The Invesco QQQ Trust (QQQ) ETF closely tracks the NASDAQ 100 Index (NDX) and enables investors to invest in the largest 100 non-financial companies. Remarkably, the QQQ ETF has gained about 39% in 2023 so far, and based on technical indicators, QQQ is still a Buy near its current levels. Further, the QQQ ETF’s Outperform Smart Score on TipRanks and the top Wall Street analysts’ average price target suggest further upside potential from the current level.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The ETF might have more room to run on the back of increasing opportunities in sectors such as artificial intelligence (AI), robotics, autonomous vehicles, the metaverse, and others.

Key Factors Supporting QQQ ETF

The QQQ ETF offers investors a diversified portfolio of companies from different sectors, including technology, healthcare, consumer discretionary, and communication services. Additionally, QQQ is known for its high trading volume, making it easy for investors to buy and sell shares.

Moving on, the QQQ ETF has delivered impressive historical performance, outperforming many other broad-market indices. Interestingly, the QQQ ETF stock has beaten the S&P 500 Index (SPX) in nine out of the last ten years, with the trend continuing in 2023 so far. Moreover, the stock has delivered an average annualized return of 17.7% in the past decade, ending in March 2023.

Outperform Smart Score

According to TipRanks’ Smart Score System, QQQ has a Smart Score of 8 out of 10, which indicates that the ETF could outperform the broader market over the long term. It is worth highlighting that more than 50% of the holdings boast an Outperform Smart Score (i.e., a score of 8 or higher).

The stock has a Positive signal from retail investors. Our data shows that about 10.2% of TipRank’s retail investors changed their holdings of the QQQ in the last 30 days. Moreover, The SPY ETF enjoys bullish blogger sentiment on TipRanks.

Is Invesco QQQ a Good Buy, According to Analysts?

As per 1,206 top analysts providing ratings on the QQQ’s 102 holdings, the ETF is a Moderate Buy, and the average price target of $394.92 implies a 7.47% upside. It is noteworthy that these top analysts have an impressive history of helping investors generate massive returns from their recommendations.

QQQ ETF’s Best-Performing Stocks

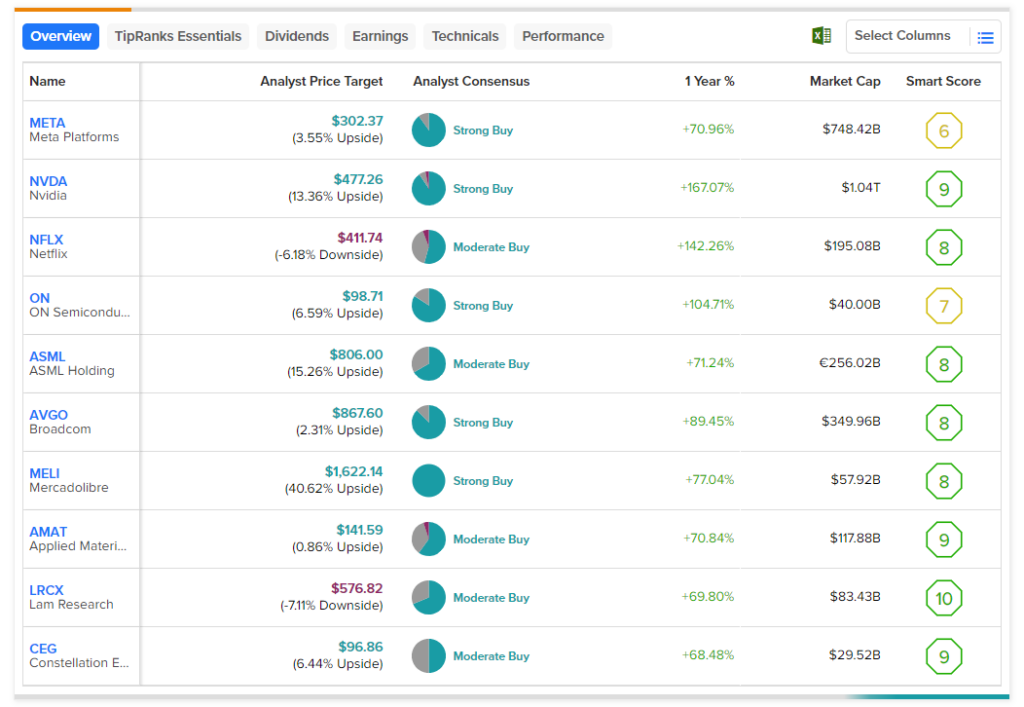

Here are some notable companies within the QQQ ETF that have demonstrated outstanding performance in the past year:

- Nvidia Corporation (NVDA)

- Netflix Inc. (NFLX)

- ON Semiconductor Corporation (ON)

- Broadcom Inc. (AVGO)

- Mercadolibre, Inc. (MELI)

- Asml Holding N.V. (ASML)

- Meta Platforms, Inc. (META)

- Applied Materials, Inc. (AMAT)

- Lam Research Corp (LRCX)

- Constellation Energy Corporation (CEG)