Only a relatively small number of investors enjoyed 2022’s treacherous bear conditions, and one of those was David Einhorn.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

In contrast to the S&P 500’s 19% loss, Einhorn’s hedge fund Greenlight Capital notched returns of 36.6%, in what amounted to the fund’s finest year in a decade.

The value investor’s strategy obviously worked wonders in a year when more risk-flavored stocks got hammered and in a recent note to investors, the fund stated they believe their game plan “has and will continue to achieve attractive absolute and risk-adjusted returns over a long period of time.”

So, while 2023’s opening stretch offered respite from 2022’s woes, with the markets undecided on which way to turn now, Einhorn’s recent winning strategy might be one to follow.

Turning to Einhorn for inspiration, we took a closer look at two stocks Einhorn’s Greenlight made moves on recently. Using TipRanks’ database to find out what the analyst community has to say, we learned that each ticker boasts Buy ratings and solid upside potential.

Global Payments (GPN)

The first Einhorn pick we’ll look at is Global Payments, a fintech leader offering payment technology and software solutions to merchants and businesses across the globe. GPN’s primary aim is to help its clients receive and process payments in an efficient manner. The company operates via three segments – merchant solutions, issuer solutions, and business & consumer solutions – with the services offered to clients in 30 countries across North America, Europe, the Asia-Pacific region and Brazil.

Earlier this month, GPN released Q4 earnings. The results showed revenue climbed by 2% year-over-year to $2.02 billion, meeting Street expectations, as did adj. EPS of $2.42. As for the outlook, for the full year ahead, the company expects adjusted net revenue in the range between $8.575 billion to $8.675 billion, amounting to 6%-7% growth compared to 2022 and above consensus at $8.47 billion.

The company also said it expects to complete the acquisition of peer EVO Payments (for almost $4 billion), and also close the divestiture of Netspend’s consumer business by the end of Q1. GPN has also agreed to sell its Gaming Solutions business to Parthenon Capital Partners for $415 million.

Einhorn must like the look of what’s on offer here. He upped his stake in GPN by 74% during the fourth-quarter with the purchase of 199,910 shares, bringing his total holdings to 473,150 shares. These are now worth over $53 million.

Scanning the print, and the business’ buying and selling activities, Raymond James analyst John Davis thinks the company is making all the right moves.

“Simply put,” Davis writes, “we expect a much cleaner story post the 1Q print, underlying fundamentals remain healthy, and while the deals are dilutive to FY23 EPS (~3% in total), it will result in a higher quality asset. Looking ahead, we see a path to ~$12.20 in FY24 EPS with a return to EPS cycle guidance of 17-20% (15-16% from core + 300 bp from EVO) along with a clean balance sheet to deploy capital (leverage back to ~3.25x by year-end), which was the playbook that drove significant outperformance in the stock pre-pandemic.”

“As such, with the stock trading at sub-10x FY24 EPS we continue to find the risk/reward attractive and recommend investors initiate or add to positions,” the analyst summed up.

Conveying his confidence with an Outperform (i.e., Buy) rating and $160 price target, Davis therefore sees investors pocketing returns of ~41% over the coming year. (To watch Davis’s track record, click here)

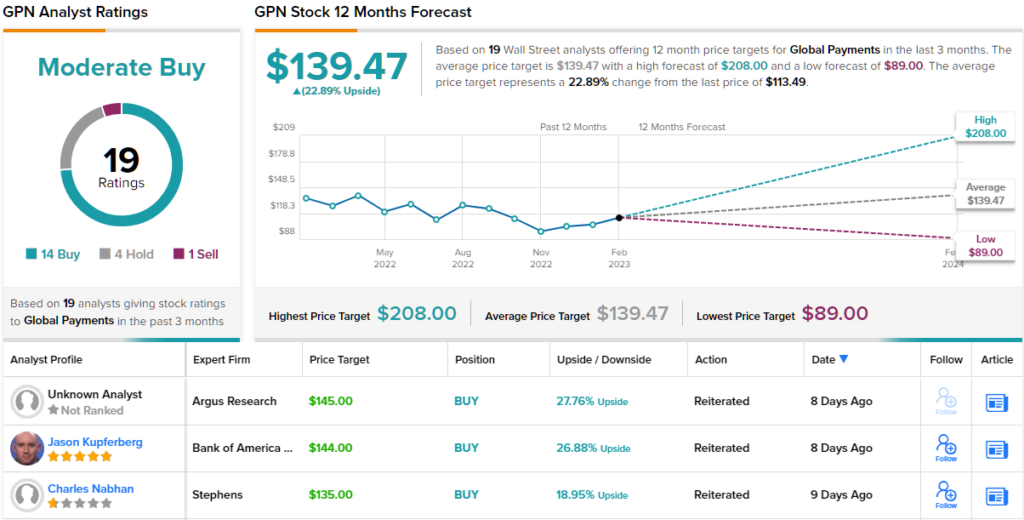

Raymond James is hardly the only firm to come out bullish for GPN; the stock has 13 additional Buys, 4 Holds and 1 Sell for a Moderate Buy consensus rating. At $139.47, the average target makes room for 12-month gains of ~23%. (See GPN stock forecast)

Tenet Healthcare (THC)

Let’s take a sharp turn now for our next Einhorn-backed stock. As the name suggests, Tenet Healthcare is a healthcare services provider. The company oversees 65 hospitals and around 110 outpatient centers and other care facilities. Additionally, United Surgical Partners International, the U.S.’s largest ambulatory platform in the country, which runs or has ownership interests in over 465 ambulatory surgery centers and surgical hospitals, also falls under the Tenet Healthcare umbrella.

Tenet dialed in its Q4 report earlier in February, posting beats on both the top-and bottom-line. At $4.99 billion, revenue climbed 2.7% higher compared to the same period a year ago while edging ahead of the forecasts by $50 million. Adj. EPS of $1.96 conclusively outpaced consensus expectations of $1.23.

For Q1, the company anticipates revenue in the range between $4.7 billion – $4.9 billion and adj. diluted earnings per share of $1.00 – $1.23. The Street had ~$5.0 billion and $1.34, respectively.

The market didn’t seem too bothered about the underwhelming outlook, with shares pushing higher following the Q4 print. Einhorn evidently thinks there’s plenty of value to be found here, too. He opened a new position in THC during Q4, by purchasing 658,900 shares. At the current price, these are now worth north of $39 million.

Mirroring the Street and Einhorn’s sentiment, RBC analyst Ben Hendrix hails a “solid” Q4.

“THC delivered a clean 4Q print and solid growth assumptions backing initial 2023 guidance,” said the analyst. “THC carries good momentum into 2023 with both the Hospital and Ambulatory segments returning to same-store volume growth in the seasonally strong fourth quarter (consistent with typical pre-COVID patterns) and with agency labor expense receding from third quarter highs… Having returned to SS volume growth heading into 2023, and with agency costs moderating, we maintain our view that THC remains undervalued relative to hospital peers.”

Accordingly, Hendrix rates THC shares an Outperform (i.e. Buy) while his $73 price target suggests the shares will appreciate 21% over the one-year timeframe. (To watch Hendrix’s track record, click here)

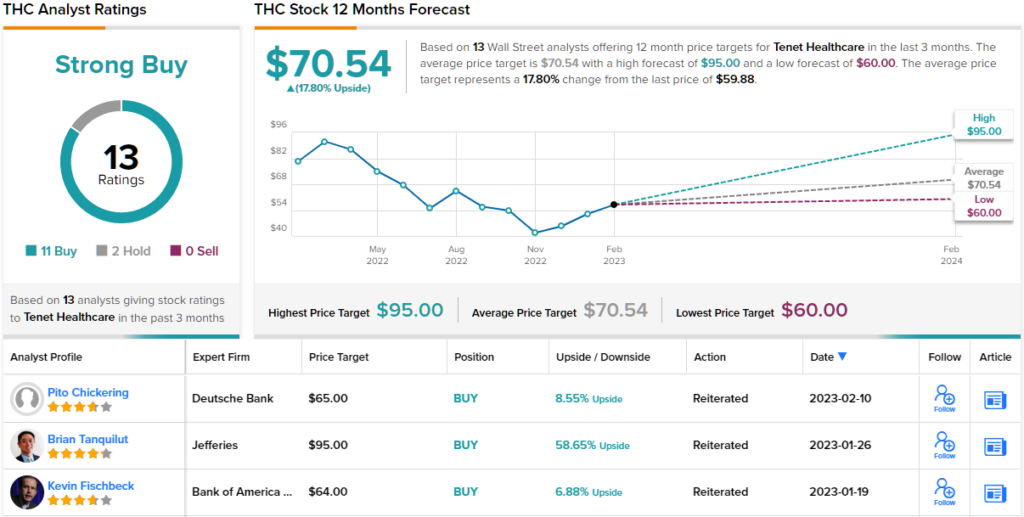

Most on the Street agree. Barring two fence-sitters, all 11 other analyst reviews are positive, making the consensus view here a Strong Buy. (See THC stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.