McDonald’s (NYSE:MCD) stock has been under pressure lately (down 17% from its all-time high), thanks in part to a slew of negatives: consumer-facing headwinds, a surprise royalty fee hike, and concerns that weight-loss drugs, like Ozempic and Wegovy, could take away demand from food companies. Though the stock’s plunge could extend further, I think MCD stock looks cheap as overblown headwinds overpower the longer-term tailwinds. Therefore, I’m staying bullish alongside the analyst community, which has a “Strong Buy” consensus rating on the stock.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

What’s the secret sauce that could power a reversal in shares of MCD? Apart from the modest valuation, which I think is too low after the latest multi-month slide, the firm could demonstrate its economic resilience over the coming quarters.

Yes, the consumer could continue to hurt as inflation weighs and the economy stalls out. But remember that McDonald’s is a fast-food company with one of the strongest value menus in the industry. If anything, a weak consumer should be sending shares higher, as it’s not hard to imagine that McDonald’s lower-cost meals will lure consumers away from some of the more expensive eateries out there.

The company’s recession resilience alone makes the stock worthy of a relief bounce at some point over the coming 18 months.

Additionally, investors may be ignoring new concepts (think the small-form restaurant concept called CosMc’s, which is based on an old-time mascot) and their ability to beef up (forgive the pun) the company’s operating margins over the coming years.

There’s a lot to love about McDonald’s stock, even as investors turn their backs on it.

A Perfect Storm of Headwinds Has Weighed. It’s Time to Move On.

When the headwinds hit, they tend to hit hard. McDonald’s stock isn’t considered an ultra-volatile play, with a 0.70 five-year beta, which entails a low correlation to the S&P 500 (SPX). Also, its well-covered dividend yields a nice 2.66% and is good for seekers of relative stability. That said, recent headlines have introduced some uncertainty into a name that tends to be among the most certain of firms to bet on in the face of a recession.

The company’s unexpected royalty rate hike (to 5% from 4% of gross sales) — the first in nearly 30 years — has been referred to as “detrimental” by franchisee groups. Though the move has undoubtedly disgruntled franchisees, it’s worth noting that the hikes only apply to new franchisees, buyers of firm-owned locations, and relocations. Of course, the community is not happy about the move. However, it’s quite a stretch to say a 1% rate hike is detrimental to the franchisee model.

It’s not just the rate hike that has many looking at McDonald’s in a negative light. Recession jitters and weight-loss drugs could weigh on sales, going forward. As noted previously, I think a hard-hit consumer is a good thing for sales, not bad, given that its value menu offers consumers a lot of bang for their buck.

Further, the non-stop talk of weight-loss drugs seems overdone at this point. It’s still tough to tell if the drugs or the wobbly consumer are to blame for any potential sales slowdowns. Either way, I view weight-loss drugs as a very mild headwind for food companies but an overblown one.

All considered, I think the negative headlines are overdone. The real value for investors lies in the company’s long-term initiatives, including its push into smaller store concepts (CosMc’s), which entail more sales, greater operational efficiency, and, most importantly, less real estate.

McDonald’s Stock: An Industry Juggernaut at a Compelling Price

McDonald’s stock may not be deeply undervalued after its recent correction. Still, as Warren Buffett once put it, it’s better to get a wonderful business at a fair price than a fair business at a wonderful price. Indeed, McDonald’s is one of the most wonderful Dow Jones Industrial Average (DJIA) components, given its moat and industry dominance.

At 20.28 times forward price-to-earnings (P/E), the stock also isn’t all that expensive. Additionally, shares trade at a slight discount to the restaurant industry average of 21.2 times forward P/E despite its impressive recession resilience.

Is MCD Stock a Buy, According to Analysts?

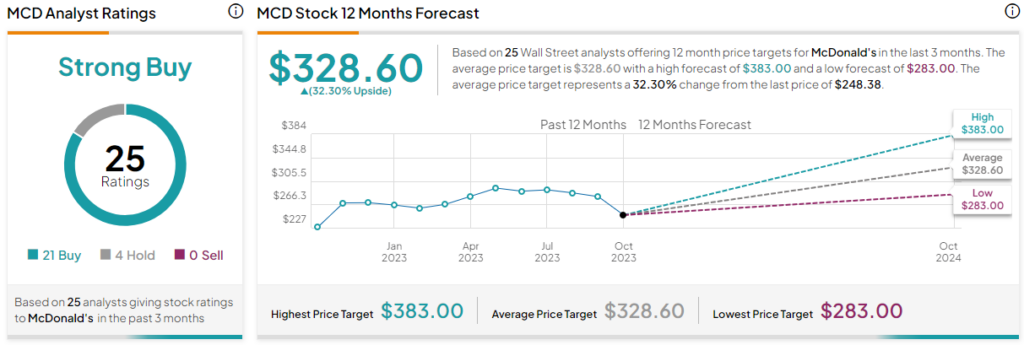

On TipRanks, MCD stock comes in as a Strong Buy. Out of 25 analyst ratings, there are 21 Buys and four Holds. The average McDonald’s stock price target is $328.60, implying upside potential of 32.3%. Analyst price targets range from a low of $283.00 per share to a high of $383.00 per share.

The Bottom Line

McDonald’s stock is on the value menu this October after its fear-fueled 17% correction, and investors would be wise to give the quick-serve restaurant behemoth a look as analysts continue to view it favorably.