s a tech giant with the network effects of Meta Platforms or Mercadolibre, or a manufacturer of equipment with significant technical complexity like Boeing, Teradyne or Lam Research, these businesses boast considerable barriers to entry that should be durable well into the future.

By investing in an ETF like MOAT, you can add the power of 50 of these stocks to your portfolio with one ETF. Its focus on sustainable advantages and attractive valuations compared to fair value estimates make MOAT a compelling option for long-term investors.