Leading grocery technology company Instacart (NASDAQ:CART) delivered stronger-than-expected Q3 sales. However, the macroeconomic headwinds, such as high interest rates coupled with less government aid, continue to pose challenges for the company. In light of the near-term headwinds, investors should be cautious about CART stock.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

CART – Q3 Performance and Q4 Outlook

Coming back to its Q3 performance, the grocery delivery company reported revenue of $764 million, up 14% year-over-year. Moreover, its top line exceeded the Street’s projection of $737 million. Instacart’s GTV (Gross Transaction Value) grew to $7.49 billion, up 6% year-over-year. Further, the strong performance of its advertising business and focus on driving fulfillment efficiencies supported its top-line growth and adjusted EBITDA, which jumped about 120% year-over-year.

Instacart reported a GAAP net loss of about $2 billion, or $20.86 a share, in the third quarter, reflecting higher stock-based compensation during its IPO. Nonetheless, the company expects its GTV to grow by 5-6% in Q4. Further, the adjusted EBITDA is projected to mark year-over-year sequential improvement during the fourth quarter, reflecting higher advertising revenue.

With this backdrop, let’s look at the Street’s forecast for CART stock.

What is the Outlook for Instacart?

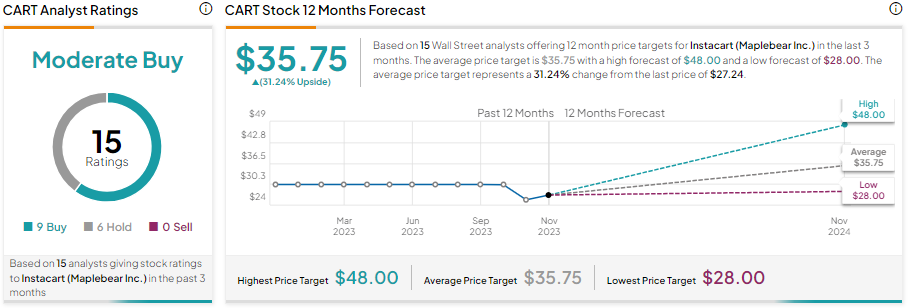

Instacart faces near-term macro headwinds, so Wall Street analysts are cautiously optimistic about its prospects. While the stock trades below its IPO price, it sports a Moderate Buy consensus rating, reflecting nine Buy and six Hold recommendations.

Given the recent decline, the average CART stock price target of $35.75 implies 31.24% upside potential from current levels.

Bottom Line

Instacart is the leader in the grocery pickup and delivery space and is expected to benefit from the growing adoption of online grocery. The company’s large scale, partnerships with 1,400 retail banners, focus on driving fulfillment efficiencies, and growing advertising revenue bode well for long-term growth. However, the macro challenges hurting consumer spending remain a short-term drag.