Investors can harness the power of entire indices by adding ETFs focusing on the Dow Jones, S&P 500, and Nasdaq 100 to their portfolios. Investing can be complex, but it can also be very simple. Simply investing in these three major U.S. indices would have generated significant returns over the past decade. Over the past 10 years, the Dow, S&P 500, and NASDAQ have gained 144%, 172%, and 272%, respectively.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

It wouldn’t be feasible to invest in all 500 stocks of the S&P 500, for example. However, you can add an S&P 500 ETF to your portfolio, giving you ample diversification and exposure to the growth of hundreds of the best companies in the United States. It’s sensible for all investors to have some exposure to the broader indices, and it’s a great way for new investors to start their portfolios with instant diversification.

Investors can use these three ETFs to add the breadth and depth of these three indices to their portfolios.

Vanguard S&P 500 ETF (VOO)

Investing in the Vanguard S&P 500 ETF is an effective way to gain exposure to the power of the S&P 500 as a whole. This massive ETF has $281 billion in assets under management.

As you might expect, since it covers the entire S&P 500, VOO ETF is very diversified with 506 holdings, and VOO’s top 10 holdings only make up 24.3% of the fund, essentially mirroring the concentration of the S&P 500 itself. The Vanguard S&P 500’s top holding is the largest stock in the S&P 500 by market cap, Apple, which accounts for 6% of the fund.

The rest of the top 10 is rounded out by familiar names, including tech giants like Microsoft, Alphabet, Amazon, Tesla, and Nvidia, as well as large-cap stocks from other sectors like Berkshire Hathaway, ExxonMobil, and UnitedHealth Group.

VOO pays a dividend and currently yields 1.6%, which is roughly in line with the average yield of the S&P 500. Vanguard is known for its low-cost funds and ETFs, and VOO is no different, with a minuscule expense ratio of just 0.03%.

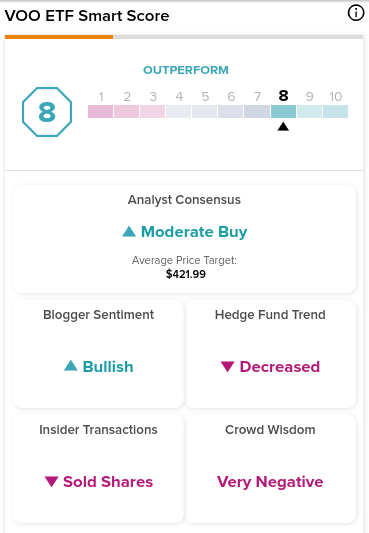

The Vanguard S&P 500 ETF has a favorable Smart Score of 8. Its average analyst price target of $421.99 indicates upside of 11.3% from current levels. Blogger sentiment is bullish, while hedge fund involvement is decreasing.

Last year, VOO stock fell 18.2%, closely tracking the performance of the S&P 500. However, things are looking up in 2023 as the ETF is up 8.4% year to date. Ultimately, the Vanguard S&P 500 is an efficacious and cost-effective way to add exposure to the entire S&P 500 to your portfolio.

Invesco QQQ Trust (QQQ)

The Invesco QQQ Trust ETF, often referred to colloquially as “The Q’s,” is a massive $161 billion ETF that invests in the 100 largest non-financial companies in the Nasdaq.

The Nasdaq is the index that is most closely associated with the technology sector, so it is unsurprising that most of QQQ’s top holdings here are the same tech stocks that make up VOO’s top holdings. Stocks like Microsoft, Apple, Amazon, Alphabet, NVIDIA, Meta Platforms, and Tesla dominate the top 10 holdings. Pepsi is the one notable non-tech stock amongst the top 10 holdings.

While QQQ is a diversified ETF with 102 holdings, it is much more concentrated than VOO. Its top 10 holdings make up 53.2% of the fund. Like VOO, QQQ pays a dividend and currently yields 0.7%.

The Invesco QQQ Trust has a positive ETF smart score of 8 out of 10, indicating an Outperform rating, and the consensus price target of $341.20 implies 11.5% upside from today’s prices. Meanwhile, blogger sentiment is positive, while hedge fund involvement is decreasing.

Tech stocks had a tough go of it in 2022, so it’s unsurprising that QQQ lost 32.5% last year. However, investor enthusiasm for tech has returned in 2023, and QQQ has soared to a 13.3% gain year-to-date. Overall, the Invesco QQQ Trust is a cost-effective way (0.20% expense ratio) to add the innovation of the large-cap tech stocks in the Nasdaq 100 to your portfolio.

SPDR Dow Jones Industrial Average ETF (DIA)

In some ways, the much larger S&P 500 has overtaken the Dow Jones Industrial Average as the dominant barometer for the U.S. economy. However, the Dow Jones is still viewed as a blue-chip index of world-class companies.

Being in the Dow Jones Industrial Average essentially screens out “bad.” This is because Dow components have to be profitable and must have an excellent reputation, sustained growth, and be of interest to a large number of investors, according to S&P Global (the company that maintains both the S&P 500 and Dow Jones Industrial Average).

The Dow Jones only includes 30 companies, so the SPDR Dow Jones Industrial Average ETF is naturally much more concentrated than the S&P 500 or Nasdaq ETFs listed above. The ETF has 31 holdings, and DIA’s top 10 holdings make up 55.2% of the fund.

Unlike the S&P 500 or the Nasdaq, the Dow is a price-weighted index, so high-priced Dow components like UnitedHealth have an outsize position in the fund. UNH, the health insurance giant, makes up nearly 10% of the fund.

The rest of the top 10 is essentially a who’s who of iconic U.S. companies like Goldman Sachs, Home Depot, McDonald’s, Caterpillar, and Visa, with Microsoft serving as the lone representative from ‘big tech.’

Because DIA isn’t as exposed to tech as VOO or QQQ, it soundly outperformed both ETFs last year (just as the Dow itself outperformed the S&P 500 and the Nasdaq), with a loss of 7% for 2022. However, as you might guess, DIA is lagging behind these two counterparts as tech rebounds in 2023, with a 2.4% gain year-to-date.

The SPDR Dow Jones Industrial Average ETF Trust has a neutral ETF Smart Score of 7. Further, the average DIA stock price target of $370.67 indicates upside potential of 8.7% from current pricing.

Like the other two ETFs above, DIA pays a dividend and yields 1.9%. Like its counterparts, it also features an investor-friendly expense ratio of 0.16%.

Investor Takeaway

In conclusion, history shows that investing in indices like the Dow, S&P 500, and Nasdaq is a fruitful way to invest over the long term. These 3 ETFs offer investors a way to gain exposure to each index in an effective, easy, and inexpensive manner.

All three of these indices look like sensible investments over the long term. Note that the Dow outperformed the others last year, thanks to its lower exposure to tech, while the QQQ is outperforming this year as tech rebounds. The VOO ETF may be the best way to get “the best of both worlds” as it features a mix of tech stocks and “old economy” stocks.