When it comes to reading market signals, insider trading activity often provides one of the clearest clues. These transactions – made by corporate executives and board members and required to be made public – can offer valuable insight into how those closest to a company view its prospects.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

As senior decision-makers, insiders have a deep understanding of their companies’ financial performance, strategic direction, and potential headwinds and their actions can reflect informed confidence, or caution, about the company’s future.

Importantly, insiders sell stock for many reasons – taxes, diversification, or personal liquidity needs – but they typically buy only when they believe the stock is undervalued and poised to rise.

That makes insider buying especially noteworthy in today’s volatile market, where shifting sentiment and economic uncertainty are sending mixed signals. When executives collectively commit millions of dollars to their own shares, investors have good reason to pay attention.

With that in mind, we used TipRanks’ Insiders’ Hot Stocks tool to pinpoint two stocks that stand out for both their substantial insider purchases and their positive analyst ratings. Let’s take a closer look.

Kinder Morgan (KMI)

The first insider trades we’ll look at are from Kinder Morgan, one of the leading energy infrastructure and hydrocarbon midstream companies in North America. The company was founded in 1997, in the Gulf Coast energy hub of Houston, Texas, and today is a $57.5 billion giant of the industry. Kinder Morgan’s asset network – which includes processing, pipeline, terminal, and storage facilities for crude oil, natural gas, and even CO2 – extends along the Gulf Coast and Florida, across the Southwest and Southeast regions, and into the Great Lakes and along both the East and West Coasts.

Some numbers will show the full scale of the company’s operations. Kinder Morgan boasts some 66,000 miles of natural gas pipelines, and has 704 billion cubic feet of natural gas storage capacity. The company’s enhanced oil recovery (EOR) operations produce approximately 37,000 barrels of oil per day, along with 17,000 barrels of natural gas liquids. Outside of gas and oil, Kinder Morgan has 9,500 miles of product pipelines, and can transport 2.4 million barrels of liquid products per day. In all, Kinder Morgan operates approximately 79,000 miles of pipelines, has 139 terminal facilities, and its pipelines move approximately 40% of all the natural gas produced in the US.

All of this puts Kinder Morgan in the top tier of the energy sector. It may not be a household name, but millions of households depend on Kinder Morgan’s activities. Return-minded investors will also benefit from the company’s reliable dividend, with a payment history stretching back well over a decade and a current forward yield of 4.5%.

Turning to the insider action, we find that Kinder Morgan’s Executive Chairman – and one of the company’s founders – Richard Kinder picked up an additional 1 million shares at the end of October. This stock purchase cost just under $26 million, and Kinder’s current stake in the company now stands at $6.67 billion.

In the company’s last set of financial results, released on October 22 for 3Q25, Kinder Morgan showed quarterly revenue of $4.15 billion. This was up 12.5% from the prior-year quarter, and it was $190 million better than had been anticipated. The company’s bottom line in the quarter, the non-GAAP EPS, came to 29 cents. While this was up 16% year-over-year, it missed the forecast by a penny.

The shares dropped in the aftermath of the Q3 results, but Goldman Sachs analyst John Mackay explains why now is a sound buying opportunity for investors. Following the readout, he wrote, “Results came in-line with GSe and consensus, but stronger gas results were a positive relative to underperformance from the lower-multiple RNG business. The latter drove a slight downward revision to 2025 EBITDA commentary as well… Details were admittedly lighter, and management continues to highlight strong competition, though we continue to expect strong conversion into the formal backlog over the coming months and quarters. With project momentum thus likely to pick up again, we see the recent pullback as a compelling entry point for the stock.”

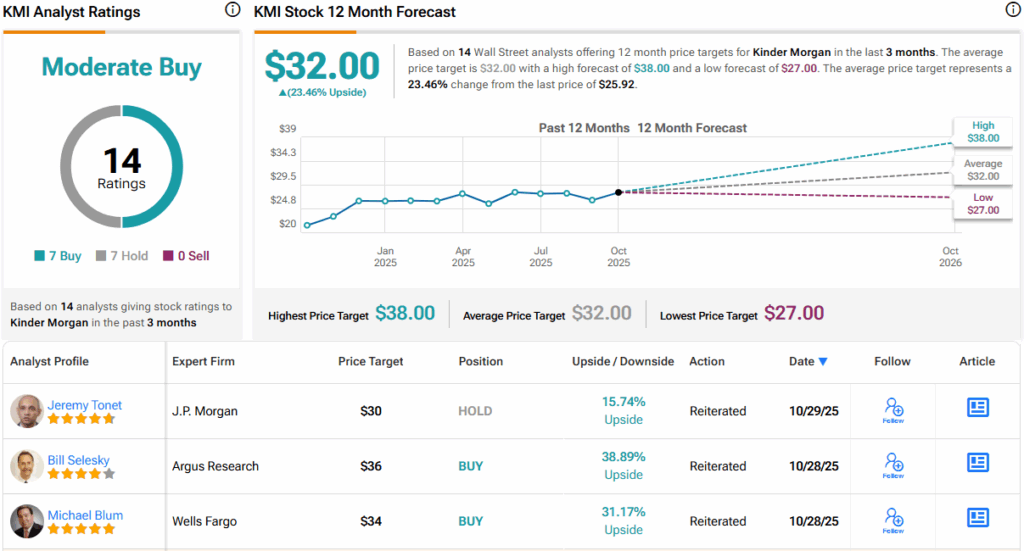

Mackay’s comments back up his Buy rating on KMI, while his $31 price target points toward a one-year upside potential of 20%. (To watch Mackay’s track record, click here)

Overall, Kinder Morgan’s stock holds a Moderate Buy consensus rating from the Street’s analysts, based on 14 recent reviews that split evenly between 7 Buys and 7 Holds. The stock is currently priced at $25.92 and its $32 average price target is slightly more bullish than the Goldman view, implying a 23.5% gain over the next 12 months. (See KMI stock forecast)

Amrize, Ltd. (AMRZ)

Next up on our list today is Amrize, a long-term player in North America’s building industry. Amrize is known as a producer and distributor of construction materials, including such essentials as cement, aggregates, concrete, and asphalt. The company describes itself as ‘the partner of choice’ in the industry and notes that, as the US and Canada must work to modernize urban and transport infrastructure, business is looking up.

In addition to its leading role in supplying building materials, Amrize also boasts a strong, coast-to-coast network of logistics and distribution facilities. The company’s network, with more than 1,000 locations, has access to road, rail, and river transport systems, allowing for timely delivery in a business where time is money.

Amrize has only recently entered the US stock markets through a 100% spin-off transaction from the Swiss firm Holcim. The transaction, which was completed on June 23, saw Amrize enter the US markets under the AMRZ ticker. Holcim conducted a dividend-in-kind distribution of one share of AMRZ for each of its own shares. AMRZ currently has a market cap valuation of ~$28.2 billion.

The newly public firm has released two quarterly earnings reports since its entry into the stock markets. In the most recent, covering 3Q25, the company’s revenue came to $3.67 billion, for a 6.6% year-over-year increase and beating the forecast by $190 million. The company’s EPS figure of 98 cents was down 2% year-over-year and missed expectations by 4 cents per share. In a metric that bears watching, Amrize generated $674 million in quarterly free cash flow, $221 million more than in the prior-year quarter.

On the insider front, we find that Amrize’s Chairman and CEO, Jan Philipp Jenisch, in late October spent nearly $6 million buying two blocks of AMRZ stock, each of 55,000 shares. In a second buy, Amrize’s Chief Technology Officer Roald Brouwer spent $207,100 to pick up 4,000 shares. Jenisch now controls $102.75 million worth of Amrize shares, while Brouwer’s stake in Amrize stands at slightly more than $460,000.

Oppenheimer analyst Bryan Blair, in his coverage of AMRZ, takes an upbeat position, saying of the company, “We appreciate Amrize’s advantaged footprint and resource base, structural pricing power, and robust/sustainable margin generation—together positioning the franchise to leverage stronger North American construction demand in 2026 and beyond. Adding solid FCF generation and capital deployment optionality (with an already-proven M&A strategy), we like AMRZ prospects for double-digit earnings growth through the cycle. Given that setup and supportive trading multiples (on pressured 2025 numbers, sub-11x EV/EBITDA), we believe our initial modeling and valuation rationale lean conservative.”

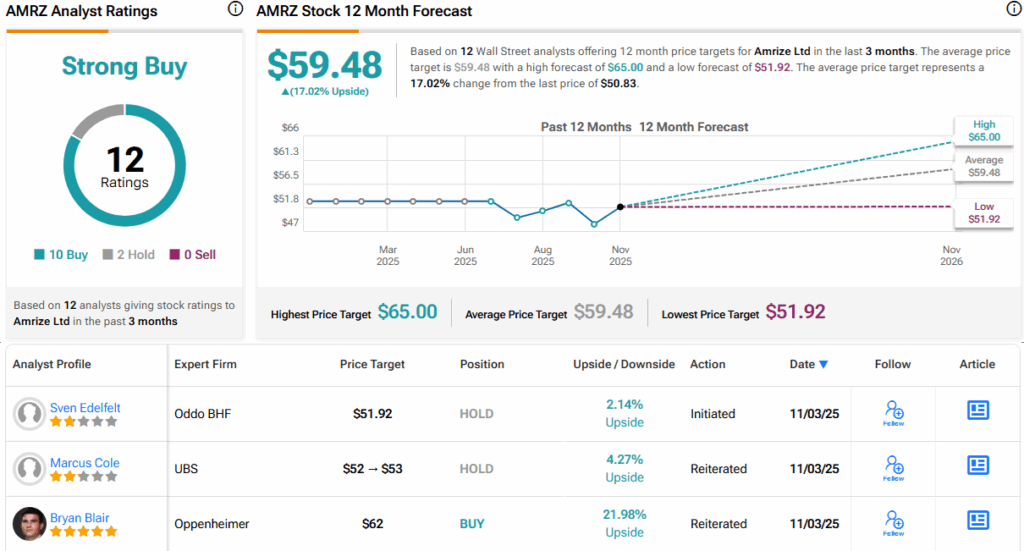

Blair quantifies his stance here with an Outperform (i.e., Buy) rating, and he complements that with a $62 price target, implying an upside of 22% on the one-year horizon. (To watch Blair’s track record, click here)

The 12 recent reviews on record for Amrize include 10 Buys and 2 Holds, for a Strong Buy consensus rating. The stock’s $50.83 trading price and $59.48 average price target together suggest a potential one-year upside of 17%. (See AMRZ stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.