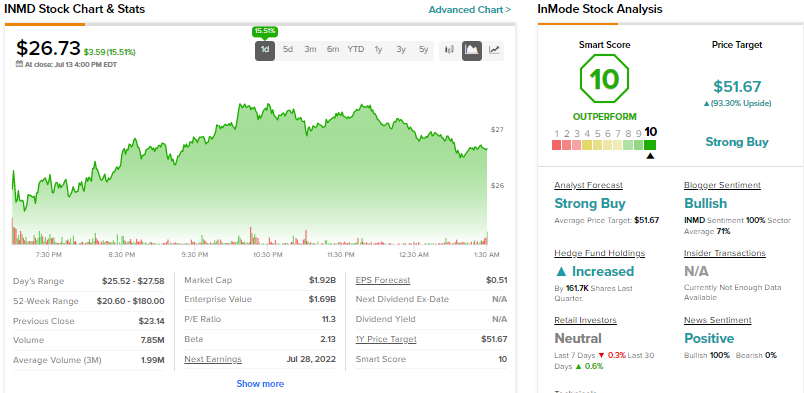

Shares of InMode (NASDAQ: INMD) popped 15.5% on Tuesday to close at $26.73 as the manufacturer of medical devices released its preliminary Q2 results. The upbeat results led to Needham analyst Michael Matson reiterating a Buy on the stock.

Let us look at the reasons behind the analyst’s bullishness on the stock.

INMD stock has performed surprisingly well in the past month, going up 20.7% amid the current market volatility.

InMode expects to release its Q2 results on July 28. In the second quarter, the company expects to generate revenues in the range of $113 million to $113.3 million, while adjusted earnings are anticipated to be between $0.57 and $0.58 per share. INMD has forecasted adjusted gross margin in the second quarter to vary from 83% to 85%.

Moshe Mizrahy, InMode’s CEO commented, “Our record results in the second quarter of 2022 are an indication of the strong demand for our proprietary technologies in the aesthetic surgical field. This positive momentum reinforces our confidence going into the second half of the year, and we are happy to increase our full year guidance range from $415-$425 million to $425-$435 million.”

Analyst Matson Thinks the Outlook is Conservative

Analyst Matson was upbeat about the preliminary Q2 results and commented that these results were “consistent with our channel checks that have indicated that aesthetic patient volumes and spending continue to see strong growth.”

The analyst viewed the raised revenue outlook for FY22 by InMode as “conservative” as he sees “potential for new products (particularly EmpowerRF and EnvisionRF) to drive additional upside during 2022.”

Matson believes that considering the rapid growth of the aesthetics market, InMode was likely to do very well as it has “developed technologies that fill the “treatment gap” between non-invasive and invasive procedures.”

The analyst’s base-case scenario assumes InMode’s revenues to grow at a Compounded Annual Growth Rate (CAGR) between 10% and 15% over the next few years, “driven by stable growth from existing products and expected adoption of new products.”

Matson also pointed out that INMD’s “margins are among the highest in the med tech sector and allow for strong free cash flow.”

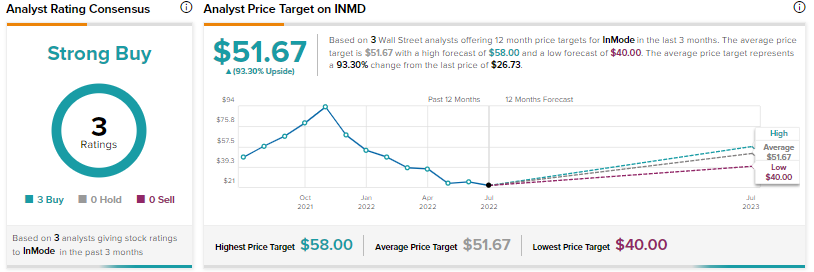

The analyst views the shares as “attractively valued” and has the highest price target of $58 on the Street for InMode. Matson’s price target implies an upside potential of 116.9% at current levels.

Other analysts on the Street are also bullish about InMode and have rated the stock a Strong Buy based on a unanimous three Buys. The average INMD price target of $51.67 implies an upside potential of 93.3% at current levels.

Bottom Line

Currently, INMD shares are trading at a price-to-earnings ratio of 13.6 times, indicating that the shares are indeed attractive at the current valuation. The stock also scores a “Perfect 10” on the TipRanks Smart Score system, indicating that the stock is highly likely to outperform the market.

The TipRanks Smart Score system is a data-driven, quantitative scoring system that analyses stocks on eight major parameters and comes up with a Smart Score ranging from 1 to 10. The higher the score, the more likely the stock will outperform the market.