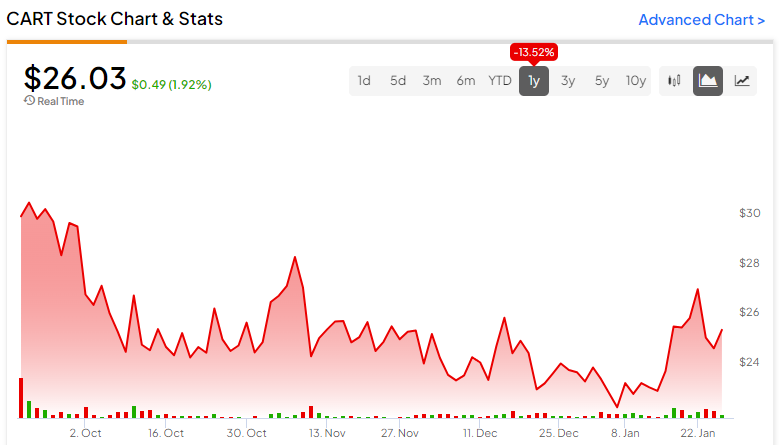

Maplebear Inc. (NASDAQ:CART), commonly known as Instacart, hasn’t seen its stock perform well since going public in September. However, it looks like investors are missing the big picture. Instacart operates an online grocery delivery platform, and online grocery shopping is a growing industry in which Instacart is a major player (CART generated $3 billion in revenue in the past year). It’s a sound business that is growing, undervalued, and cash-flow positive. Thus, we’re bullish on CART stock.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

How Does Instacart Make Money?

Instacart makes money through delivery fees charged to customers, a subscription model offering free deliveries, and partnership fees from grocers. The company also generates significant revenue from in-app advertising, where brands pay to promote their products.

All a customer has to do is download the app and order the groceries they desire. The business model seems to be working well, as Instacart generates plenty of cash flow, which we’ll discuss below.

Instacart’s $2B Loss Doesn’t Tell the Full Story; Cash Flow Does

One thing investors may be concerned about is Instacart’s wide net loss in its most recent quarter. Specifically, the company reported a GAAP net loss of $2 billion for the quarter — a huge loss when looking at its market cap of $7.3 billion. Many investors would just stop right there and not consider the company. However, that net loss doesn’t tell the full story. Free cash flow is a better metric to consider in this case.

Why? Because CART’s $2 billion net loss was mainly due to a large $2.6 billion stock-based compensation (SBC) expense, and free cash flow adjusts for that expense. Yes, SBC is a real expense because issuing more shares dilutes shareholders. Still, the company recently went public, and a company will often issue equity awards related to the IPO. Put simply, the $2.6 billion expense, which caused the $2 billion net loss, is essentially a one-time charge due to the IPO.

Therefore, we think SBC is likely to come down to more reasonable levels from here, which will make GAAP income look much better next quarter. If you take a look at operating cash flow (OCF) and free cash flow (FCF) compared to net income, you’ll see a stark difference.

OCF came in at $111 million in the quarter, while FCF was $95 million, showing that the company is capable of generating cash flow. Notably, FCF is expected to come in at $577.3 million this year and $686.2 million in 2025. Meanwhile, in the last 12 months, this figure comes in at $361 million.

Instacart Looks Undervalued Relative to Its Growth Potential

Using the free cash flow figures stated above, it’s clear that Instacart is not trading at a sky-high multiple. Based on its market cap of $7.3 billion, its free cash flow multiple is around 20x. Its forward multiples for 2024 and 2025 drop to 12.7x and 10.6x, respectively.

Put simply, in 2025, it’s likely that you will be seeing a free cash flow yield of 9.4% if you buy at today’s price. For a company that is still growing (7.7-8.2% revenue growth expected for the next two years, with earnings expected to grow at a faster rate), this looks like a good valuation.

Revenue growth may even come in higher than those expectations. That’s because, by 2024, the North American grocery delivery market is expected to reach $270.60 billion, growing annually by 13.29% to hit $445.8 billion by 2028, according to Statista.

Two Key Risks to Consider

Earlier, we discussed how SBC is likely to come down to reasonable levels from here. However, there’s always the risk that this expense doesn’t come down enough. If it stays high, then the investment thesis would have to be tweaked a bit. This is definitely something that investors want to monitor in the company’s next earnings call, which is scheduled for February 13. We will be looking for a large drop in SBC as well as any possible commentary from management about the topic.

Regardless, any shareholder dilution can be offset via share buybacks, as the company has no debt and $2.07 billion in cash to use for future buybacks (not including $75 million worth of restricted cash and equivalents). Notably, CART already has a $500 million buyback plan in place.

Another risk to consider is the lock-up period termination. Instacart’s lock-up period will end on February 15. This means that those who received shares as part of the company’s IPO will be able to sell their shares starting from that date. Benchmark Co. analyst Mark Zgutowicz says that this will lead to an imbalance in supply and demand. Nonetheless, while this is true and may have an effect on the stock price, it doesn’t affect the company’s results and shouldn’t be a concern for long-term investors.

Is CART Stock a Buy, According to Analysts?

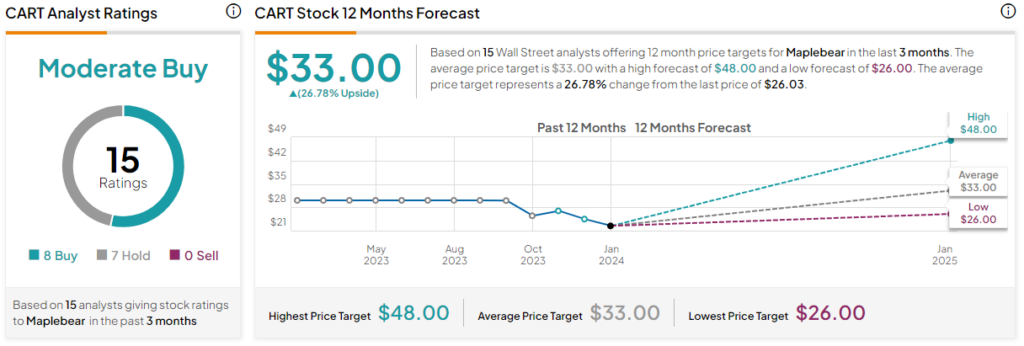

On TipRanks, CART comes in as a Moderate Buy based on eight Buys, seven Holds, and zero Sell ratings assigned in the past three months. The average CART stock price target of $33.00 implies 26.8% upside potential.

The Takeaway

While many investors dismiss Instacart due to its large loss in the most recent quarter, they need to look deeper to not miss the big picture. Instacart is a leader in a growing market, and the company is able to generate ample cash flows. Stock-based compensation and the lock-up period termination are two risks to consider, but these risks look priced in based on the company’s low valuation, especially when factoring in its large cash position. Overall, the pros seem to outweigh the cons.