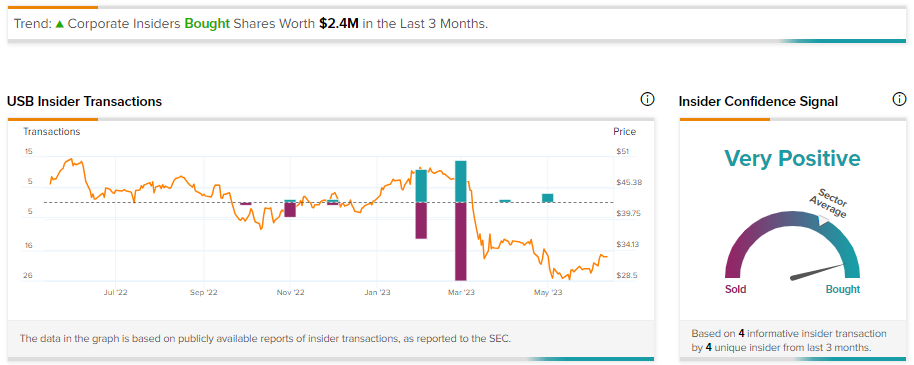

The failure of three regional banks and concerns over deposit outflows have put the entire banking sector in a tight spot. Given investors’ negative sentiments, shares of U.S. Bancorp (NYSE:USB), the parent company of U.S. Bank, fell nearly 27% in the last three months. While investors reduced their exposure to USB, Corporate Insiders have capitalized on its low prices and increased their holdings, according to our Insiders Trading Activity tool.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Per the data, three insiders, including its vice chair Jim Kelligrew and two directors, made three Buy transactions in USB stock last month. Overall, corporate Insiders bought USB shares worth $2.4M in the past three months.

These transactions came in the form of an Informative Buy, suggesting that insiders used their own money to buy shares. This is important as it highlights insiders’ confidence in the company’s prospects.

While USB stock fell following the recent turmoil in the banking sector, it delivered solid first-quarter financials. Its average loans and deposits improved both on a year-over-year and quarterly basis. Furthermore, its management highlighted that its deposit balances have remained stable despite the chaos in the banking space.

Interestingly, TipRanks offers daily insider transactions as well as a list of top corporate insiders. It also provides a list of hot stocks that boast either a Very Positive or Positive insider confidence signal.

While USB stock has a positive signal from insiders, let’s check what Street recommends for the stock.

Is USB Stock a Good Buy?

USB’s diversified loan portfolio, solid credit quality, and high-quality deposit base (insured deposits accounting for 51% of total deposits) augur well for future growth. However, the macro uncertainty is keeping analysts cautiously optimistic about the stock.

USB stock sports a Moderate Buy consensus rating on TipRanks, reflecting 10 Buy and nine Hold recommendations. Further, these analysts’ average price target of $44.31 implies a solid upside potential of 34.84%.