It seems like everybody and their uncles are talking about the Instacart/Maplebear (NASDAQ:CART) IPO. However, I’m not too eager to add this fast-moving stock to my holdings, and I don’t expect the stock to generate any quick or “insta-profits” for investors yet. I am neutral on CART stock until investors and analysts determine an appropriate price for it and because of fierce competition from an established rival.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Instacart (also known as Maplebear) bills itself as the “leading grocery technology company in North America” (though, as we’ll discuss in a moment, there’s a competitor that would probably dispute that claim). The Instacart app enables customers to order items from local grocery stores and get them delivered.

The company just had its IPO on September 18, and financial traders are buzzing about Instacart. Naturally, the company benefited from the COVID-19 lockdowns since they prompted many people to order groceries online for home delivery. Nevertheless, investors should learn all of the pertinent facts before jumping into the trade with CART stock. And in my opinion, the best move right now is no move at all.

Instacart’s Wild Market Debut

Here’s the rundown. Instacart stock debuted for trading two days ago at a public offering price of $30 per share. Interestingly, at around the same time, Instacart co-founder Apoorva Mehta stepped down as chairman of the company.

Is that a bad sign? Not necessarily, as Mehta still sees a significant opportunity for Instacart. “The grocery industry is a $1 trillion business, which is very complex and underpenetrated by e-commerce,” Metha observed.

Suffice it to say that CART stock was a fast mover on its first day of public trading. On Tuesday, Instacart stock opened for trading at $42 but then retraced and ended up closing the day at $33.70.

Today, the stock closed at $30.10. Like many recent IPO stocks, I suspect that Instacart stock will remain volatile for a while. That’s the main reason I’m neutral on the stock. It takes some time for the market to achieve “price discovery,” or the process of figuring out an appropriate price for an asset.

To be honest, I’m also concerned that the COVID-19 catalyst has already come and gone for Instacart. Maybe I would have been more bullish if the company had its IPO in 2020 or 2021. Granted, there’s been talk of a recent spike in COVID-19 infections, but for the most part, the main window of opportunity for Instacart is in the rear-view mirror.

Not Enough Analyst Coverage on CART Stock Yet

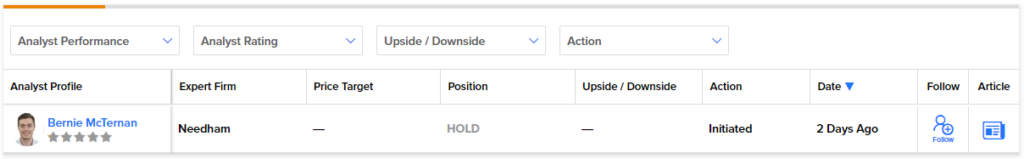

Here’s another reason why I’m neutral on CART stock. I like to hear the opinions and forecasts of Wall Street experts regarding my favorite stocks. However, TipRanks currently observes that there’s only one prominent analyst covering Instacart stock.

That analyst is Needham’s Bernie McTernan, and he only gave Instacart stock a Hold rating (with no price target), which isn’t ultra enthusiastic. Apparently, a primary consideration is the anticipated slowdown in growth following a surge in pandemic-induced demand. This is similar to the post-COVID-19 concern for Instacart that I referred to earlier.

Reportedly, online grocery sales in the U.S. escalated at a nearly 60% compound annual growth rate (CAGR) from 2019 to 2022. Investors shouldn’t expect that trajectory to persist, though. The next three years are predicted to be tougher than the previous three in terms of growth. Hence, this might not be the ideal time to invest in Instacart.

Along with all of that, prospective investors should weigh the intense competition from rival grocery deliverers, such as Uber Technologies (NYSE:UBER) and DoorDash (NYSE:DASH). Also, unlike Instacart, Uber and DoorDash have plenty of established analyst ratings.

Notably, right before Instacart’s IPO, DoorDash announced that it had expanded its list of grocery partners (i.e., the grocery stores for which DoorDash delivers groceries). Thus, DoorDash poses a competitive threat in the grocery delivery app space and could take market share from Instacart.

Conclusion: Should You Consider CART Stock?

Jumping headfirst into a brand-new IPO is a risky proposition. The first few weeks are likely to be volatile for a new IPO stock. That, along with the lack of significant analyst coverage, is a good reason to stay out of the trade with Instacart stock for a while.

Besides, Instacart faces strong competition and won’t benefit from COVID-19 lockdowns like it did in 2020 and 2021. Consequently, even if you’re excited about the company’s buzzworthy IPO, I still don’t believe it’s the right time to consider CART stock.