Over the years, Israel has become increasingly acknowledged as one of the world’s most innovative and rapidly-evolving tech hubs. However, while Isreal is known for exporting products such as sophisticated cybersecurity software, communications devices, and critical parts used in the aerospace & defense industry, its healthcare sector has also been booming lately.

In this article, we are looking at InMode (NASDAQ: INMD), one of Israel’s fastest-growing health-tech companies. At the moment, the company’s investment case is quite enticing because, besides growing rapidly, InMode is also highly profitable. Combined with the fact that InMode’s shares have corrected substantially from last year’s highs, I am bullish on the stock.

What Does InMode Actually Do?

InMode specializes in providing minimally-invasive surgical medical treatment solutions. Specifically, the company is a market leader in the global aesthetics market, with its products being used by physicians to remodel subdermal adipose or fatty tissue, primarily in women.

It’s a niche market, and with the women’s aesthetics-improvement market becoming increasingly popular, InMode is well-positioned to keep growing while capturing a greater chuck of its overall industry share as well. The company’s rapidly-growing revenues and profits certainly prove this.

Phenomenal Growth Momentum

InMode’s growth has sustained incredible momentum, driven by several catalysts. Particularly, InMode’s growth is being pushed by organic growth as its solutions become increasingly popular, a growing number of offerings amid an intense focus on R&D, and a continuous expansion of its distribution network, including acquiring ownership stakes in its own suppliers.

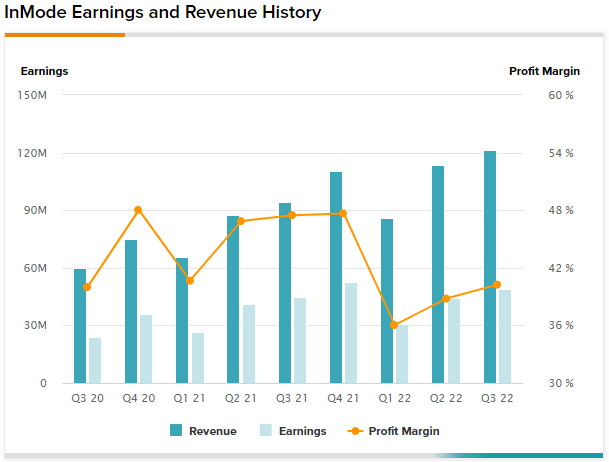

In fact, over the past three years (2018-2021), revenues have grown at a compound annual growth rate of 52.8%. What’s even more impressive, however, is that InMode’s growth momentum has been sustained in its most recent quarters, despite a worsening macroeconomic outlook. With consumers’ purchasing power supposed to decline amid elevated inflation levels, spending on discretionaries like aesthetics improvement should be sloping. Yet, InMode’s most recent results displayed just the contrary.

InMode’s revenues came in at a record quarterly revenue of $121.2 million in Q3, implying a year-over-year increase of 29%. Further, management commented that it sees this positive momentum lasting into Q4, which should contribute to total revenues for the year, landing between $445 million and $450 million. At the midpoint, this implies revenue growth of around 25%, which is very impressive given the current market landscape.

A Cash-Cow Business Model

Medical device companies generally enjoy high margins, but InMode’s are in a league of their own. The company’s gross margins have hovered between 82% and 87% over the past several quarters. How is this being achieved?

Well, InMode essentially outsources almost all of the manufacturing of its products to its prime suppliers, while the company retains ownership of the proprietary manufacturing equipment and its suppliers’ assembly lines. Thus, its operations are very lean and mostly frictionless.

Furthermore, InMode is debt-free, which means that after its operating expenses are dealt with, the rest of its gross profits basically end up directly at the bottom line. Accordingly, net income margins usually hover near 40%, which only a handful of rapidly-growing companies can boast. For context, in its Q3 results, net income and adjusted net income came in at $48.8 million and $56.6 million, implying net margins of 40.2% and 53.3%, which are utterly spectacular numbers.

Massive Cash Position & Low Valuation Should Lead to Heavy Buybacks

As mentioned, InMode is a very cash-generative business due to its highly-profitable, lean business model. With profits stacking up over the past few years and InMode having no debt, its net cash position has gradually grown to $482.7 million. This may not sound like a huge number, but considering the company is valued at just around $3 billion, it actually is.

Speaking of InMode’s valuation, following the stock’s violent correction over the past year and management’s Fiscal 2022 adjusted earnings-per-share outlook of $2.28 and $2.30, its forward P/E ratio is just 15.75x. This is a very cheap multiple, in my view, given InMode’s growth momentum, sky-high margins, market-leading position, and clean balance sheet, and it should encourage the company to aggressively buy back stock. Year to date, InMode has already repurchased $42.6 million worth of stock, and this number should move substantially higher as we advance.

Is INMD a Good Stock to Buy, According to Analysts?

Turning to Wall Street, InMode has a Strong Buy consensus rating based on three unanimous Buys assigned in the past three months. At $53.67, the average InMode stock forecast suggests 48.75% upside potential.

Takeaway: A Compelling Investment Case

Among Israel-based companies, InMode has stood out to me due to its unique qualities, amazing growth, and outstanding profitability prospects. With the stock trading on the cheap and the balance sheet being the healthiest it’s ever been, it may be a good time to consider InMode’s investment case.