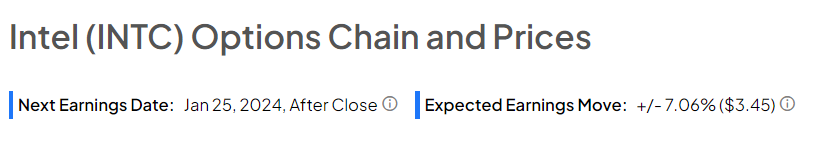

Semiconductor giant Intel (NASDAQ:INTC) is set to release its fourth quarter Fiscal 2023 results on January 25, after the market closes. The company’s quarterly performance might have benefited from the ongoing recovery in PC sales, rising demand for AI chips, and the ramp-up of its foundry capabilities.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The stock has jumped nearly 67% in the past year. Moreover, the stock outperformed the tech-heavy Nasdaq 100 Index (NDX) rally of about 47% in one year.

INTC – Q4 Expectations

Currently, analysts expect revenue to rise by 8% from the year-ago quarter to $15.16 billion. Also, Intel is expected to post earnings of $0.45 per share in Q4 compared with $0.1 per share reported in the prior- -year period.

INTC is expected to have witnessed a rise in orders for its processors and microprocessors, driven by a recovery in demand for PCs. Furthermore, revenues in the Client Computing Group (CCG) segment are expected to have increased due to new product introductions.

Analysts’ Ratings

Ahead of the Q4 results, 5-star Wedbush analyst Matt Bryson raised the price target on Intel stock to $45 (8% downside potential) from $35 while maintaining a Hold rating.

Also, on January 22, another Top-rated analyst, Aaron Rakers from Wells Fargo, reiterated a Hold rating on the stock. Rakers believes that higher revenue from the CCG unit should drive the company’s top-line numbers.

What is the Price Target for Intel?

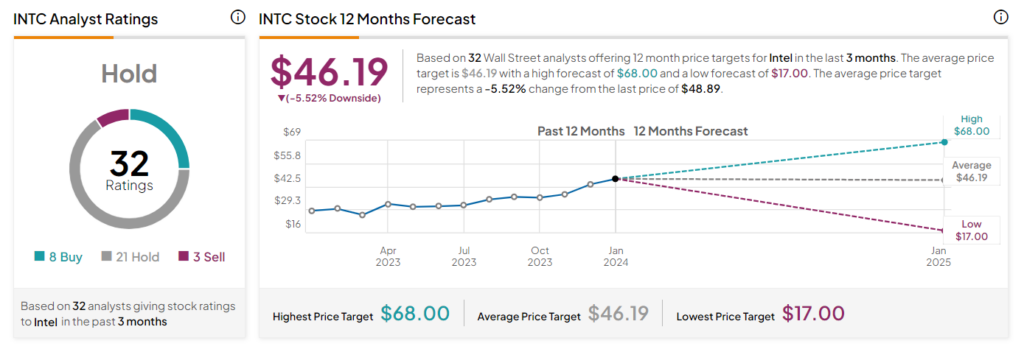

In the past week, Intel received one Buy, six Hold, and one Sell rating from analysts. Overall, Intel stock has a Hold consensus rating based on eight Buys, 21 Holds, and three Sell ratings. The average price target of $46.19 implies 5.5% downside potential from current levels.

Insights from Options Trading Activity

While analysts are sidelined about INTC stock, options traders are pricing in a +/- 7.06% move on earnings, smaller than the previous quarter’s earnings-related move of -9.3%.

Learn more about TipRanks’ Options tool here.

Bottom Line

Intel’s focus on increasing AI adoption, efforts to introduce new products, and recovery in PC sales keep the company well poised for long-term growth. However, the analysts see limited upside potential in the stock after a recent share price rally.