Intel (NASDAQ:INTC) and AMD (NASDAQ:AMD) have been moving in opposing directions over the past several years. As Intel lost its way (and lead in the CPU scene) and AMD continued its ascent, many analysts have gravitated towards Lisa Su’s (AMD’s CEO) empire as the preferred chip stock of the two.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

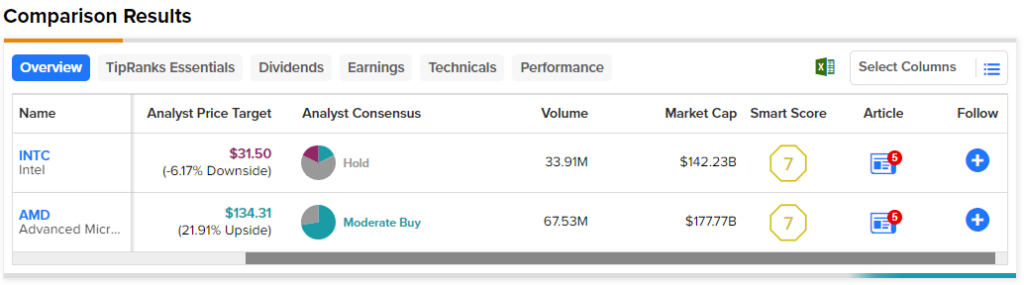

Undoubtedly, AMD has taken the “market cap crown,” and it’s since expanded the lead in a hurry ($177 billion for AMD vs. $140 billion for Intel), a lead that now looks out of reach for an ailing Intel that’s quickly losing the confidence of investors.

Therefore, let’s use TipRanks’ Comparison Tool to compare the two chip giants to see where analysts currently stand on the two names. Undoubtedly, Intel stock is an underdog for the deep-value crowd, while AMD is the play for investors who’d rather pay up for the lead.

Intel (NASDAQ:INTC)

It’s been a rough ride for shares of Intel, which just came off one of its worst weeks of trading in just over a year. Though the company has a plan in place to retake the chip crown in a few years, a growing number of folks are becoming increasingly skeptical. Indeed, the chip space is arguably one of the worst races to play from behind.

Further, Intel hasn’t done enough to impress the Street, which seems to only be impressed with AI innovations these days. Though analysts and investors seem to be in no rush to pick up those battered shares of Intel, I still view Intel as more than just a value trap, even if it continues to be up against it. The “Hold” rating on Intel stock may suggest it’s a long-shot underdog. However, I’m inclined to be more bullish than bearish at these valuations.

It may be a daunting task to catch up in the chip space against the likes of AMD. That said, I don’t believe it’s right for positive news on Intel stock to go mostly unnoticed by Mr. Market. Whenever you can catch Mr. Market wrongfully punishing a name, you may be able to get a better bang for your buck.

Recently, Intel shed light on plans to spend $4.6 billion to construct a new facility in Poland. The company also plans to pour a whopping $25 billion in Israel to upgrade a chip plant. Undoubtedly, Intel is not shying away from investments — it can’t afford to if it’s to catch up! Intel also announced its intention to expand upon its custom chip business.

Undoubtedly, Intel has felt the pinch as tech innovators gravitated towards making their own chips. As Intel works to bolster its foundry and trim costs in the longer term, I do believe the company is moving on the right track. Arguably, its recovery trajectory seems much more promising after last week’s positive bits of news.

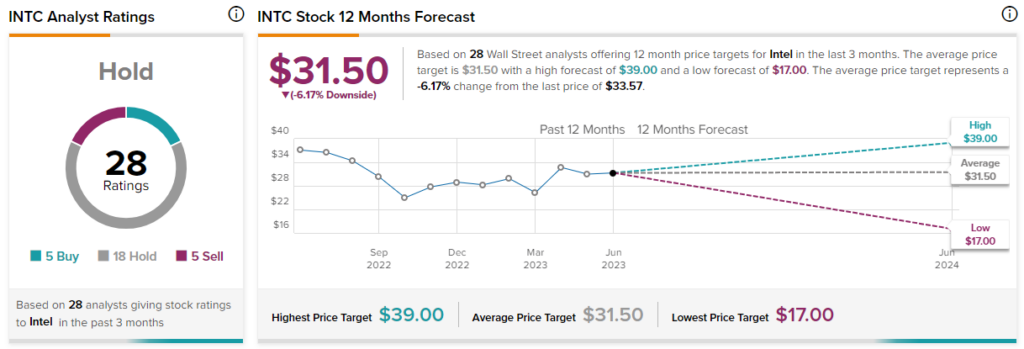

In any case, Intel is a stock that’s so unloved that it’d fall anyway. With only five out of 28 analysts recommending the name as a Buy, very few want to put their necks out with the name right here. At least until the company can give us more evidence that it can close the gap.

If it does, though, the stock may have already gained considerable ground by then. As such, I’m not against nibbling into a small position here if you’re a deep-value investor who has faith in Intel’s managers.

What is the Price Target for INTC Stock?

Intel’s a Hold, with five Buys, 18 Holds, and five Sells assigned in the past three months. The average INTC stock price target of $31.50 implies 6.2% downside potential.

AMD (NASDAQ:AMD)

AMD has the wind at its back, dethroning Intel and leaving it behind as it continues its impressive advance into new frontiers. Investors want to hear about AI, and that’s precisely what they’ve been getting from AMD lately. As AMD continues powering forward, it’s becoming increasingly difficult to find reasons to sell the name. Therefore, despite the stock’s hot run, I remain bullish.

Intel stock is still down more than 50% from its high. Meanwhile, AMD stock has doubled from its October lows and is off just over 30% from its highs. The company’s latest AI chip reveal has been met with intrigue and could help take AMD stock right past its all-time highs.

Undoubtedly, AMD isn’t just a CPU play; it’s also a top player in GPUs. The company’s latest MI300X AI chip will be ready to ship to some later in the year. At this juncture, it’s hard not to imagine AMD as the next Nvidia (NASDAQ:NVDA).

Demand for AI chips has been unprecedented, and I do view AMD as a worthy rival for Nvidia, the red-hot chip stock that many analysts can’t seem to get enough of. Only time will tell how AMD’s offering stacks up. Regardless, Morgan Stanley (NYSE:MS) views AMD stock as a top pick with near-term AI upside. I’m inclined to agree. AMD stock looks timely, with a modest 38.3 times forward earnings multiple that’s far lower than that of Nvidia (53.9 times).

What is the Price Target for AMD Stock?

AMD comes in at a Moderate Buy, with 21 Buys and eight Holds assigned in the past three months. The average AMD stock price target of $134.31 implies a 21.9% gain from here.

Better Buy: INTC vs. AMD Stock

All things considered, I have to go with the analysts on this one. AMD has the wind at its back, with hot, new AI chip innovations in a market that continues to pound the table on all things AI.