Investors keen on investing in the technology sector could consider the Invesco QQQ Trust (NASDAQ:QQQ) ETF. This appealing ETF closely tracks the Nasdaq 100 Index (NDX) and provides an opportunity for investors to hold stocks from 10 different sectors. Interestingly, based on technical indicators, QQQ is still a Buy near its current levels.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Technical Analysis in Detail

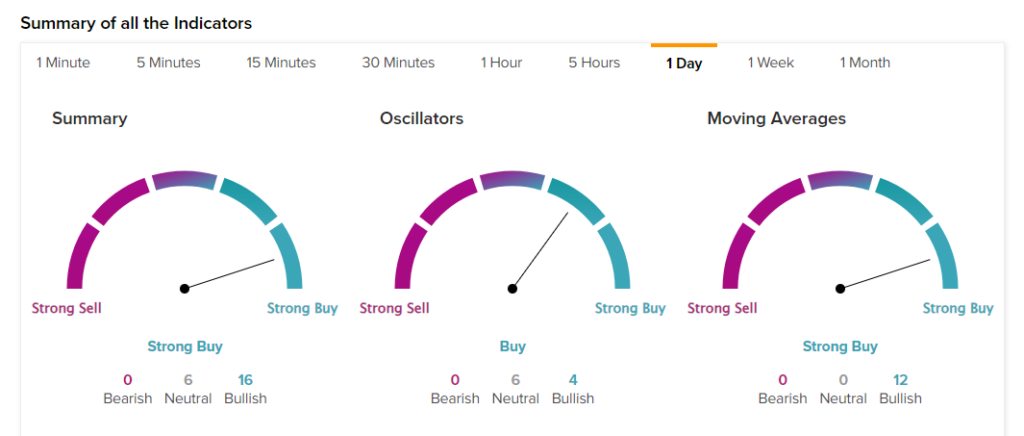

According to TipRanks’ technical analysis tool, the QQQ ETF stock’s 50-day EMA (exponential moving average) is 349.63, making it a Buy. Further, the moving average convergence divergence (MACD) indicator also signals a Buy.

At the same time, QQQ’s price rate of change (ROC) of 0.35 points to a bullish trend. Also, the QQQ ETF’s Williams %R signals a Buy.

Overall, on the one-day time frame, QQQ stock is a Strong Buy, according to TipRanks’ easy-to-read technical summary signals. This is based on 16 Bullish, six Neutral, and zero Bearish signals.

Latest Update on QQQ ETF

The QQQ ETF’s impressive year-to-date rally of over 41% can be largely attributed to the substantial increase in stock prices of the top seven technology companies. These companies include Microsoft (MSFT), Apple (AAPL), Nvidia (NVDA), Amazon (AMZN), Tesla (TSLA), Meta (META), and Alphabet (GOOGL) (GOOG). Together, these stocks account for more than 55% of the holdings in the QQQ ETF.

It is important to note that Nasdaq (NDAQ) has scheduled a special rebalance of the Nasdaq 100 Index before the market opens on July 24. The purpose of this rebalance is to mitigate the issue of overconcentration in the index by reducing the combined weight of these seven giants. According to the index’s methodology, it is expected that the total weighting of these stocks will decrease by between 6% to 8%.

Furthermore, The Trade Desk (TTD) will be added to the Nasdaq 100 prior to the market opening on July 17, 2023. TTD will be replacing Activision Blizzard (ATVI), which is set to be acquired by MSFT.

Is QQQ a Good ETF to Invest In?

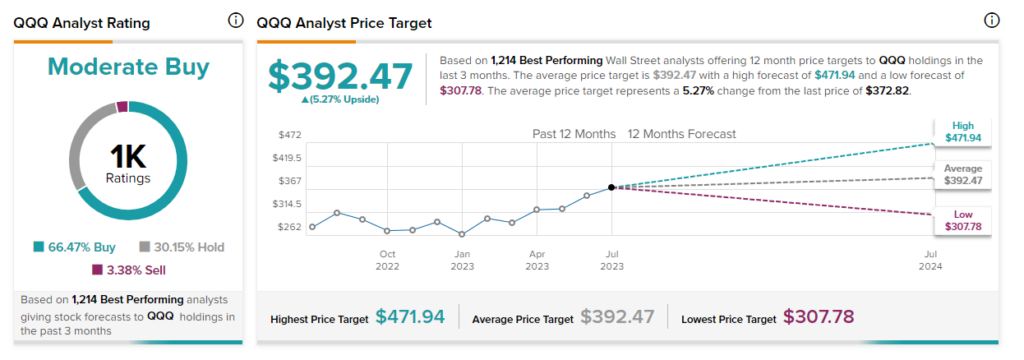

As per 1,214 top Wall Street analysts providing ratings on the QQQ’s 102 holdings, the ETF comes in as a Moderate Buy, and the average QQQ price target of $392.47 implies 5.3% upside potential. It is noteworthy that these top analysts have an impressive history of helping investors generate massive returns from their recommendations.

Moreover, according to TipRanks’ Smart Score System, QQQ stock has a Smart Score of 8 out of 10, which indicates that it could outperform the broader market over the long term.