Last month, the Federal Reserve implemented its fifth straight interest rate hike this year, and its third consecutive hike at 75 basis points, bringing its key funds rate up to the 3% to 3.25% range. The move showed that the central bank is deadly serious about taking on the stubbornly high inflation that has been plaguing the economy since the middle of 2021.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The Fed’s turn toward an aggressive anti-inflationary policy may not be hard enough, however, as the September data, released this morning, showed the headline consumer price index (CPI) at an annualized rate of 8.2%, slightly lower than August’s 8.3%, but slightly higher than the 8.1% which had been forecast. There’s no good news here, and we should expect the Fed to take further aggressive rate hiking action at the next FOMC meeting on November 1 and 2.

After the data release, the 2-year Treasury bond yield jumped by 16 basis points and hit 4.45%, and the 10-year note once again moved above 4%. These moves portend a shift by investors from stocks toward bonds, to lock in higher yields.

For investors still intent on sticking with stocks, the logical move is find a defensive play that will provide some protection against inflation. Dividend stocks, especially the high-yield payers, are the ‘standard’ move in the defensive playbook, and we’ve used the TipRanks data to look up two that offer yields high enough to give some insulation against inflation. And even better, they both have a ‘Strong Buy’ consensus rating from the wider analyst community. Let’s take a closer look.

Alpine Income Property Trust (PINE)

The first high-yield div payer we’ll look at is Alpine Income Property Trust, a commercial net lease REIT with a focus on retail properties. Alpine’s portfolio is composed of open-air strip malls and stand-alone retail locations, spread across 35 states. The company is headquartered in Florida, where it has 4 properties; the state with the largest number of Alpine properties is Texas, with 25, while Ohio and New York tie for second place, each with 12 properties.

Alpine has a total of 143 properties in its portfolio, a combined 3.3 million square feet of leasable space. The company boasts, justifiably, that it has a 100% occupancy rate. Revenues and earnings have been strong over the past two years, with consistent sequential gains at the top line.

Alpine saw revenues of $11.3 million in 2Q22, the last quarter reported. Earnings spiked in that quarter, to $14.3 million, after coming in at just $304K one year earlier. Alpine had a diluted EPS of $1.05 in 2Q22. Of particular interest to dividend investors, Alpine reported an adjusted funds from operations (AFFO) of $0.47 for 2Q, a 20% increase year-over-year, and more than enough to fully cover the regular stock dividend.

That dividend deserved a closer look. The most recent declaration, made in August, was for 27.5 cents per common share, a modest bump of 1.9% from the previous quarter – but the sixth dividend increase in the past three years. Alpine’s current common share dividend annualizes to $1.10 and gives a yield of 7%, more than triple the average dividend yield in the broader markets, and high enough to be useful as insulation against current inflation.

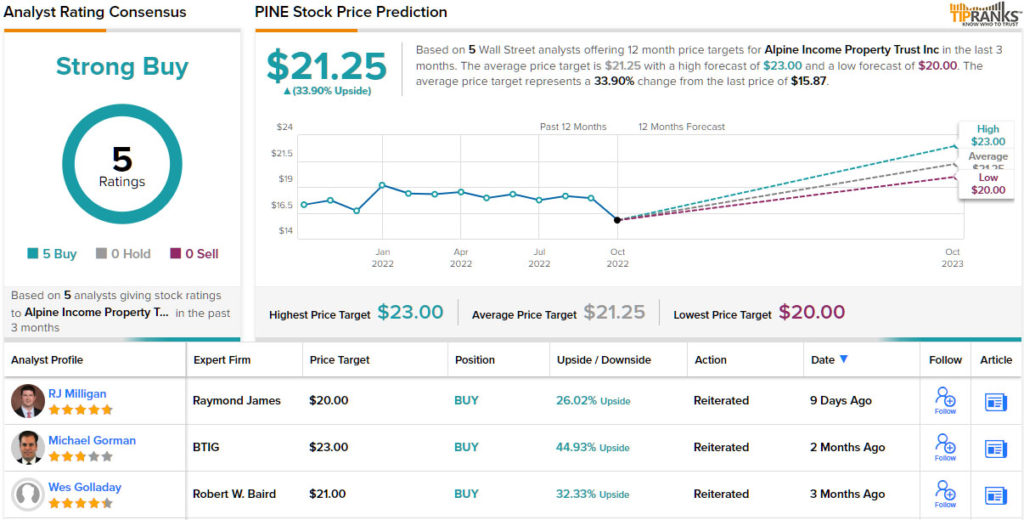

In the eyes of Raymond James analyst RJ Milligan, who holds a 5-star ranking from TipRanks, all of this adds up to a company in a very solid position.

“Investors continue to build positions in more defensive sectors (including net-lease) given concerns about a coming recession, which has helped drive the net lease sector’s YTD outperformance despite spiking rates and high inflation. We expect PINE will continue to benefit from this rotation given its high quality portfolio, discounted valuation, and well-covered dividend,” Milligan opined.

Following from this upbeat stance, Milligan rates PINE shares an Outperform (i.e. Buy), and his price target of $23 implies a one-year upside potential of 44%. (To watch Milligan’s track record, click here)

While this commercial REIT has only picked up 5 recent analyst reviews, those were all positive, testifying to PINE’s underlying strength and attractive qualities – and giving the stock a unanimous Strong Buy consensus rating. The shares are selling for $15.87 and their average price target of $21.25 indicates a potential gain of 33% in the next 12 months. (See PINE stock forecast on TipRanks)

CTO Realty Growth (CTO)

Let’s stick with REITs, a sector known for its dividend champs. CTO Realty Growth is another commercial REIT with income-generating shopping mall and retail investments in 9 states. CTO has 6 properties in its home state of Florida, and 3 each in Georgia and Texas. The bulk of CTO’s assets are in the coastal Southeast or the Southwest, but the company does have a 15% ownership interest in Alpine, the stock discussed above.

In recent weeks, CTO has announced two important developments that have enhanced the company’s liquidity. First was the September 21 notice that the firm had expanded its credit facility to $565 million, and that was followed on September 26 by the announcement that the company had sold off three properties in Jacksonville, Florida for a total of $34.9 million.

Earlier in the summer, CTO reported its results for 2Q22, with fund from operations (FFO) coming in at $1.41 per share for the quarter, up 60% year-over-year, and adjusted FFO growing 38% to reach $1.48 per common share. These results were more than enough to support the dividend, which was declared for Q3 on August 22 and paid out on September 30. The Q3 dividend was raised by a modest 1.8% and paid out at 38 cents per common share. The dividend’s annualized rate of $1.52 gives a yield of 8.6%, which is higher than current inflation numbers and ensures a real rate of return for investors.

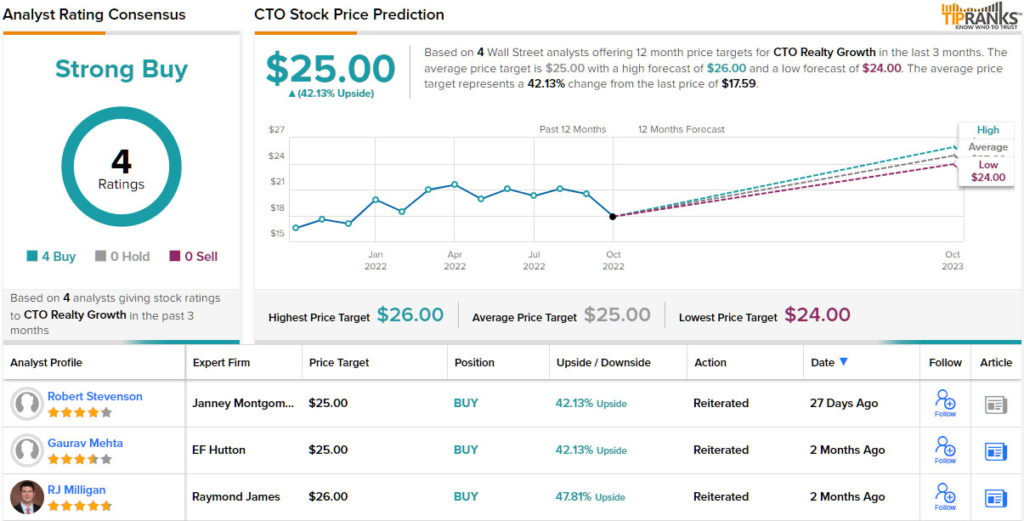

Analyst Robert Stevenson, watching this stock for investment firm Janney Montgomery, is unabashedly bullish on CTO. He says of the company, “Our continued positive view on the stock is based on the company’s assets, high dividend yield, and ability to continue to grow earnings and dividends for shareholders… CTO is one of our favorite yield names within our REIT coverage universe.”

Factoring in a discounted valuation and attractive growth potential, Stevenson rates CTO a Buy, along with a price target of $25. If his price target is achieved, investors could realize a potential total return of ~44% (To watch Stevenson’s track record, click here)

There are 4 recent analyst reviews on file for CTO and they are unanimously positive, to give the stock its Strong Buy analyst consensus rating. The shares are priced at $17.54 and their $25 average target matches Stevenson’s 42% upside forecast. (See CTO stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.