Savvy investors will always be looking to pick up shares of undervalued stocks. That is, after all, the essence behind the slogan ‘buy low, sell high.’ The problem, though, lies in determining which stocks are merely temporarily languishing in the doldrums and are primed to pick up steam, rather than indicating that their depressed prices are just not worth the time of day.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Of course, there are many ways to assess that scenario, and one simple strategy is to examine the actions taken by insiders. These corporate officers operate ‘on the inside’ and possess knowledge not accessible to the casual investor. Once they are seen picking up stock of the companies they work for, especially in bulk, it conveys a message that they may consider the shares to be undervalued.

With this in mind, we’ve opened up TipRanks’ Insiders’ Hot Stocks tool to find two stocks that fit a certain profile: equities that have been on the backfoot this month, but insiders have been loading up by the truckload – that is, they’ve been pouring millions into them recently. In fact, according to some Wall Street analysts, these names might just be ready to bounce back.

EVgo, Inc. (EVGO)

We’ll start in the EV sector, or specifically, EV charging, with a look at a leader in the space. EVgo runs the U.S.’s largest public fast charging network for EVs, boasting north of 850 fast charging locations. These serve more than 60 metropolitan areas spread over 30 states, all powered by 100% renewable energy.

The comprehensive charging infrastructure includes strategically located fast and ultra-fast chargers at convenient places such as shopping centers, grocery stores, and public parking areas. Through its mobile app, drivers can easily locate and initiate charging sessions, monitor the charging progress, and even pay for the services. EVgo’s charging stations are compatible with various EV models, making them accessible to a wide range of electric vehicle owners.

With the increasing adoption of EVs in the upcoming years, the company is poised to capitalize on this trend. However, despite these positive prospects, the company’s recent performance has been pretty abysmal, with a 38% decline in May.

This decline can be attributed primarily to two factors. Firstly, the company’s Q1 results fell short of expectations. Although the revenue surged by an impressive 228.6% year-over-year, reaching $25.3 million, it fell $1.45 million below consensus estimates. Furthermore, the company’s projected 2023 revenue, ranging between $105 million and $150 million, fell below the analysts’ expectation of $138.76 million. Secondly, the company exacerbated the situation by announcing a public offering of $125 million of Class A common stock, which triggered a subsequent sell-off.

EVgo’s share decline did not seem to concern the company’s Chairman David Nanus. In response to the decline, Nanus took action last week by loading up on 5,882,352 shares of EVGO, which are now valued at $21.76 million.

That act probably chimes well with Evercore’s James West. The analyst believes the company is primed to ride the EV boom, and writes: “As a pure play on owner-operated public DCFC charging and charging as a service, EVGO is well positioned to benefit from the rapid growth underway in public EV Charging with its leverage to the mega-theme of the electrification of mobility… The company uses proprietary algorithms that analyze census and other data sources to pinpoint premium and convenient charging station locations that meet the company’s high return hurdle rates.”

How does this translate to investors? West rates EVGO an Outperform (i.e. Buy), backed by a $12 price target. Should the figure be met, investors will be sitting on returns of a hefty 224% a year from now. (To watch West’s track record, click here)

Turning now to the rest of the Street, where the stock garners an additional 3 Buys and Holds, each, plus 1 Sell, for a Moderate Buy consensus rating. Going by the $8 average price target, the stock will post gains of ~116% over the next 12 months. (See EVGO stock forecast)

Insulet Corporation (PODD)

Let’s now pivot from EVs to healthcare and focus on Insulet, a leading medical device maker that specializes in the development and manufacturing of innovative systems for insulin delivery.

The firm’s main focal point is its Omnipod insulin delivery system, which received FDA approval in January 2005. More recently, in January 2022, the FDA gave the all-clear for the Omnipod 5, an automated insulin delivery system that works without the need to attach plastic tubing to the body and can be fully controlled by a smartphone app.

The product was launched in the United States in August last year and helped the company beat the forecasts in the recently reported Q1 statement. Revenue reached $358.1 million, amounting to a 21.2% year-over-year increase and outpacing consensus by $27.89 million. At the other end, EPS of $0.23 came in well ahead of the $0.10 expected by the analysts. And for the full year, the company increased its revenue growth expectations from the prior range of 14% to 19% to between 18% and 22%.

Investors liked the results and pushed shares higher in the aftermath of the report’s release. However, the stock has retreated since (in total, down by 14% in May), and not aided by the recent news of rival Medtronic’ agreement to acquire EOFlow, a South Korean maker of wearable insulin patches.

Meanwhile, one exec must be confident the company is up to the challenge of its competitor. Director Michael Minogue scooped up 3,300 shares recently, spending over $1 million on the purchase.

The company also gets the backing of Canaccord analyst Kyle Rose, who writes: “There’s A LOT to like here, and we believe the fundamental thesis remains intact, reinforced by O5 momentum, the longer-term outlook for T2-specific products, and IP initiatives. That said, we expect continued pressure on GMs as O5 becomes a greater percentage of sales (and carries negative mix until at scale), as PODD sells through built-up inventory accumulated at high component costs, and as macro headwinds remain. We continue to believe the combination of the pharmacy channel, recurring revenue model, and T2 patient interest positions PODD with a ‘floor’ for growth.”

“We believe the launch of O5 fills any perceived competitive gap vs. existing AP/HCL pumps and will magnify the competitive advantage of the pharmacy channel and the benefits of the no-risk, pay-as-you-go model, which should support sustained upside to consensus growth expectations,” the 5-star analyst went on to add.

These comments underpin Rose’s Buy rating while his $355 price target implies 12-month share appreciation of 30%. (To watch Rose’s track record, click here)

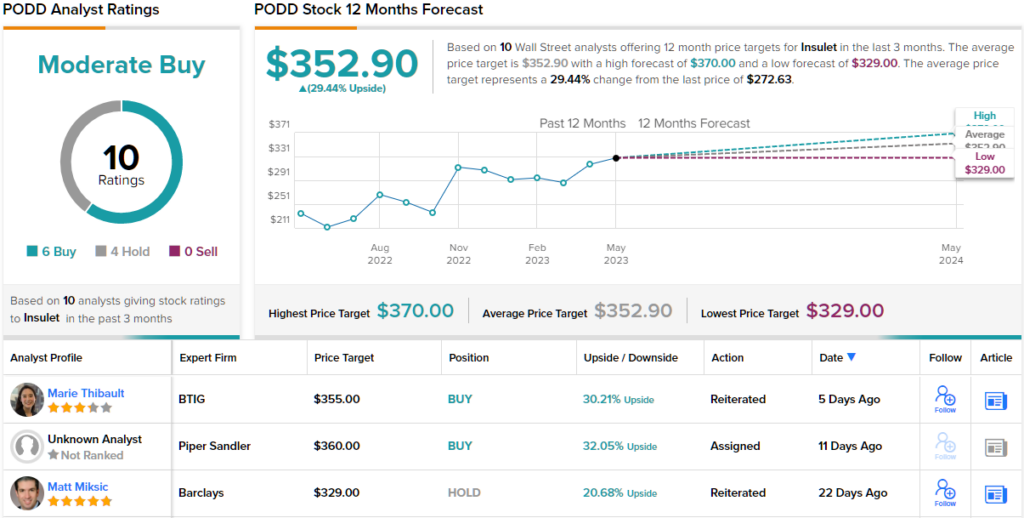

So, that’s Canaccord’s view, how does the rest of the Street see the next 12 months panning out for Insulet? Based on 6 Buys and 4 Holds, the analyst consensus rates the stock a Moderate Buy. At $352.9, the average target represents potential upside of 29%. (See Insulet stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.